This is my final article for The Penny Pro this year, and what a year it has been!

This has been a year for the books, with small caps, penny stocks, and the overall market. The resilience and strength of the market in 2021 will be remembered for years to come.

The year has also been filled with opportunities across the board.

So I am focused on bringing my A-game next year because, in my opinion, the opportunity is here to stay!

As the year comes to a close, I wanted to leave you with an end-of-year gift, Gang.

I am going to, in detail, explain how I traded and capitalized on a setup in a penny stock.

It wasn’t just any regular setup. Instead, it was a stock with breaking news that resulted in a significant breakout.

Therapeutic Solutions International (TSOI)

According to Yahoo, TSOI focuses on immune modulation to treat various specific diseases. The company develops a range of immune-modulatory agents to target cancers, improve maternal and fetal health, and fight periodontal disease, as well as for daily health.

As you can see, on the daily chart and higher time-frame, the stock has consistently been in a downtrend since reaching a high of $0.1345 in August.

More recently, the stock spent four days consolidating after it made a low of $0.0185.

It appeared that the stock needed a catalyst to break the downtrend and reignite volume in the name, and that’s precisely what happened two days ago.

Recent News: Dec 28, 2021, TSOI awarded a landmark patent for cancer and COVID-19 treatment.

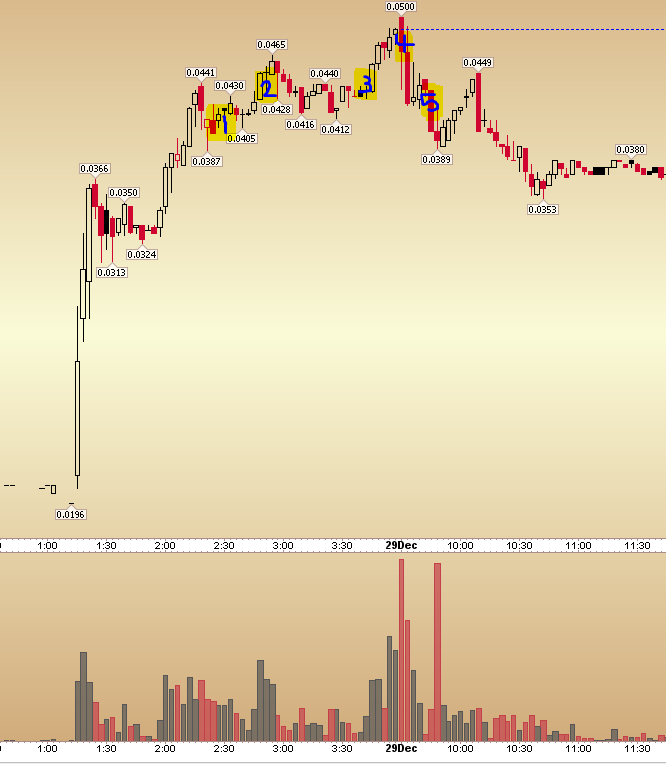

Here’s a look at a two-day chart showing the previous two days.

The impact of the news was significant.

As a result of the breaking news, the stock broke out of the downtrend and consolidation and more than doubled in value in one day.

The volume and news in the stock quickly grabbed my attention.

The opportunity was there, and the volume and range existed. Now, all that I needed was a plan and opportunity to enter.

After the stock broke out midday and experienced a sharp increase in volume, I was looking for the action to hold up.

At 2 pm, the stock again saw volume increase as the stock broke out of an intraday consolidation breakout pattern.

This made me believe that this stock could have continuation and momentum to the upside.

I was now looking for an entry opportunity.

I noticed that the stock was holding above the morning high and sustaining the volume increase into the close, and therefore entered the long on a slight pullback.

After letting my members know about the setup and idea in the chatroom, I got long TSOI at $0.039, around 2.22 pm.

I sold the position at $0.0434, around 2.49 pm.

I took advantage of the range and volume in the stock by entering on a pullback (first highlighted area) and selling on a move higher towards the resistance of the consolidation (second highlighted area).

However, as the end of the day approached, I was looking for another entry as I believed the stock could have overnight continuation and trade higher the following day.

Therefore, I got long once again at $0.043, near the close, looking for a move towards $0.05. I had confidence in the idea as the stock remained strong throughout the afternoon, and the volume held up.

The following day, I sold ⅔ of my position at $0.04855, from $0.043. As I was looking to sell the remainder near $0.05. The stock reversed and pulled back, and therefore I sold the remainder of the position at $0.042.