I talk about squeezes a lot and it’s usually some small-cap that’s making the news.

Occasionally, you’d get a big boy like TSLA thrown into the mix.

But can you squeeze out an entire major commodity?

Doubtful, right?

But our very own Ben Sturgill will strongly disagree, as he recently did just that!

Natural Gas Background

I can’t blame you if you aren’t following the commodities market, not many traders do – but I’d certainly advise you to keep an eye on it, just to be aware of the major events.

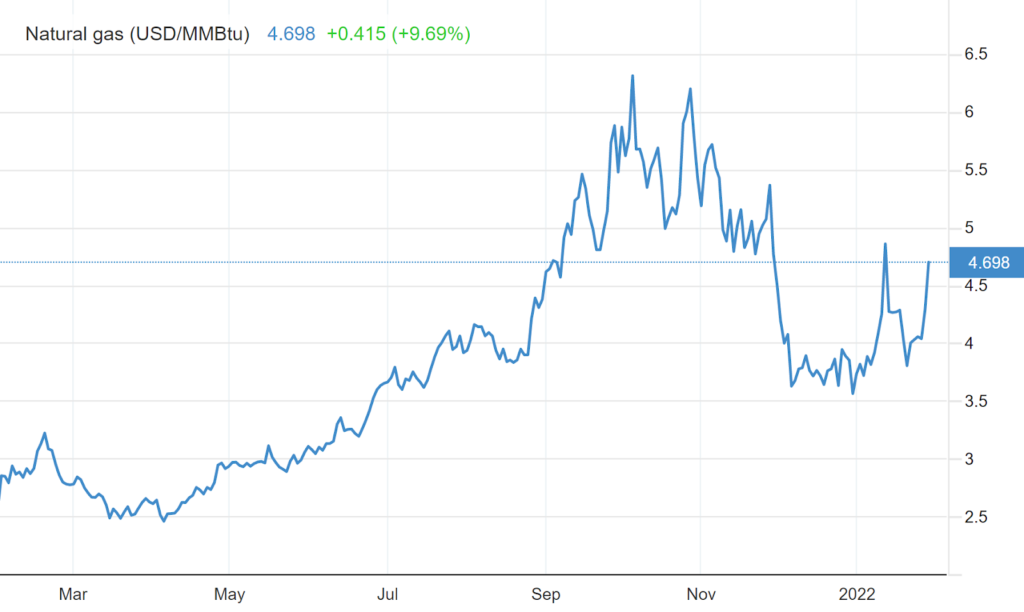

For those of you missing context – the price of natural gas has been on a wild ride over the past year:

Having risen sharply higher in 2021 on exploding demand and supply constraints, it’s pulled back since, until…

You can clearly see the spike we’re in right and the reason for it is Russia!

As you may be aware, Russia, one of the world’s biggest gas producers, has been toying with war with Ukraine.

I don’t know where to even begin to comment on the whole war thing, so let me stick to basic principles of the economy here.

If the war were to break out, gas supply from Russia may be significantly impacted – limiting the supply by one of the market’s main players.

Lower supply with unchanged demand means higher prices – hence, the market jumped on the risk this may happen.

Now, back to trading…

Ben’s and Ethan’s LNG Trade

Ben Sturgill, alongside with Ethan – one of the moderators of The Workshop – have been eyeing UNG over the past few days.

UNG stands for US Natural Gas Fund and it’s one of the main products for trading Natural Gas.

And it was the action of the past few days that caught Ben’s and Ethan’s eye:

Gas prices were clearly rushing through the roof on war fears, printing a very strong squeeze pattern on the chart.

From a technical standpoint, a continuation and acceleration looked like the only way further. Couple with the fundamentals, the trade made only more sense.

In Ben’s own words, the thesis was fairly simple: “when it started having those couple big days in a row it seemed like a good play into the end of the week. It had a very bullish daily candle and its intraday chart was strong compared to the market. So given the geopolitical potential, relative strength and technicals, it seemed like a good shot to take for a lotto.”

Ben also noted the setups one MAJOR advantage – this is a commodity trade, meaning it won’t get hurt by the market’s volatility and the earnings season.

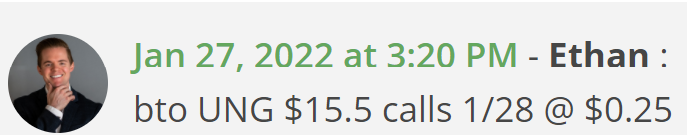

So Ethan and Ben both entered the trade yesterday, later in the session:

By the time the market opened, LNG had already gapped up into the $17 area!

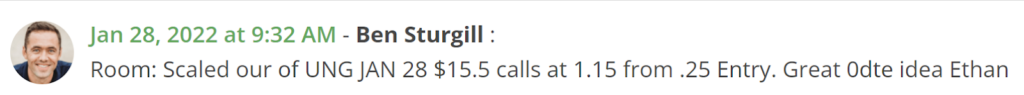

Hence, Ben called his quits: