Rotation, Rotation, Rotation!

That’s what nimble trading is all about, and that’s what my weekly Bullseye Trade ideas tend to focus on.

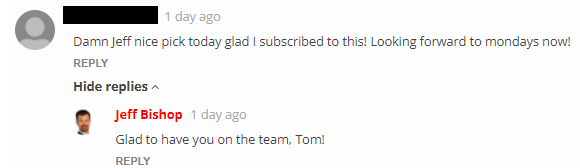

Speaking of our Bullseye picks, we have been on an absolute roll recently, and our members have been sharing their excitement, as you can see here:

Trust me when I tell you that this excitement is tame compared to a lot of the other comments we’ve been receiving.

Now, beneath the surface of the widely publicized major indices like SPY and QQQ, the market is just a massive living, breathing organism with sectors and industries that are constantly stretching to extremes then reverting back to their means (averages).

Knowing when to rotate your portfolio in a manner that captures these movements is part of the trading craft that we are all trying to master.

One reliable part of this never-ending rotation is where the healthcare sector tends to outperform the market during times of increased uncertainty such as we’ve been seeing so far this year.

And I’ve got the charts to prove it!

MRNA has been showing relative strength

As this first chart shows, the healthcare sector has shown leadership over the S&P 500 during all of the recent major market downturns.

The reason for this is, similar to the consumer staples sector, which contains stocks like supermarkets and consumer goods companies, the healthcare sector contains many companies with business models that generate revenue even in uncertain economic times.

Therefore, this leadership is the result of “smart money” accounts rotating their funds from more risky companies to these less risky stocks in order to reduce risk and find alpha in their portfolios.

It was tempting to go with the hot sectors of late, like miners, fertilizer stocks, shipping, oil, etc…but all of these sectors have had a great run already, so I was hesitant to jump on these trends as they all looked vulnerable to needing to take a breather earlier this week.

MRNA is a stock that doesn’t necessarily follow the ups and downs of the overall market and can make a move up even if the market isn’t nice to us this week.

I think the Chinese lockdowns are a bigger deal than the market is leading us to believe.

When I looked at all of the “re-opening stocks” at the start of the week, they looked quite weak.

Coming into this week’s trading, I felt that ongoing COVID fears in China would cause MRNA to remain bid and rally.

My trade plan for this week’s Bullseye Trade was as follows:

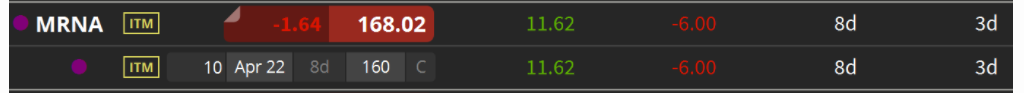

Buy to Open (BTO) the MRNA 22 Apr 22 2022 160 Calls near $7.00, with a stop of a close < $148.

If we use the open of $6.44 for this option on Monday as the starting point, the MRNA 22 Apr 22 2022 160 Call quickly jumped by 54% in just the first 35 minutes of Monday’s trading!

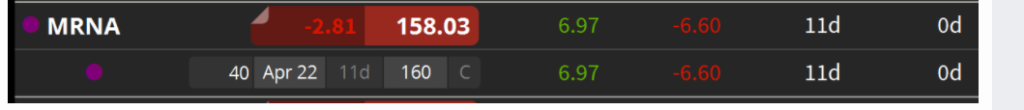

And since MRNA never fell below my $148 stop, it is also worth highlighting that 22 Apr 22 160 calls rose as much as 134% intra-week this week.

I still like the stock against the $148 stop for the reasons highlighted above, but I did use Wednesday’s rally to sell 30 of the original 40 calls that I bought at the start of the week.

I am holding onto the final 10 contracts of this original order, as the stock continues to work toward my original targets of $178 and $190.