In the markets, there’s the smart money and the dumb money. The dumb money is usually referring to retail traders who are inexperienced and might trade based on what they see on CNBC.

Smart money traders are usually the people in the know, such as industry experts and large financial institutions. Now I don’t want to sound like a conspiracy theorist, but despite being illegal, I believe Insider Trading is far more common than is made out. I believe that someone always knows something, and there is a way to potentially spot some of these activities.

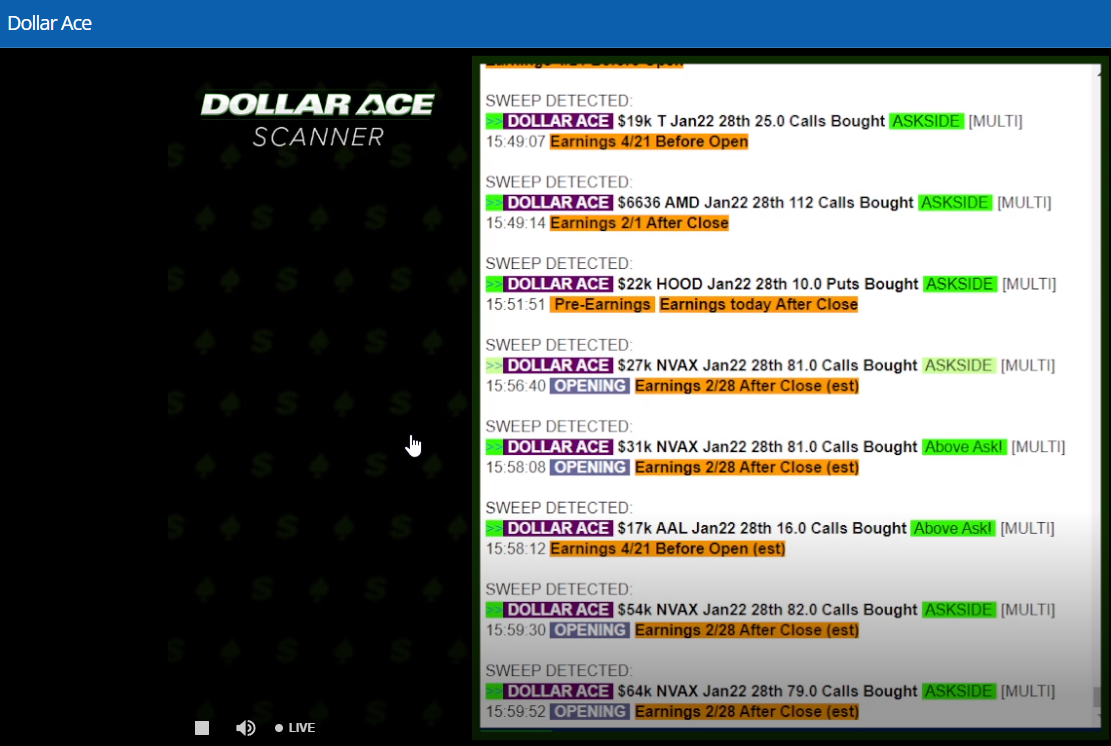

Sometimes large options purchases can precede seemingly unexpected news. Unusual options activity such as this can be picked up by scanners such as Dollar Ace, which Ben Sturgill is an expert at using. Ben has been using the software for years and understands what to look for when the smart-money steps in!

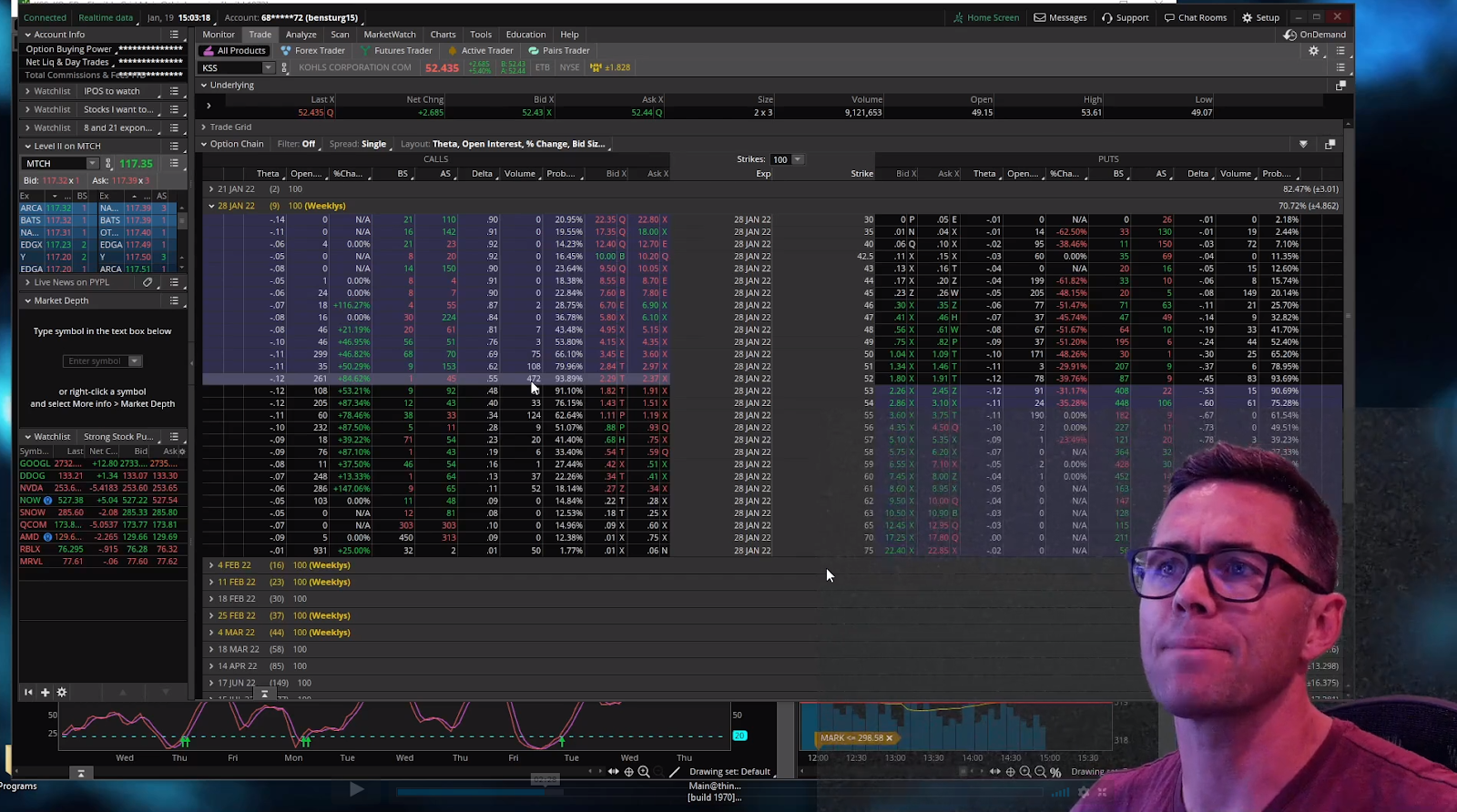

In fact, Ben spotted unusual options activity recently in KSS. He talked about what he saw on the 19th of January to his subscribers and just 4 trading days later on January 24, it was announced that there was takeover interest in KSS. The stock gapped up 30% on the news, and options were up over 400 %! Someone always knows!

A lot of beginner traders learn about charts and candlesticks when they begin trading. Those are all great concepts to understand how price has been moving and where it might move in the future. However, a big factor in future price action is understanding what the “smart money” is doing or likely to do next.

The reason for this is that it is the smart money or large funds who either know much more than you or have way more money than you and thus can affect the price and future demand and supply for a stock.

This is where a scanner such as Dollar Ace can come in very handy. Unusual options scanners show very large options purchases that may be unusual or uncommon and thus detect the possibility of insider trades or at the very least show what very large market participants may be doing.

For example, here is a screenshot of the Dollar Ace Scanner taken late yesterday. 5 minutes before the close yesterday, someone bought over $175k worth of NVAX options between strikes of $79 and $82, expiring Jan 28th, which is today. Given that NVAX closed below $73 yesterday, that’s a whole lot of money to risk on a move 10% higher. Is it possible someone knows something? Whether a news announcement comes to pass is another story. In any event, this type of scanner is a great tool to see what the big money, is doing, and how that can affect the future price of the stock!

KSS

On the 19th of January, Ben Sturgill noticed unusual options activity in Kohls Corporation (KSS). There was HUGE unusual options activity buying on KSS for call options expiring on Jan 28 and for March 2022. Why is it unusual? Well, it’s not every day you see someone loading up call options on a retailer, and the amount bought was also significant.

KSS also had a large short float which meant that if any news were to hit, the up move could be very extreme given how many short-sellers could be on the wrong side of the trade.

The options Ben was looking at were the $52 calls, and they were selling for around $2.50. Now he was looking for a scalp trade to $2.70. You see not every Unusual Call options buy will be a huge insider buy with someone who “knows” what’s coming.

Well, it just so happens that 4 days after Ben spotted this unusual options activity this headline hit:

Shares of Kohl’s Up 24% Premarket Following Reports of $64/Share Bid by Acacia Research-Led Group; Potential Bid by Sycamore Said to be $65 or More.

KSS opened at $61.71 and traded as high as $63.85 on the day of the news. Needless to say the options Ben was looking at traded over $10 for over a 400% move.

Someone always “knows”.

Bottom Line

A big factor in future price action is understanding what the “smart money” is doing or likely to do next. The smart money, or large funds, either know much more than you or have way more money than you and thus can affect the price and future demand and supply for a stock. This is where a scanner such as Dollar Ace can come in very handy.

Unusual options scanners show very large options purchases that may be unusual or uncommon and thus detect the possibility of insider trades or at the very least show what very large market participants may be doing. This large call buying can precede big moves in these stocks.

Understanding what the smart money big traders are doing can give a trader added confidence that a trade could be more likely to work. Professionals such as Ben Sturgill study scanners like Dollar Ace on a daily basis and know what to look for when big dollars hit the tape!

Comments are closed.

1 Comments

Upper surface of sea in high tide and low tide of daily swing to beat daily inflation market connect to prizes control on food.