How many times have you spent hours looking for the right options trade, waited anxiously for the market to open the next day so that you can place the trade, only to watch the value of your options wither away to nothing as time passed by?

Folks, WE’VE ALL BEEN THERE.

It’s basically part of the inevitable process of learning about the negative effects that time has on the value of purchased options.

But there’s good news!

Now that you’ve experienced the effects of Theta (time decay), you know you need to do something about it.

Don’t make the decision to NEVER trade options again.

If you do that, you’ll just be another statistic in this new world where people who don’t understand the value of learning from failure.

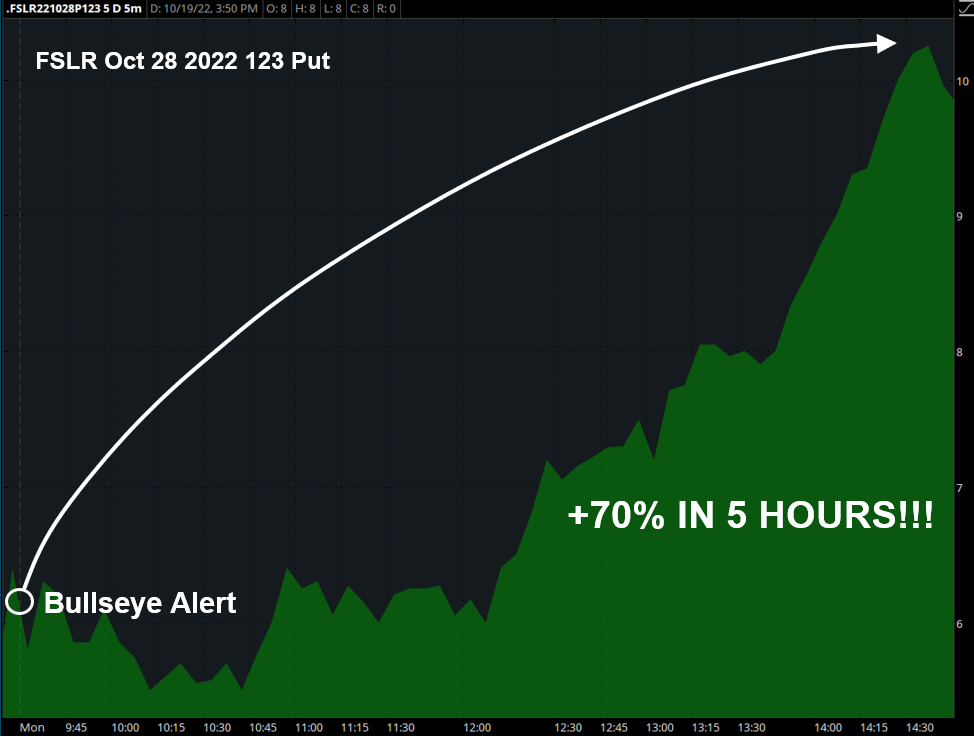

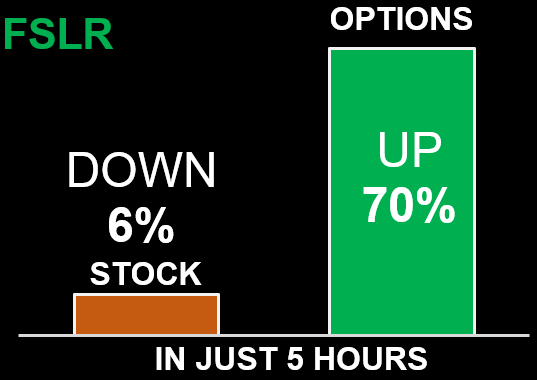

You see this chart?

This is how much my Bullseye Trade of the Week idea moved right out of the gates this week.

Now, look at the power that the options gave me over simply just shorting the underlying stock.

Folks, this trade moved so fast that Theta (time decay) didn’t even have a chance to have a negative effect.

Look, there is NO shortcut to success in this world.

The world of options is complex, BUT INTERESTING TO LEARN.

And we at RagingBull? Well, we have spent YEARS putting the body of educational materials together to help you achieve this.

Here, let’s start with this quick lesson that just might be the most important lesson on your journey to becoming a better trader.

By the way, if you have any questions at ANY time, or if you just want to talk, give us a call at (800) 585-4488.

Teachable Moment:

Theta

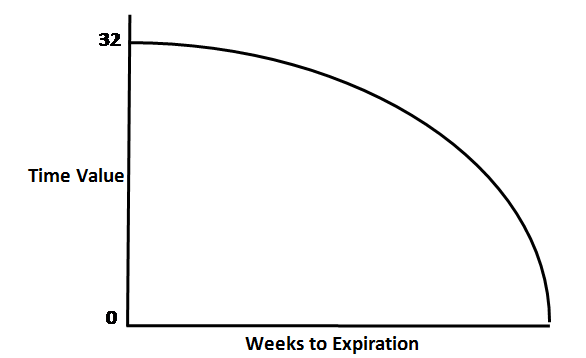

An option’s price is made up of intrinsic value and time (extrinsic) value. The closer an option gets to its expiration date, the faster that extrinsic value erodes. That rate of decay is the option’s Theta. It represents the amount of time value that will be lost in the next day.

The closer the option gets to expiration, the bigger Theta gets. And, this increase happens at an exponential rate. Here’s an example of how Theta might erode an option’s time value.

![]()

And, here’s what that would look like when plotted on a graph.

Now, whenever you buy an option (call or put), your position has a negative Theta. On the other hand when you sell premium (call or put) you have a positive Theta. For an option buyer, Theta works against you, and for the option seller, Theta works in your favor.

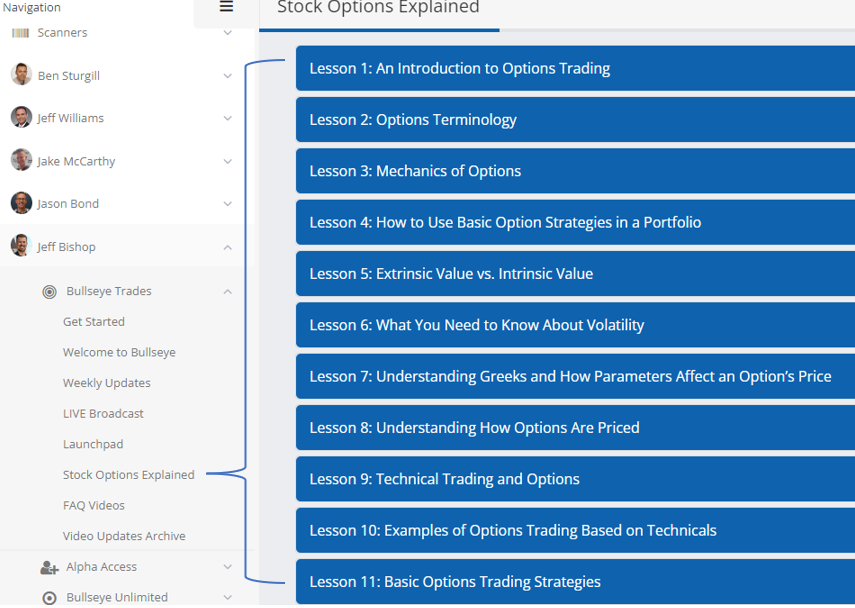

Folks, this is straight from the educational section of my Bullseye Trades Member dashboard:

Look, I know how tough this market is, and I HATE TO BREAK IT TO YOU, but I think we are going MUCH LOWER after a bounce.

So, RIGHT NOW, I am offering you this 60% discount to join me, often in REAL TIME, in learning how to master the use of options trading in this environment. BUT SEATS ARE LIMITED!!!

If you’re just not ready to join me and my friends, then at least watch this INCREDIBLY informative playback of one of my events from this past week, at no risk to you.

To YOUR Success!