Before we get started, I just have to reiterate how excited we are to have our newest guru, Jake McCarthy, on board.

Jake’s immense knowledge of the cryptocurrency space, as well as his insights into the technology and trends of the metaverse are unmatched, and that’s exactly the kind of leadership we all need to help us pinpoint the next big opportunities in these exploding industries.

… if you want more info on the world of crypto just tap here!

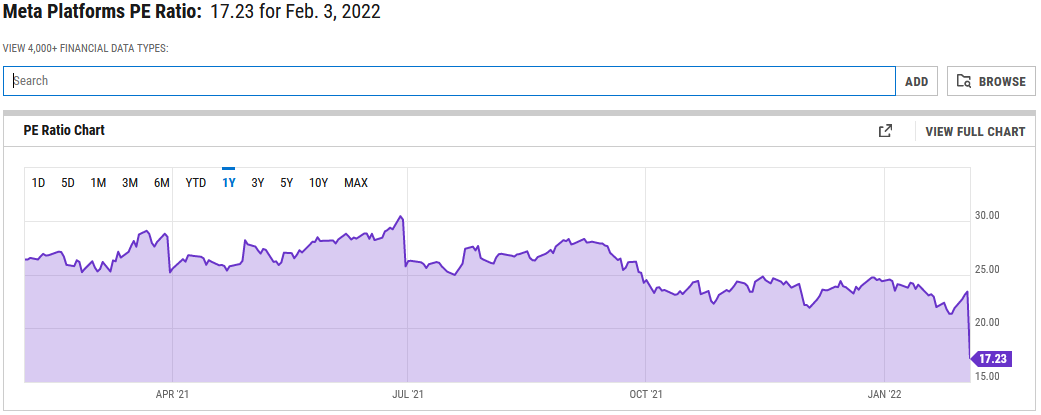

By the way, did you know that even after Meta Platforms Inc. (FB) (the company formerly known as Facebook that changed its name to reflect its business model shift towards the metaverse) witnessed its worst trading day in history with a collapse of -26% on Thursday, the company’s PE (price to earnings ratio) still stands at what is considered an elevated level of 17.23.

With that in mind, today I am going to highlight the stock that looks the most interesting to me right now and has a far more attractive PE.

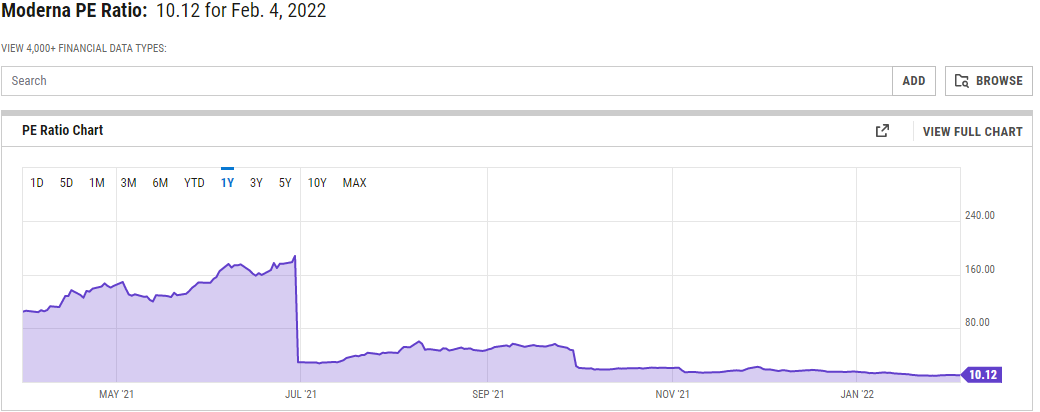

Today, we’re going to look at Moderna Inc. (MRNA).

They say bottoming is a process, which means it often takes longer for bottoms to form than it does for tops to form.

You know what I say to that?

I say, “Bring It,” because, as an options trader, I have a number of strategies that benefit from the passage of time.

And my favorite strategies on this list, known as vertical credit spreads, are very simple to implement.

When I want to be bullish on a stock that I think could take some time to form a bottom above an important support level, I use a “bull put spread.”

Note: There is a complete educational section at the bottom of this commentary for you to reference. For now, just understand that this trade profits as long as the price stays sideways-to-higher through expiration.

At the start of this week, I called for the market to start rallying.

Then, as the market started to fizzle near this week’s highs, I began talking about the major indices like SPY and QQQ retesting the recent lows.

This, my friends, is called a bottoming “process.”

These processes can often be gut-wrenching, so right now this is definitely not a time to fall in love with stocks. This is speed dating time. Don’t hold them long.

However, MRNA is a company that I really find interesting right now, not just because it is bottoming near massive support, but also because it is in an industry that is not particularly sensitive to the explosion in interest rates we are seeing right now.

That’s why I referenced FB earlier, because, even though that stock is now oversold after Thursday’s earnings-induced collapse, it is a large-cap growth stock that is highly vulnerable to the recent jump in rates.

In addition, MRNA only has a P/E ratio of 10, so this is also a “relative value” trade to me.

So, as MRNA looks for a bottom near massive support that is defined by the long-term consolidation that took place from December 2020 to May 2021, I’ll be looking to set up a bull put spread in the area of $150 to $140 (see chart below).

Educational Content:

When would a trader use a bull put spread?

This trade is best utilized when a trader has a neutral to the bullish opinion of a stock or ETF.

Since the trader is a net seller and collecting a premium, the trade benefits from both time decay and rising stock prices.

The trade is also statistically proven to provide better odds of success than many other trading strategies.

What are the basic mechanics of a bull put spread?

A bull put spread is the easiest multi-leg options strategy to learn because it consists of one long put with a lower strike price and one short put with a higher strike price, both of which have the same expiration date.

Since the trader is selling the put with the higher premium, a bull put spread is established for a net credit (or net amount received).

The trade profits when the value of the spread declines over time.

What’s the maximum profit potential?

The maximum a trader can make on this trade is limited to the net premium received (minus commissions).

The maximum profit is realized if the stock price is at or above the strike price of the short put (higher strike) at expiration and both puts expire worthlessly.

What’s the maximum loss potential?

To find the maximum that can be lost on the trade, find the difference between the strike prices minus the net credit received (plus commissions).

The maximum loss risk is realized if the stock price is at or below the strike price of the long put at expiration.

What’s the breakeven point of the trade?

To find the breakeven point, take the strike price of the short put (higher strike) and subtract the net premium (credit) received.

To YOUR Success!

Comments are closed.

1 Comments

Hello ,i am looking at the MRNA stock at $162 So my question is this(1)are you hoping this stock going down(2)are we going to buy these both strikes in put section like you said 140&150strikes.I need more help Thanks