Small-cap stocks have been in full swing over the past few weeks, which sure makes traders like Jason Bond smile ear to ear:

Momentum trading setups are hot, the moves are huge and it’s only fair that we use the opportunity to make the most of it.

But higher rewards come with increased risks.

To curtail some of those, let me tell you about one thing Jason Bond always NEEDS to see on a small-cap chart, before getting into a trade.

I’ll also share 3 hottest stocks from his current small-cap watchlist – all featuring the pattern!

Strong, Time-tested Support

All of RagingBull traders will often talk about the importance of confirmation – finding signs that the market agrees with your thesis.

With small caps, those can come in 2 different shapes:

- Momentum Continuation Trade: A stock trending higher MUST hold higher and establish above a support level that it defends multiple times.

- Momentum Reversal Trade: A stock slipping lower MUST stop going down, establish support that it defends multiple times.

This may not sound like much, but following this simple rule in momentum trading will save you a lot of headaches.

In the first case, seeing such support signals you of inherent strength, the willingness of others to buy at current price levels AND gives a clean level to trade against.

In the latter case, you get proof that the sellers have exhausted AND get a clean level to trade against.

Let me show exactly what I mean with Jason’s latest watchlist as an example:

LUCD Above $3

Lucid Diagnostics (LUCD) – not to be confused with Lucid Motors (LCID) – has been in a freefall… up until now!

The past few weeks have clearly shown that there’s solid buying at and above $3, and lack of sellers who can push the stock lower.

If some momentum buyers step in – the stock can easily have a run up from here.

And your risk is clearly defined to under 4. Jason says: “This weekly chart shows the double bottom at $3 on LUCD, with a range between $4-$6 if it turns higher.”

Hence, he plans to be on the long side if the stock keeps holding above $3 for a run-up into at least $4+.

VINE Above $3:

Fresh Vine Wine’s chart is strikingly similar and so is the trade idea.

It’s a beaten-down IPO with no bottom in sight that’s starting to show some support above $3.

If this continues – we might very well see a reversal and a solid upmove.

Hence, Jason wants to get long as close to $3 as he can, with a stop under $3.

His initial target is $4.50+, but god knows where a powerful reversal can take him in a trade like this.

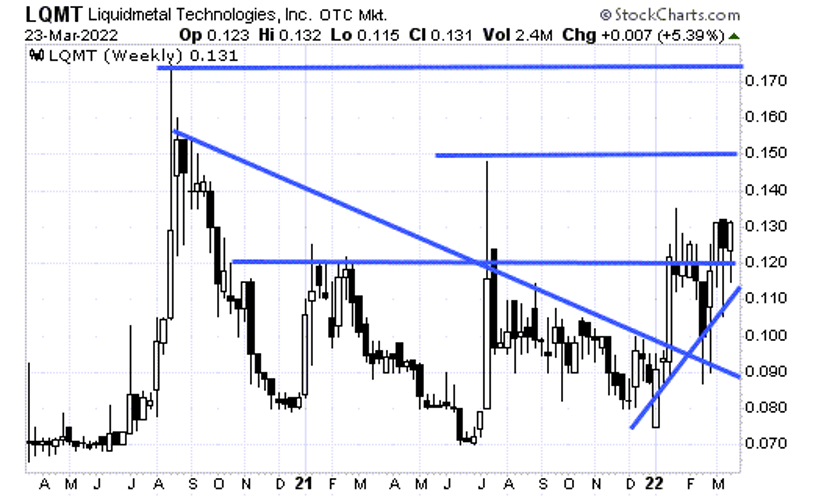

LQMT Above $0.12:

A rare OTC entrant to Jason’s watchlist, this name has made many heads turn lately – this one is a great example of a runner that’s established a strong support higher.

If you look at the past 3 weeks, you’ll see exactly what I discussed above – the stock is already up a lot, but it stubbornly doesn’t want to close lower!

Sellers aren’t able to take it lower meaning an influx of new buyers can easily push it higher.

Hence, Jason has it on watch above $0.12, stop right below it, for a trade into the highs at $0.17.

Let’s see how this works over the next few days, but one thing is clear – it’s NEVER a bad idea to have an extra layer of caution and conviction, and this is exactly what this setups provides you with!