Put Buying

When it comes to options trading, it starts with calls and puts. The long put has similar characteristics of a short stock position, but it doesn’t require a margin account to trade, and is open to options traders who are cleared to trade at the second level.

At the most basic definition, put options are a bet that a stock is going to go lower. More specifically, they are contracts that give a buyer the right to sell the underlying asset for a specific price by a certain date. Even though buying a put option gives you the right to sell the stock, you are not obligated to and can choose to let the option expire.

While put buying is the most traditional way to bet bearishly on a stock, traders who have graduated to higher levels could also employ a long put spread, which combines a bought put with a sold one, to lower risk (while also lowering their profit potential), or take a more neutral approach with a short call or short call spread. We’ll take a closer look at these bearish strategies in subsequent sections.

For now, here’s a quick rundown on the ins and outs of put buying.

Long Puts

When you decide to buy a put option, you are purchasing the right to sell 100 shares of the underlying stock at the contract’s strike price.

As such, put options are often used by investors as a way to hedge against potential losses in their equity holdings. By locking in a minimum selling price on the shares, the put option serves as a type of insurance policy to protect against a drop in the stock’s value.

That said, puts can also be used for straightforward speculation on a price decline in the underlying.

Here’s an example of how a traditional put buy could potentially play out.

Returning to the RBLL stock used in the call buying section… Let’s say the shares are trading at $50, and you think the stock is due for a drop. You could short 100 shares of RBLL or borrow the shares from your broker and sell them to another trader, at a market value of $5,000.

But instead of shorting the stock — which requires a margin account and carries significant risk — you decide to buy one 50-strike put for $1, creating an initial net debit of $100 (1 options contract x $1 premium paid x 100 shares per contract).

In order to break even by expiration, you need to make at least $1 on the option. Here’s how you’d get to your breakeven price.

Put Option Breakeven = Strike Price – Cost of an option (premium)

OR

$50 – $1 = $49

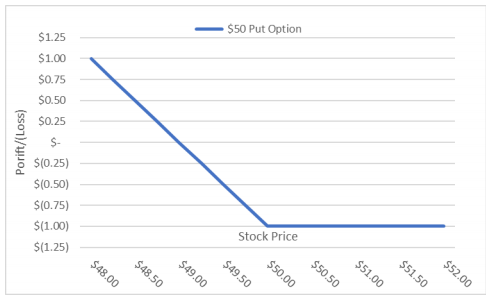

Here’s a payout diagram for this put option.

Up until $50, the option will have no (intrinsic) value at expiration. That means you lose the $1 you paid for the option. At $49, you break even at $0. And unlike a call buyer, whose profits are theoretically unlimited, a put buyer’s profits max out once the stock gets to $0.

Now, let’s say RBLL stock falls all the way to $45 at options expiration. The 50-strike put is now worth $5 (5 points intrinsic value; zero time value). Accounting for 100 shares, you could now sell to close the put for $500, netting a $400, or 400%, profit. Had you shorted the stock, you could buy back the shares at $45 to replace the borrowed ones, and still pocket a $500 profit [($50-$45) x 100 shares], but a much slimmer 10% return on investment.

In the event the share price increases instead of drops, it will be in the trader’s best interest to allow the option to expire, in which case the trader will only be out the amount of the premium that was paid to purchase the put.

In this scenario, by contrast, the short seller’s losses can add up quickly, and are theoretically unlimited.

Wrapping Up

There are a number of ways to place bearish options bets, but buying a put is the most traditional — and is open to traders who have graduated to the second level of options clearance. This strategy allows you the option to sell a stock at a certain price by a specific date and gives you a more limited-risk bearish bet than shorting a stock (which requires a margin account). And thanks to the benefit of leverage, buying a put option gives you greater flexibility and may garner higher returns than a short stock trade.