First of all, I’d like to wish you a Happy Presidents’ Day. Holidays such as this are a great opportunity to take a break, unwind and recharge the batteries. It’s also a great opportunity to take some time to do some homework and sharpen up for the coming trading week.

Futures were higher this morning as Biden and Putin agreed in principle to France’s summit proposal before all these gains were given back. The market also closed very weak on Friday. One of the weakest large caps was NVDA, which sold off steadily after reporting corporate earnings after the close on Wednesday.

The Professor has identified 3 very Bearish-looking charts, all previously high flying semiconductors, that he thinks could go lower in the short term.

Semiconductors have long been one of the favorite trades on the street. This sector has seen insane amounts of demand due to factors such as Bitcoin mining, AI development, growth in Video Games, and Virtual Reality. Prices also skyrocketed during Covid due to a chip shortage. However, perhaps stock prices got a bit ahead of themselves as semiconductors have pulled back significantly since late November. The head of the snake, NVDA is down 30% from its highs.

Since reporting corporate earnings Wednesday, NVDA is down more than 10% in 2 days, and the Professor believes 3 more stocks in the semiconductor sector could go lower in the short term.

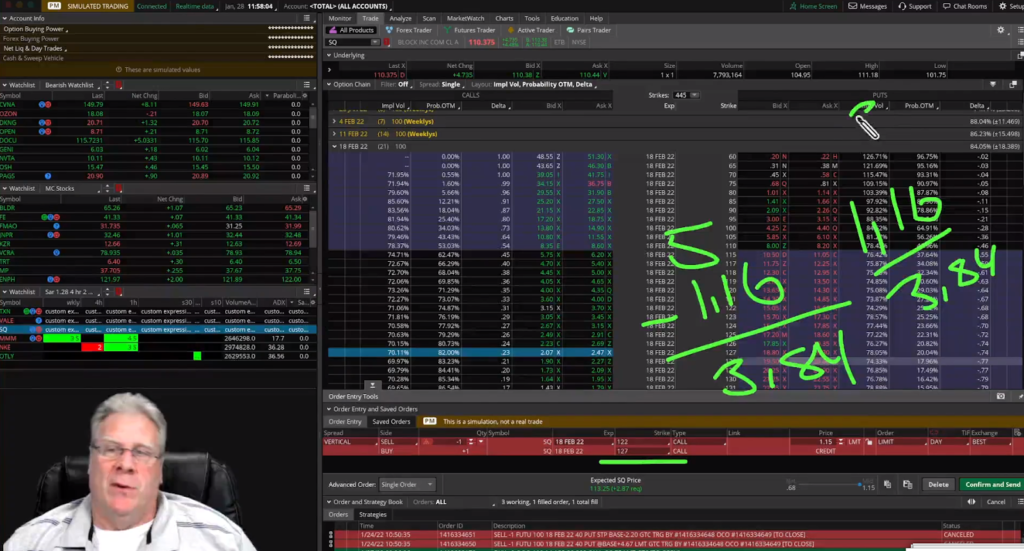

Here are his notes:

AMAT

Overall the market is looking bearish and since most stocks move in the direction of the market, I am looking for more short trades than long trades.

This triangle and squeeze pattern is set up in anticipation of the lower trendline being broken.

If this level is broken, I am going to start to look to buy puts or sell call spreads at that time.

My Trade: Target one is $126.34 and target two is $121.75 to the downside. Buying Mar 18 $130 put.

LRCX

This stock is moving mostly sideways and forming a pennant formation after a selloff.

I am looking for a bearish break below the lower gold line as an entry.

In the sub chart, there is a squeeze with negative momentum combined with a bearish On Balanced Volume. This is showing me there is continued bearish trading volume and increased selling pressure could come back once the squeeze fires to the short side.

This adds to my confidence that a downtrend will continue so I am going to position myself accordingly.

My Trade: Buy Mar 18 $560 put. Target one is $529.97 and target two is $506.28

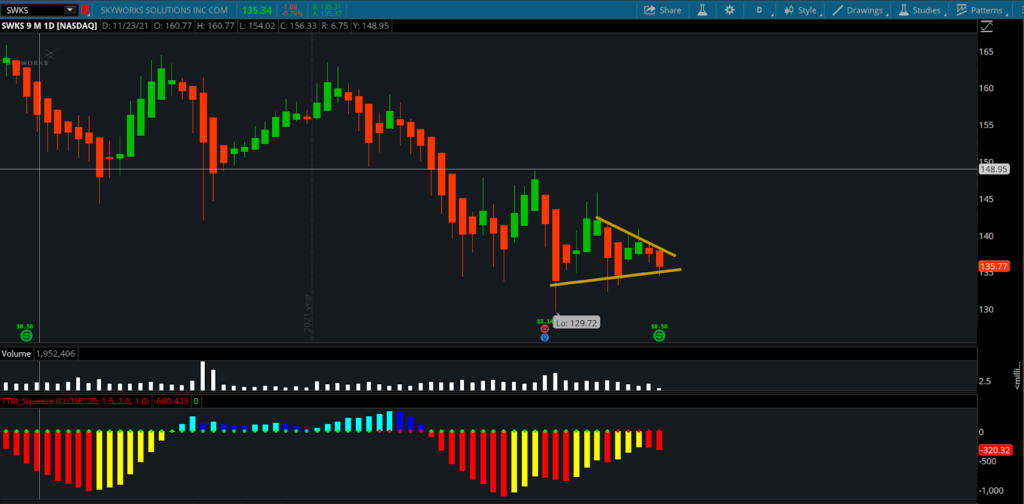

SWKS

Another pennant pattern making it the second one in a row for bearish trades. In addition to a bearish chart pattern, a squeeze is set up here with red bars showing downward momentum.

If there is a break of the lower gold line on the pennant that will be my entry for a short trade.

My Trade: Buy Mar 18 $135 Put. Target one is $130.46 and target two is $127.21

Bottom Line

Semiconductors have been one of the best performing sectors of the past couple of years. However, with the recent market pullback, this high-growth sector has shown some relative weakness!

In the last 2 days, NVDA has been very weak post earnings and has sold off over 10%. 3 more stocks in this sector that have bearish setups are AMAT, LRCX, and SWKS. The Professor is looking to get into these trades on the short side through options.

Comments are closed.

3 Comments

Chart exhibits are excellent. Coupled with weak earnings comments for NVDA

enhances the forecast of the breakout.

This is the first time reading your post. I like it: simple and clear.

Warm regards.

What is Professor’s background? Thanks…Pete

Thank you, Jeff! Thanks, Mike! It sure is fantastic when you both teach live. I love that. I usually have six charts going along with all of my positions to watch, so it really helps to be able to hear your training, and live picks. Thanks!