Here’s a stock with a very interesting story…and lesson.

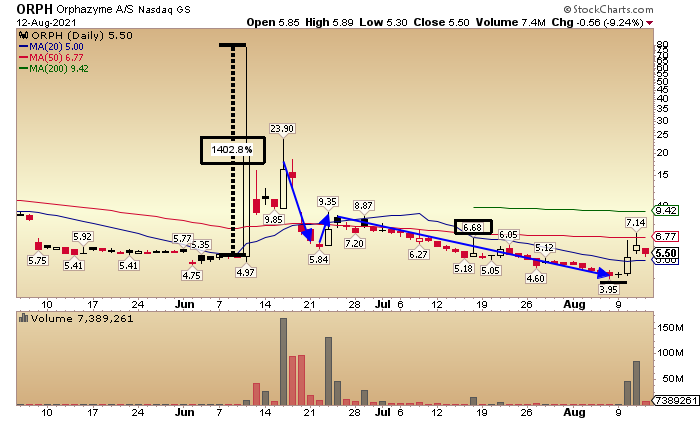

I’m talking about Orphazyme (ORPH) which went from $5 up to $77 in a single day.

And about a week later it was back to trading around $6.

This is a lesson in what can happen when chasing parabolic moves in stocks. As well as trading on speculation vs. waiting for the facts (I’ll get to that later).

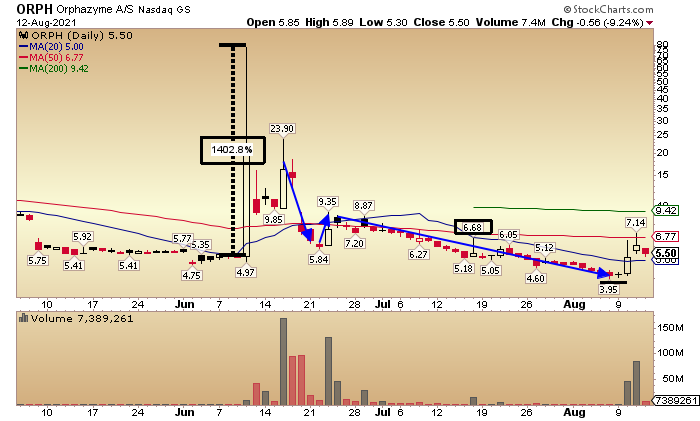

Since then, ORPH has been in a consistent slide, recently hitting a low of $3.95.

That is until last Tuesday when the stock shot up to $7.14 over a two-day period.

There’s quite a bit to unpack here…starting with what caused the spike to $77 back in June…and what that has to do with the recent move.

Is this simply a dead cat bounce…or is the stock waking up?

Orphazyme (ORPH)

Orphazyme (ORPH) is a biopharmaceutical company developing therapies seeking to pioneer a heat-shock protein response for the treatment of neurodegenerative orphan diseases.

When it comes to the crazy moves in this stock, we don’t have to look any further than the company’s leading drug candidate, Arimoclomol.

ORPH wasn’t on anyone’s radar as it traded around the $5 level back in May.

But all that changed on June 10 when the stock shot up to a 52-week high of $77.77.

For owners of the stagnant stock, this was great. For the traders chasing this thing up…not so much, as the stock was trading sub $10 the very next day.

So, what happened on June 10?

This brings us back to the company’s leading drug candidate, Arimoclomol.

It appears that traders were speculating about a favorable outcome from the FDA’s extended review period for the drug, which was set to expire on June 17.

Front running the decision caused a squeeze to $77 that day…probably with a little help from Reddit once it caught fire.

But this was purely speculation without facts…and those who chased it got burned.

In the end, the FDA did not approve it and instead… issued the company a Complete Response Letter requiring “additional data… to bolster confirmatory evidence beyond the single phase 2/3 clinical trial to support the benefit-risk assessment of the NDA.”

Since then, ORPH has been trending down reaching a low of $3.95 last week.

Dead Cat or Back to Life?

Coming off that low, the stock rallied to $7.14 earlier this week.

Was it just a dead cat bounce? Shorts finally cashing in on their massive wins.

With the stock trading off the very next day, it could be…

But there’s a little more to the story.

The company is still trying to work with regulators to get Arimoclomol approved. And in the meantime, are also looking outside the U.S. for European approval, with an opinion expected later this year.

So this could be more than just a dead cat bounce, it could be another shot in the arm from speculators hoping to see a better outcome from European regulators…and ultimately hoping to get FDA approval over time.

However, the lesson of what can happen when chasing parabolic moves and trading on speculation vs. facts needs to be kept in mind with this stock. We all saw what happened in June.

The company doesn’t have much going for it without this approval, and any move in ORPH right now is still based on speculation.

Time will tell with this one…

But it doesn’t mean it’s untradeable…It just goes to show why I take trades in stocks like this on a short-term basis and look to get in and out quickly.

I don’t want to get caught holding the bag.

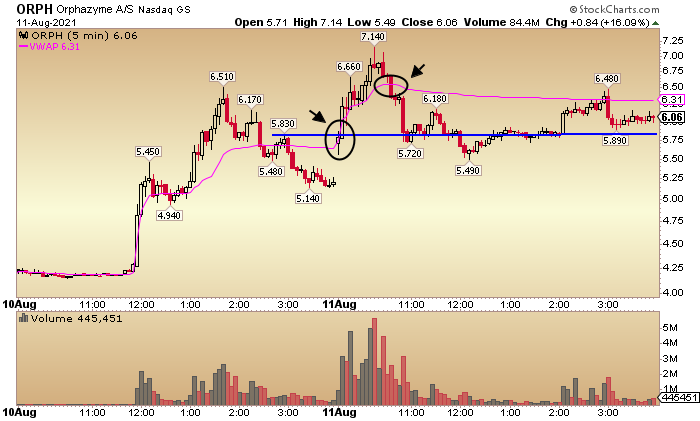

Take a look at the intraday chart below…this shows the 1-minute timeframe for Aug 10 and 11.

The stock shot up to a high of $6.51 on Aug. 10, closing the day at $5.14.

The next day, the stock made another move to a $7.14 high.

I circled 2 areas on the chart above.

The first was a potential buy area. After trading below, the stock was breaking above the $5.83 level set the day before…and trading above the VWAP (pink line).

The break above $5.83 was a potential entry for an intraday day-trade. A stop could reasonably be placed below the low of the day at $5.56 (if it doesn’t continue up, no one will want to be in it).

After breaking $5.83 for the entry, I would simply look back into the previous day’s range for price targets.

Right away I see the $6.51 day’s high for a first target. Then looking at the daily chart, I see a $6.68 previous high from July 16, and the 50-day MA at $6.75 after that.

And the price action on the chart tells the story as ORPH hit a high of $7.15 that morning.

The second circle on the chart is when the stock moved below the VWAP line…also a potential sell point (if I was still in it, this would have been a signal to get out or tighten up my stop).

As you can see, no matter what the full story is…when trading short term, as long as a stock is moving, it deserves some of my attention.

Final Thoughts

ORPH punished the traders who chased the stock on its move to $77 on speculation of FDA approval.

Without said approvals, the stock won’t really have anything to get behind, so it’s still a very dangerous and speculative play.

That said, there is the potential for catalysts later this year with the European regulators looking into the drug and the idea that the company will keep working with the FDA to hopefully get it back on track there.

From what we saw back in June, with the move to $77, this stock has some serious squeeze potential in it.

The question is whether it will make good on the catalyst or die in the night.

For me the play is to trade what I see. I won’t be chasing this into the stratosphere, but when I see a short-term trade setup…I know the stock can move.

It’s just about sticking to my plan and keeping my risk in line.

Comments are closed.

1 Comments

I like the analysis given here on this potential investment possibility. Yes, it is a highly speculative investment strategy. But, with AI predictive analysis combined with the correct play on the right time decay decision, this could mean potential multi thousand percent profit potential. I will take this research and combine it with my analytical tools to try to make this a possible huge ROI play.