Man, I am so angry with myself.

You see, I value friends and family more than anything else in this world.

That means that I go out of my way to remember birthdays and special occasions, so that I can send the special people in my life my best wishes at least once a year.

So what did I go and do yesterday that I actually almost lost a little sleep over last night?

I forgot that yesterday was Snoopy’s birthday.

Now, you may think that this is trivial, but Snoopy is an American icon.

One of those symbols of innocence and purity that, dare I say it, today’s children may never experience again.

With that, I have already made plans to sit back with a couple of bourbons and watch at least one or two episodes of the Peanuts tonight in a belated celebration.

Go ahead, call me sentimental…I don’t care.

Because I think it’s important to celebrate the things that brought us so much joy and helped ease the pain of some of life’s hard, early lessons.

From what I am seeing all over social media right now, a lot of traders can use something to ease the pain being brought on by some REALLY bad advice in a difficult market.

This market is SLOPPY, right now.

This market is SLOPPY, right now.

But hey, Uncle Jeff told you this was going to be the case before the market even opened on Monday.

Not only that, but I was warning you of a pullback right before SPY developed that massive bearish engulfing pattern on July 27th.

Now, we here at RagingBull are a close-knit team of professional traders.

And one of my best buds, Jeff Williams (JW), has been at this game just about as long as I have.

We’re talking a little more than 40 years of combined trading experience!

So with knowledge like that, you are darn right we are going to run ideas by each other from time to time.

And this brings me back to the point I made about cherishing the things in life that help ease the pain, because JW is a MASTER at two things:

- Helping to easing traders’ pain by teaching a strategy that has generated a win rate of 78% in markets similar to what we’ve seen in recent weeks (*results not typical, trading is hard)

- Identifying the market’s pain points

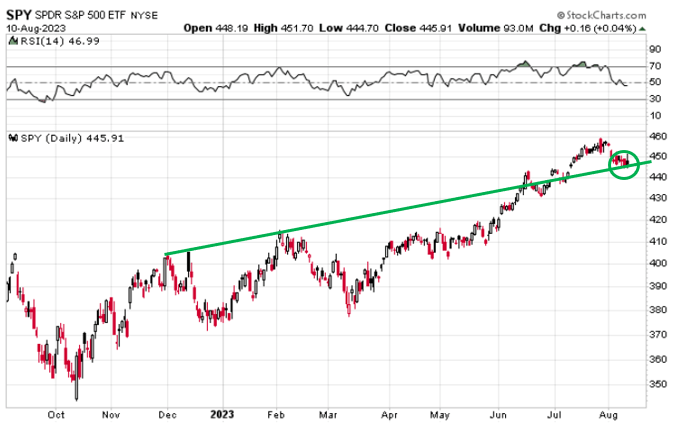

JW is dialed in to this market, and right now he is eyeing this BIG point of pain that could generate a tidal wave of opportunities if broken.

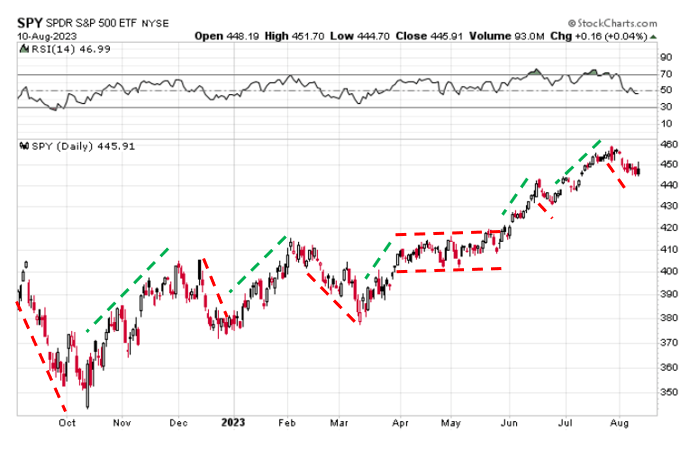

Take a look at this chart of SPY.

This, my friends, is trading.

This, my friends, is trading.

Big corrections followed by big rallies, with the occasional sideways range thrown in.

But if you’re trading options like we are here…

Well, these swings can be especially painful because, unlike owning stocks, Theta (time decay) will not allow you to just sit around and wait for the market to recoup if you get stuck in a big market swing that goes against you.

Interestingly, this is also a picture of the timeframe that JW has been able to build a nearly 78% win rate as part of his red hot🌶️ Market Navigator service.

Now, if you are saying to yourself, “Well, I see people on X.com (formerly Twitter) claiming that they never lose,” Uncle Jeff might just reach through the screen and slap you.

EVERY trader has losses…it’s a statistical fact.

Heck, even some of the greatest traders in history, like Paul Tudor Jones, have had many defeats.

But like Paul Tudor Jones, JW knows how to capitalize on pain points in the market.

These are price levels that, if broken, would force large numbers of traders to relative their pain by reversing existing positions, resulting in exaggerated price moves.

Fun fact, Paul Tudor Jones’ claim to fame is that he tripled his fortune on one trade alone, by letting a massive short position run during the 1987 Black Monday crash that he predicted.

Please don’t think I am alluding to anything here.

But you should be listening to what JW has to say as SPY sits right at a pain point with MASSIVE potential right now.

Folks, if you want to ignore JW’s track record in this difficult environment, I can’t force you to do anything.

But what I can do (and have done) is authorize an extra $300 be taken off of JW’s already discounted Market Navigator service.

With the market sitting at this critical juncture, the timing of this deal could not be any better.