Due to their flexibility, I like to structure a lot of my trading ideas using options. I do this because it can be easier to define my risk in a trade, and some options strategies require less buying power than buying or shorting expensive stocks.

Options aren’t the only powerful weapons I have access to.

An important measure I look at before entering an options trade is Delta. Delta measures the rate of change in an option’s theoretical value for a $1 change in the price of the underlying security.

Delta

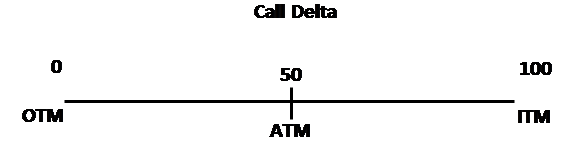

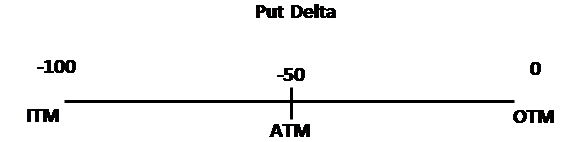

Delta is one of the most important Greeks as it tells you how much your option will move if the underlying stock moves $1.00. For a call, Delta will always generally range between 0 and 100. For a put, Delta will range between -100 and 0.

A Delta of 0 occurs when the option is deep out-of-the-money (for a call) or is out-of-the-money and expiring shortly. For example, If A stock is trading at 100, and you have 102 calls expiring in 15 minutes, they may have a Delta of zero.

The Delta of a call increases in value as the underlying stock rises (or falls in the case of a put), and the option gets closer to being at-the-money.

When the option is at-the-money, the Delta is usually around 50 (-50 for a put). In the case of a call, Delta continues to rise as the underlying stock rises. For a put, Delta continues to decline as the underlying stock falls. As the option gets more in-the-money Delta will ultimately rise to 100 (or fall to -100).

On expiration, an option will close at Delta of 100 if it’s at least a penny in-the-money for a call option, and -100 for a put option that closes at least one penny in-the-money.

As the graph above shows, call Delta will move from zero when the option is out-of-the-money, get to 50 when it’s at-the-money, and it can reach up to 100 if it is deep in-the-money. The graph below shows the same thing, except in the opposite direction for a put.

Delta is expressed in percentage terms. A 50 Delta means that an option’s premium will increase or decrease by 0.50 times a $1.00 move (up or down) in the price of the underlying stock. In other words, an option with a 50 Delta will move by $0.50 for every one dollar move in the underlying stock.

The bigger the Delta, the more the option will move like a stock. That is why sometimes I prefer to buy calls with a Delta closer to 100. Although they might be more expensive, I might actually be taking less risk by paying more because the options will move almost 1 to 1 with the stock.

On the other hand, if I am making a Friday lotto play, sometimes I might prefer Out of The Money calls with a Delta close to 0, as there may be inherently greater leverage. Although in this case, the risk of being wrong may be much greater, if I am correct and there is some breaking news, for example, the returns can also significantly increase. This may happen if there is a large move in the stock and the cheaper OTM options get In the Money and continue further. In this case, a 0 Delta option becomes one with 100 Delta.

Furthermore, it may seem obvious, but options contracts give a trader literally more options, especially when managing a position. Delta can be used as a guide to managing risk.

Adjusting Delta

Delta can also be used as a way to add, subtract or neutralize deltas from being long or short stock. Each share of stock is 1 delta, so 100 shares of stock would equal 100 positive deltas. Each $1.00 the underlying moves up would result in a gain of $100. Some investors may want to adjust this exposure at certain times during a trade, and options can be used to do just that!

For example, let’s take a covered call, which is selling 1 call against 100 shares of stock. A short call is a bearish strategy and therefore has a negative delta naturally. Selling an out-of-the-money (OTM) call with a delta of (0.25) would hedge directional exposure by 25% I would now have a net delta of 0.75 and no additional risk. I do limit my upside potential, but I also reduce my loss potential if the stock price drops.

If I wanted to completely neutralize my delta temporarily, I could sell two at the money (ATM) calls at a delta of (0.50). This would net the delta out to 0, but I would be taking on more risk as one of the short calls would be uncovered.

It’s important to remember that deltas change, so in both of these examples, if the stock price dropped, the call deltas would decrease, reducing the overall hedge. Options can be a great way to fine-tune directional exposure at any time.

Delta Neutrality

A portfolio may consist of various positions (some bullish and some bearish). Sometimes, it can be very difficult to trade directionally, so there are trading strategies that choose to keep deltas neutral. This means that if there are big directional moves in the market, a delta-neutral portfolio will be at less risk than if I was fully directional and wrong. In this case, I would rely on theta decay, and implied volatility overstatement as the main drivers of my trading setup, not directional trading.

Bottom Line

An important measure I look at before entering an options trade is Delta. Delta measures the rate of change in an option’s theoretical value for a $1 change in the price of the underlying security. The bigger the Delta, the more the option will move like a stock. Delta can be used as a guide to managing risk. Although they might be more expensive, I might actually be taking less risk by paying more and buying calls with a Delta closer to 100. because the options will move almost 1 to 1 with the stock. On the other hand out of the money options with a Delta closer to 0 are risker but may provide a bigger opportunity. Delta Neutral trading strategies can also be used so that I do not have to predict the direction of the market to be ready for a great trade setup.

Comments are closed.

3 Comments

I’VE BEEN TRADING OPTIONS FOR A FEW YEARS NOW, AND I’VE NEVER BEEN EXPLAINED THIS PRINCIPLE, THANX AGAIN& AGAIN!7

IF I EVER GET THE MONEY TO BUY YOUR PREMIUM SERVICE I WILL JUMP ON IT!7

Really good information. Thank you.