Everyone’s a genius in a bull market.

I didn’t make that up…it’s actually a common saying on Wall Street.

Anyway, gone are the days when you could place a bullish trade and have good odds that the Federal Reserve’s “punch bowl” manipulation of stock prices would help guide the way to a favourable result.

What that means for you as a trader is that, NOW, more than ever, you must have all the necessary market insights from someone who can educate you on how to put them into practice for yourself.

Before we continue, let me ask you a question.

Have you been taking advice from either Jim Cramer or Cathie Wood recently?

The reason I ask is because, first of all, Cramer’s track record has been questionable enough that there’s actually a Twitter account that positions against his market calls.

You can find it @CramerTracker.

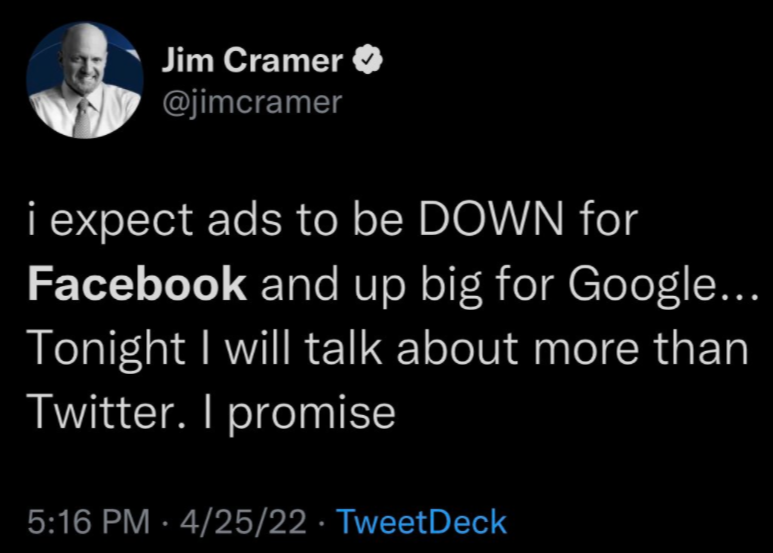

Take this recent gem, for example:

And what happened?

Well, the opposite…and as a result shares of FB gapped higher by 16% post-earnings on Thursday.

Then, there’s good old Cathie Wood.

Poor Cathie!

She just keeps riding losers lower and adding to those losses.

Don’t believe me?

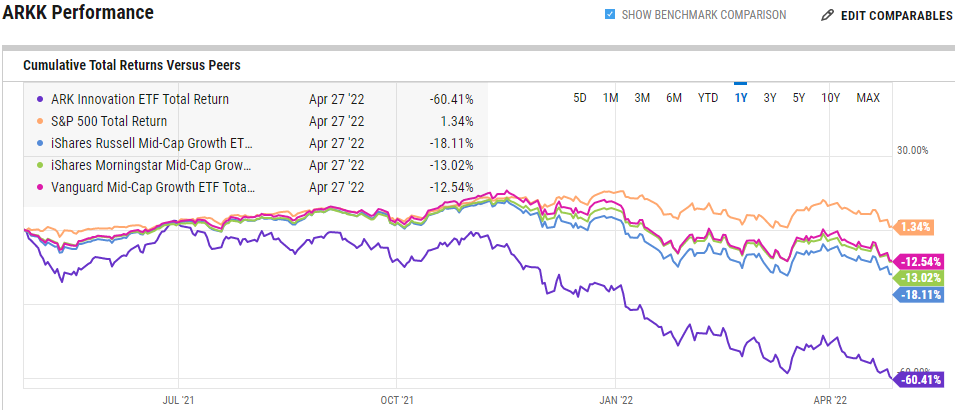

Just look at this 1-year performance comparison of Cathie’s flagship fund (ARKK) relative to the key market benchmarks.

Source: YCharts

Yup.

That’s ARKK all the way down at the bottom there, with a 1-year decline of 60.4% vs. the S&P’s increase of 1.3%.

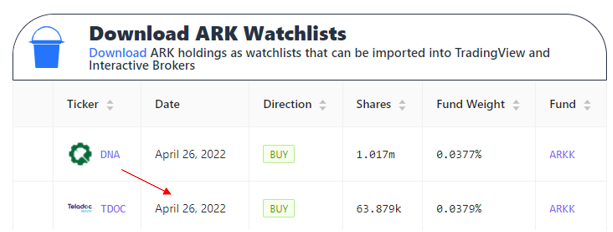

What’s the latest debacle for Cathie?

Teladoc Health (TDOC)

Yup again!

Her fund actually added another 63.9K shares just one day before TDOC collapsed 43% overnight on Thursday.

Source; Cathiesark.com

What’s the point I am trying to make here?

It’s that so many novice investors follow the ideas of these people because they have a wide-reaching public voice.

The potential problem with this is that their insights are not part of a plan where trade management is involved.

Whether it be in the Master’s Club, or the weekly Bullseye Pick, or in my Total Alpha updates, trade management, and education is part of what I do nearly EVERY TRADING DAY.

Now, I am fortunate to be able to say that I have been on a pretty good run where a streak of my recent weekly Bullseye Picks have moved in the desired direction, at least early on in the trade.

You can learn more about these trades by reading the articles on our website here, here, and here.

But, I am not ashamed to admit that there are times when these trades do not go my way.

And that’s where the value comes in, when I as a guru build a plan for managing trades when prices don’t move as desired.

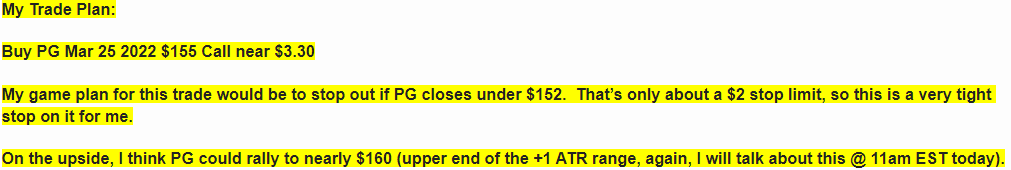

A perfect example is my Bullseye Pick all the way back on March 7th, which, I am happy to say, is one of the last picks that did not work out well.

Anyway, here is an actual screen grab of my gameplan from that day’s actual Bullseye alert:

Needless to say, and as I discuss in this article that educated readers on what went wrong, the trade did not work out and protective measures were in place.

What you see next is an actual comment from someone that digested the educational content in that article.

Friends, I’ve already got my plan ready for Monday’s Bullseye Pick of the Week.

Remember, trading is not easy, but I am going to do everything I can to help you develop a plan.

And DON’T FORGET! I do it in REAL-TIME, but you’ve got to be there MONDAY MORNING IN – THIS ROOM.