Call Options: A Chance to Own Stock.

When a trader buys a call option contract, they buy the chance to own shares they bought at the strike price on or before the expiration date. The contract gives you the right to take that chance if you want, or to let the contract expire. For most option traders, however, their goal is to benefit from the change in value of the option itself. Let’s take a closer look at how that happens.

Suppose a trader buys a call option on XYZ stock with a strike price of $100. Let’s also suppose that at the time of purchase, the option has 30 days left until it expires. The setup might look something like this:

At the moment this chart depicts, the 100 call option contract can be purchased for a price of $2.00 per share. This implies that the trader would spend $200 dollars to buy the contract because the contract includes the chance to buy 100 shares. This might not seem like a very interesting proposal to have the opportunity to buy the stock at a higher price than it is trading right now, but that’s often how option traders operate. They look for a stock they think has an opportunity to move significantly higher within the option contract’s window of time.

They hope to see the stock make a big move in their favor. Imagine if the stock moved more than eight dollars higher in two weeks. If that scenario played out, the option buyer now has the chance to buy XYZ at $100, even though the stock is worth $108. If the option buyer wanted to exercise their right to buy the stock at $100, they could do so.

If they exercised their right, they’d pay $10,000 to acquire the shares which are now worth $10,800. They spent $200 to buy the option which means they have a $600 net gain on the trade.

However, most option traders don’t operate this way. Most option buyers instead choose to sell the option back into the market. . They can sell their option anytime until the market closes on the date of expiration.

After a few days, the option price is priced at $9.10 per share. If the call option buyer sells the call option back into the markets (rather than exercising it) they get $910. That means the net profit from the trade is $710 instead of $600. A favorable outcome such as this is, of course, what every option buyer hopes for.

But anything can happen and the share price might only rise a small percentage, or it might even go lower. Let’s consider how the outcome of this trade might play out in either of these scenarios.

First, let’s suppose that XYZ only rose to a price of $103 per share. In this scenario the option might be priced as high as $3.80. This represents an opportunity for the option trader to generate a net profit of $180 by selling the option. The alternative would be for the option buyer to exercise their right to buy the shares at $100. They would forgo the profit they might have had from selling the option, and would tie up more capital, but they no longer have to worry about the expiration date of the contract. The trader can now own the stock by purchasing it at a bit of a discount compared to what they would have had to pay if they just bought the stock when it was priced at $99.50.

Trading doesn’t always work out like we hope it will, so now let’s consider how the trade plays out when the move is unfavorable to the trader. In this scenario we’ll imagine that the price of XYZ trended lower after the initial purchase.

In this scenario the price of the stock falls to $98 and the price of the call option decreases as well. Notice that taking the opportunity to exercise their contract to buy the stock at the strike price of $100 is not in the trader’s best interest right now, but they have two additional alternatives at this point.

The first alternative is that they might decide to wait and hope that the price will rise over the remaining two weeks before expiration. The second alternative is that they might decide to simply sell their option contract to someone else while it still has value. The value of the option contract is $.90 per share (or in other words $90). That’s because the option still has some time left before it expires. Both the time decay and the price decline have had an influence on the price of the option contract, so the price is significantly lower than it was when first purchased.

The value of the call option increases when the price of the stock moves higher, and decreases when the stock price moves lower. Call options give the buyer the chance to buy a stock at a set price, but they don’t need to take that chance unless the stock’s move makes it favorable to them to do so. These examples demonstrate how a call option contract can both capture benefit and limit risk depending on the movement of the underlying stock.

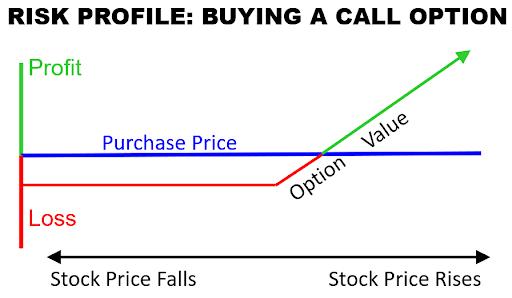

Buying call options offers a way to capture the opportunity behind an upward move in a stock price, while maintaining a limited amount of risk. A common way to depict this relationship is through the use of a risk profile graph.

This depiction shows how the option price changes based on the movement of the stock price. Once a call option is purchased, the value of the option will tend to increase as the stock price rises. Theoretically, this increase is not limited. However if the stock price falls, the value of the call option can only go to zero, so the amount of loss is limited to the purchase price of the option.

In summary, buying a call option allows the trader a chance of owning a stock if they choose to do so. The cost for having that chance is the price of the option. If the stock moves favorably, they can benefit by exercising the option or by selling the option to someone else. If the stock moves unfavorably, they will lose some or all of the money they used to purchase the option, but their risk is limited to that amount of loss.