The Russian-Ukrainian conflict easily ranks among the biggest geopolitical and economic shocks of our lifetime.

The current crisis may be different from COVID-19 in nature, but much like the pandemic, this war managed to cause major market havoc in record time, leaving a few stones unturned.

American and European indices shook, while Russia-related equities (and currencies) got dumped into oblivion.

And yet, every major market pain usually brings a major gain somewhere on the other end of the spectrum.

In the case of the Russian war in Ukraine, it was the commodities that came out on top.

As oil and gas prices hit record highs, related stocks like INDO, USEG, and IMPP have been very active traders.

Ben Sturgill believes he just uncovered another commodity that could become the next BIG market theme of the ongoing conflict.

And that is Uranium!

Uranium Supply Dilemma

It may not be as obvious as the oil and gas situation, but uranium production and sales are also directly affected by the Russian-Ukrainian conflict.

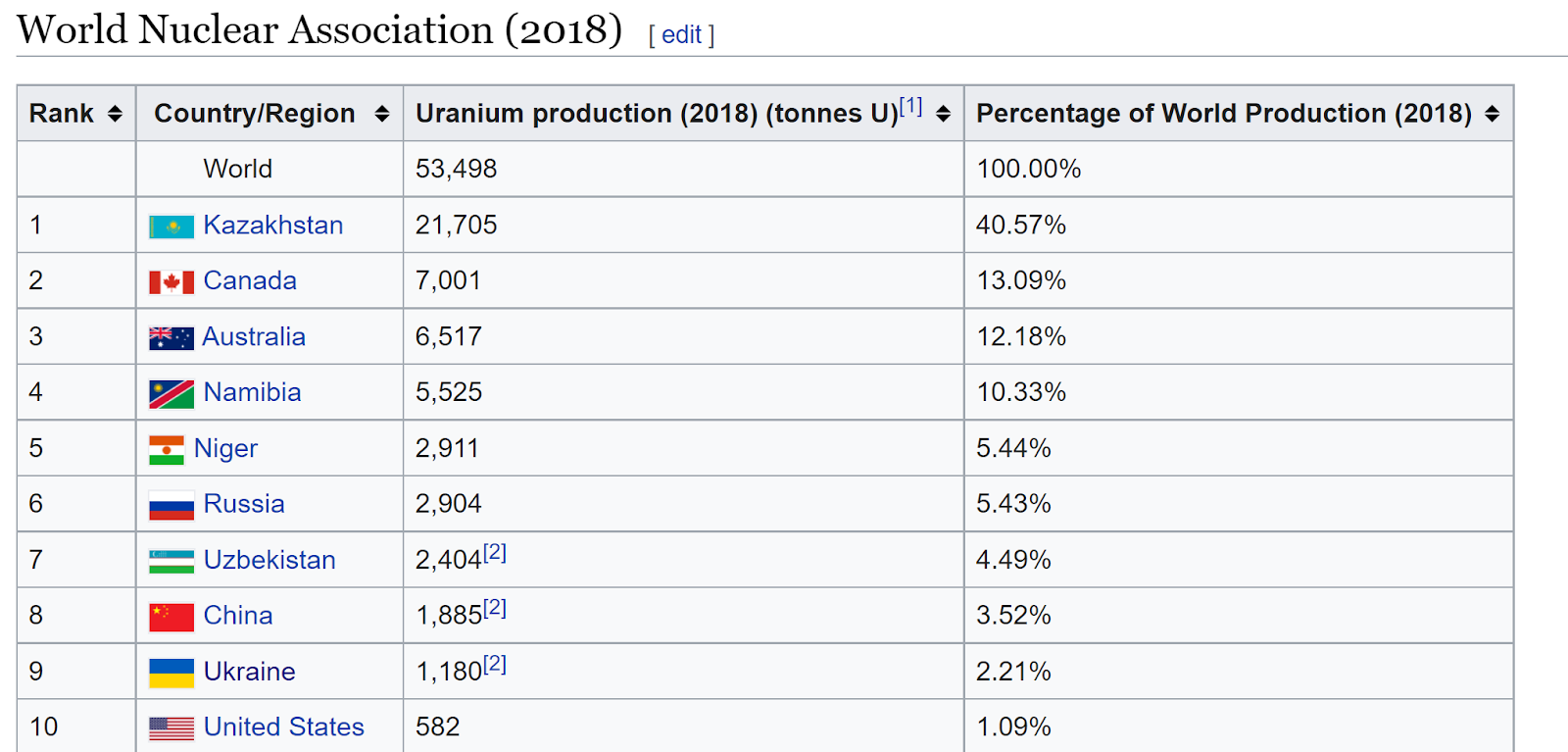

Let me explain why. Here are the world’s Top 10 producers of uranium as of 2018, according to Wikipedia:

If you glance at it, you’ll find that Russia and Ukraine combined make just over 7.5% of the world’s production.

No small number, but it doesn’t seem enough to stir up the market, right?

Well, this brings me to the elephant in the room, which is… Number 1, Kazakhstan!

At over 40%, the country’s output can surely have a major impact on the price, right?

But Kazakhstan is not involved in the conflict, you may say… and that’s right and wrong at the same time. Sure, Kazakhstan is NOT a party in the conflict.

BUT, and this is a bit BUT, Kazakhstan is an ex-soviet country with strong ties to Russia. It also shares a huge border with Russia, relying on the country for logistical support for many of its exports to the west.

Given that no western company can do business with Russia these days, it gets very troubling to move stuff to and from Kazakhstan, and uranium seems to be no exception.

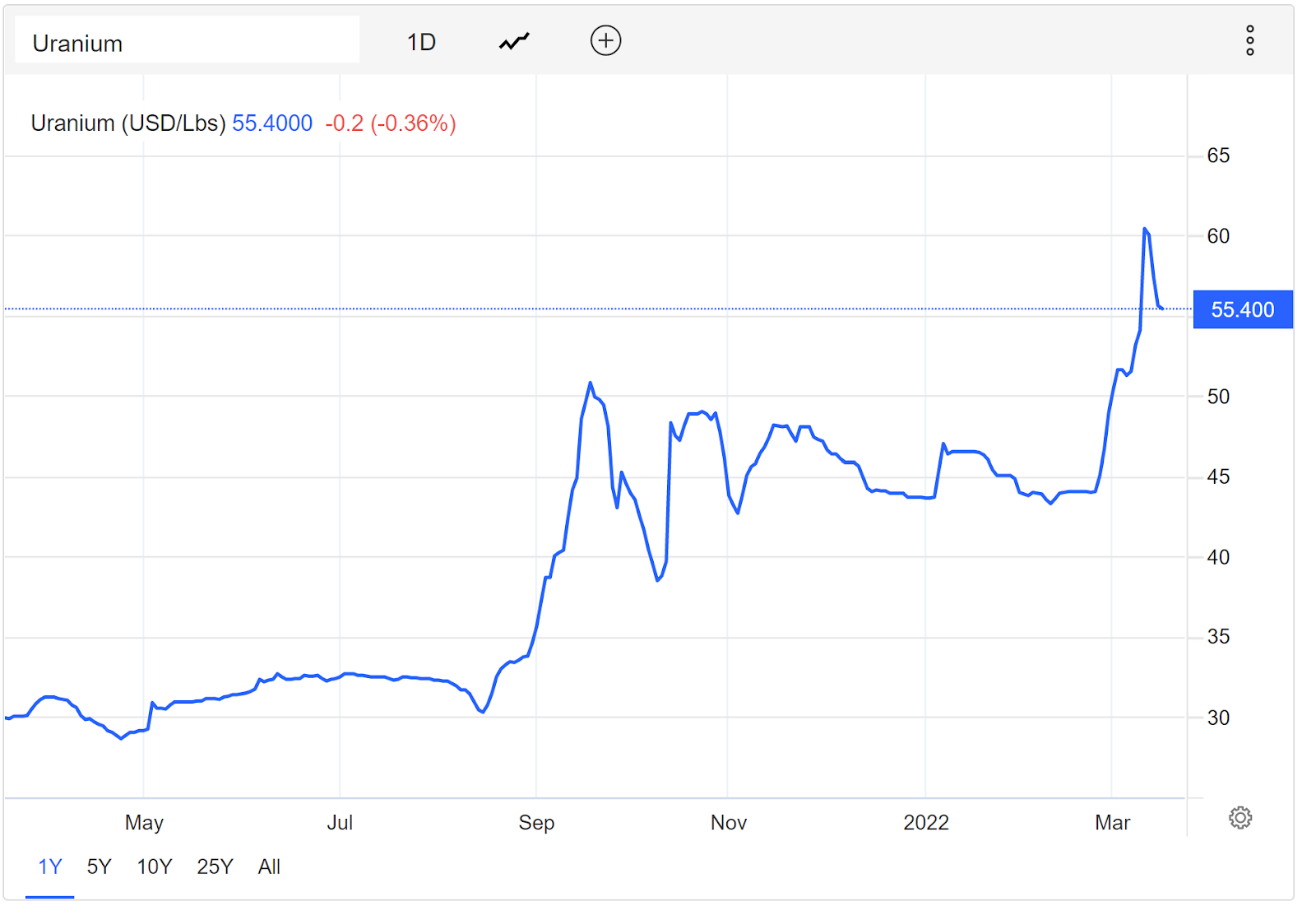

At least the market doesn’t think it is:

The price of uranium shot from under $45 to over $60 since the conflict began, but the equities market seemed to have missed it.

Well, that may very well be changing right now…

DNN is On The Move

DNN, or Denison Mines, is a Canadian uranium mining company.

It’s stock saw a minor reaction over past few weeks, but is getting a notable bid today:

Given its “cheapness”, solid risk/reward, and the general “overlookness” of this corner of the commodities market, Ben believes this is a trade worth taking.

In his own words:

“This is a sector that could pick up steam with everything happening in Europe right now.

As for me, the sector, the low cost, the name and the time it has to work out, makes me want to take a shot at DNN“

Here’s a contract Ben is considering:

DNN May 20 $2 Calls at $.15. Target is $.30 and Stop is $.05

Given how inexpensive shares are, Ben is also considering a pure stock trade against $1.40 area.

Let’s see if uranium turns into the next big “conflict” trade – by the looks of it, it certainly can!