We’re headed towards the end of the earnings season, but don’t let your guard down just yet.

There’s at least one more stock from the “hot” that’s about to release its quarterly report and it goes by the name of… Palantir Technologies (PLTR)!

The biggest beauty of trading such tickers during earnings – they may get REALLY wild into the readout.

Emotions run high on both sides, so if the numbers are even slightly better or worse than consensus, things may get out of hand.

And this brings the most important question of all – do I trade Palantir with a Strangle, going into the readout?

What Is a Strangle?

On paper, a strangle is one of the simplest options strategies to enter.

All you do is buy both a put and a call in the underlying with the same expiration date.

For example, let’s assume I think Apple (AAPL) has a big move in the next 2 days, but I don’t know if it’s up or down.

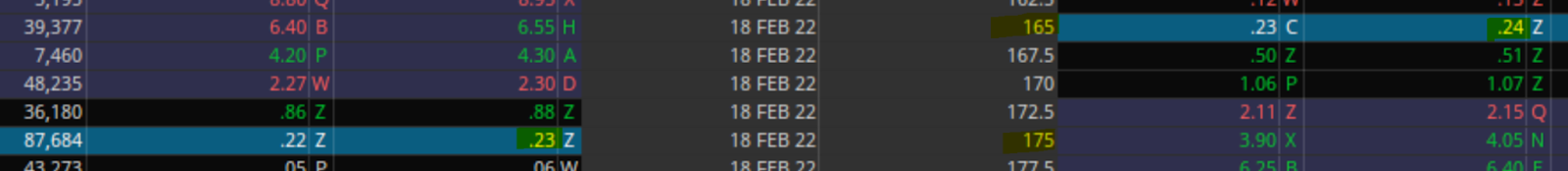

I can go ahead and buy both a $175 call and a $165 put.

See how this works? I’m just betting on a BIG move, and I don’t really care about the direction – if a stock flies high, my Call will gain a lot; if it drops low – my put will be in action.

There’s a downside, of course – I’m paying a premium on both sides! Hence, I need a truly MAJOR move to make the trade worthwhile.

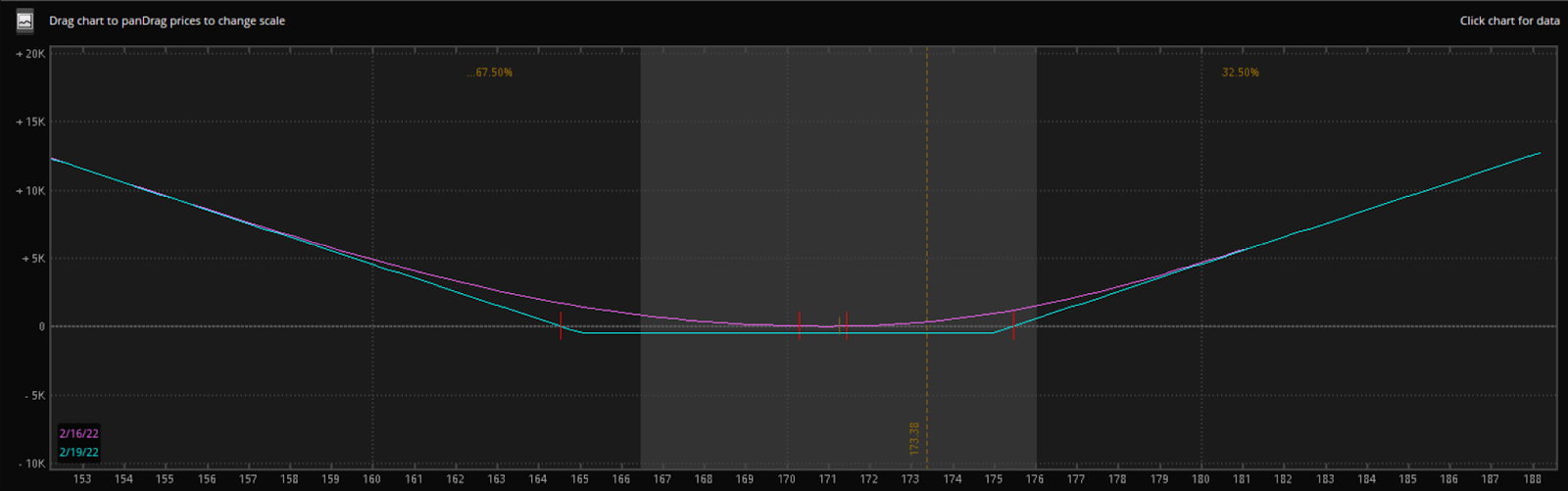

Here’s the payoff chart of my theoretical Apple trade:

I’m making money if Apple gets outside of ~$164.5 and $175.5 range by expiration… but that’s a big range when you only have 2 days left!!

That’s the problem of the strangle – you need a truly huge move, otherwise, the trade may not work.

Obviously, going into earnings, the premiums are elevated – option sellers need to compensate for the additional risk.

Hence, before making such a bet you really need to make sure the stock is capable of pulling it off.

PLTR’s Upcoming Earnings Report

Palantir is scheduled to report earnings tomorrow, on February 17th, after the market closes, and Ben Sturgill thinks we may be in for a ride…

The name has been “hot”, a lot of eyes are glued to it, it still sports a nearly 7% short interest, and it’s pulled back quite a bit, making for an easy target for longs, should the company’s numbers impress.

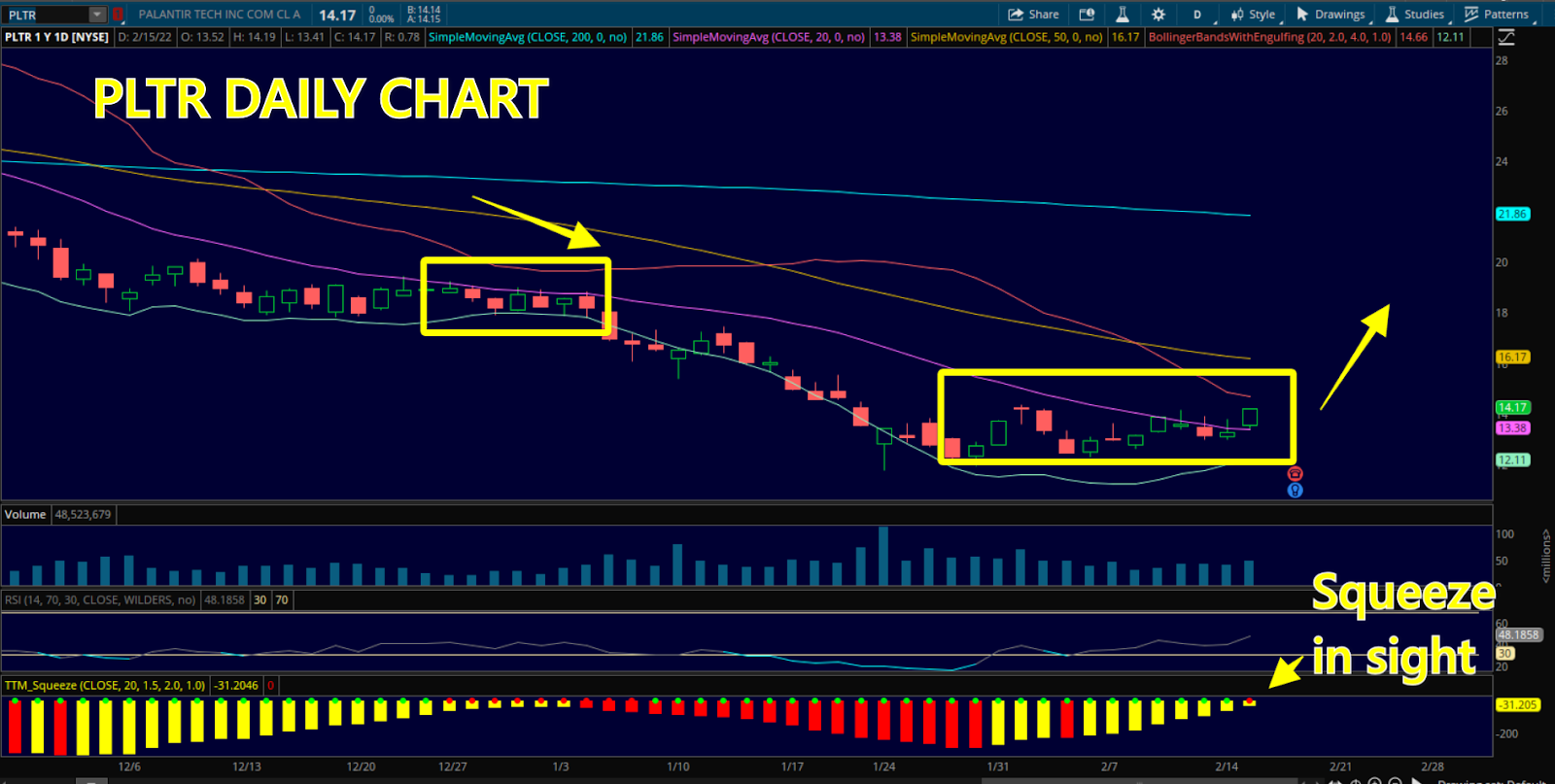

Besides, there’s the technical setup:

Here’s how Ben puts it:

“As you can see from the chart above, PLTR has seen promising volume here in the right direction, unlike the time the stock was at this squeeze level and dropped all the way to $12 a share.

I could see a strangle play working out here into earnings; historically the stock has moved 10% -/+ post.”

Be sure to check out Ben in The Workshop, to see what contracts he’ll use and when he’ll enter!

1 Comments

An easy to understand concept, Nice!