To me, as the market continues to just be all over the place, having trading strategies that hold potential whether the market goes up or down is key.

In other words, I don’t just want the “easy” money – the “bull market” money – because that goes away.

I want to know what I can do when markets, stocks, industries collapse.

My man Ben Sturgill has been watching the big money fly away from companies lately, and he’s got a plan to trade these moves.

Ben has really dialed into the “dark pool” trades lately, and he’s got a pick that he thinks could go down a long way… which would actually be good news for his trade plan.

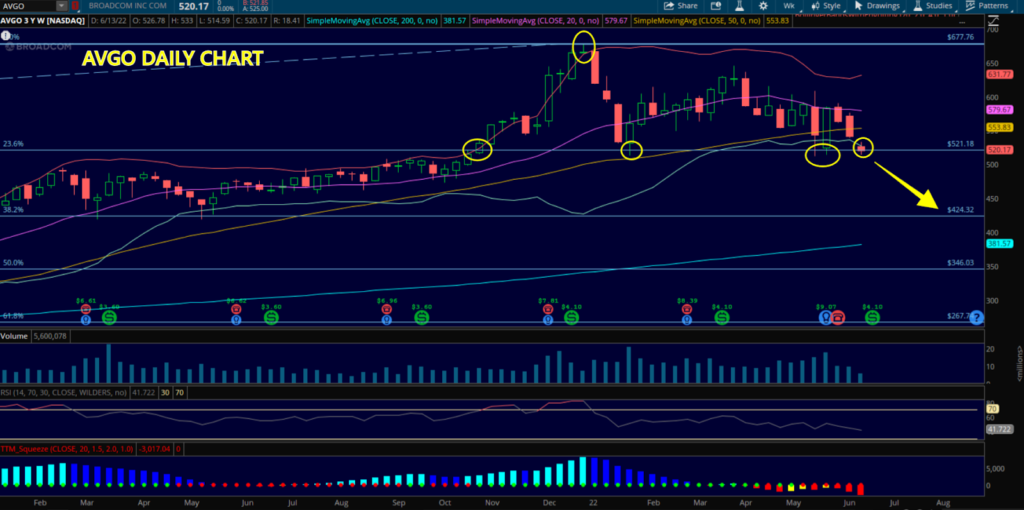

Does AVGO have a date with its 38.2% retrace ($424.32)?

That’s the question on my mind as I watch the Dark Pool price action here.

Since AVGO made a high earlier last year around $677.76 a share back on 12/28, the stock has consolidated a bit in a range from $520 to $640.

It’s now at the bottom of that range again.

While the company is very profitable and has billions of dollars of cash on the sidelines for stock buybacks, it is also facing risks from having its supply chain anchored in Taiwan, and from my understanding, extremely dependent on Taiwan existing without any threats from China.

AVGO has held up fairly well in this environment, but if you look at the weekly chart, it has a key support line. If that breaks, I think it could fall hard.

Plus, almost half a billion dollars traded on it in the dark pools yesterday.

I’d like it on a break below $495. If it could stay below that level, I’d like the Oct 21 $300 Puts. I know that’s a far way down but it’s also a far way off to get there.

AVGO is on my watchlist, and I share that list LIVE every day, along with my trade plan for each stock based on the Dark Pool activity that I see.