Trading is a game of numbers.

You can’t win all the time. The good news is – you can’t lose all the time either.

Some trades will work because you’ve done everything right… others will be pure luck.

What happens in any individual case is not the point – your success or failure depends on how you manage your numbers in the big picture.

The goal of a trader is to ensure that your winners are either more frequent or much bigger than your losses – this way, the mathematical outcome of your trading remains positive.

The easiest way to get there is to limit your losses.

Today, I want to discuss one of the biggest hurdles that may drain both a trader’s account and his chances of making it.

I’ll also show you how the pros approach the issue – namely, our very own Ben Sturgill!

Respect! Your! Stops!

I know, I know… all of the RagingBull traders talk about this a lot…

Plus, the issue is a trivial one, right? We all know stops gotta be respected!

Well, yes and no.

On paper, this is one of the most obvious truths out there – if the trade is not working, you get out.

But in reality, even the most seasoned traders of all may at times find themselves stuck in positions far behind their original stop level.

For the less experienced and those of us who are only getting started – having the character and the discipline to stop out is one the first lessons to learn. It’s also, quite possibly, the most important habit for you to develop.

Respecting your stops will save you countless dollars and nerve cells… But a lot more than that – it will provide you with longevity!

Look, trading is not easy – you need to spend a lot of time in this game before you figure out what works and why.

And trust me, you’re not going to last if you frequent outsized losses.

Calculating your risk, keeping it tight, and following through with stop orders are keys to staying safe.

Ben Sturgill will tell you all about it.

Years into the game, Ben is still the first to…

Admit Wrong and Stop Out

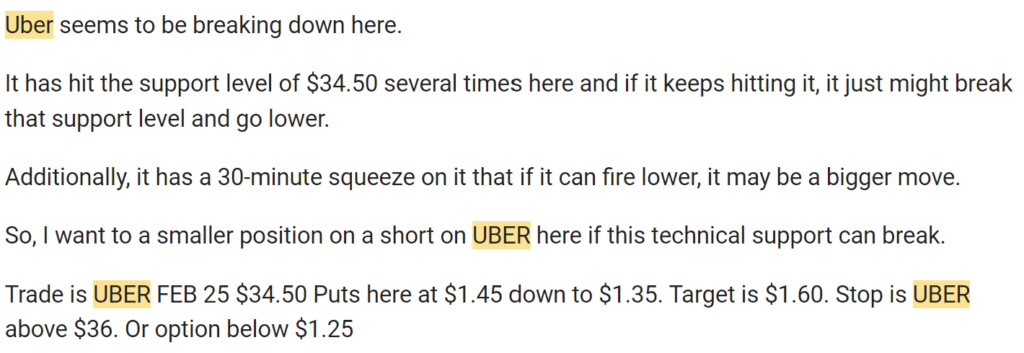

If you happened to catch him yesterday in The Workshop, right as the market was melting Ben was noting the weakness in Uber (UBER).Here are the exact words from his email trade alert:

Note the proactive approach to risk – Ben understands the added risk of holding a position overnight, so he only puts on a small position.

To a bystander, that might have gone unnoticed, but the decision surely paid off this morning when Uber went… AGAINST Ben!

In pre-market, the stock was already getting close to Ben’s stop at $36.

Ben was realizing he was likely wrong in the trade so he made it simple. Here’s a quote from his morning prep email:

“this morning it (Uber) is UP and I will need to see if it can drop below that $35 level by 10 to stay in”

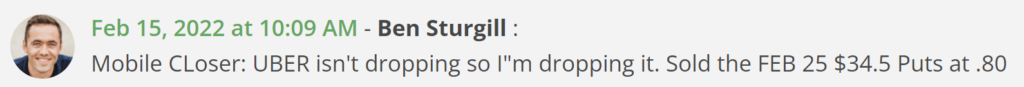

And once never happened, Ben called it quits, like the pro he is:

Bottom Line

Ben is anything but a newbie… The man has seen it all, traded it all, made and lost money in every type of market.

Yet he still uses a bionic, computer-like approach to risk – “if it hits my stop, I’m out”.

Don’t be stubborn – be smart. Protect your capital and respect your own rules.

2 Comments

Will you be telling us soon why you went big with your 7% stake in GRVI and of your hopes for the company’s prospects?

thank you .