If you pull up Twitter or any finance-related TV channel, all you’re going to hear is that one stock is going to the moon, and another stock is about to come crashing down…

What the biggest talkers out there often miss is that the market (and any given ticker) has a third state… that of not doing much!

Believe it or not, stocks don’t only break out or break down – they can also range, consolidate, sit tight at a level or just hang about.

The cool part is – it’s almost always possible to still make a return, even when a name in question doesn’t move much!

Let me tell you about one option spread strategy that’s designed to capitalize on exactly that.

Option Spreads

Many of you have heard me talk about bull and bear spreads – the type of options bets designed to collect the premium and get paid when time passes or volatility shrinks.

Let me explain this through an example – let’s say you’re betting that a stock will bounce.

I did just that with BABA some 2 weeks ago:

I saw the shares lose over 20% in a matter of a few trading sessions, have a few “blowoff” days on large volume, and fall right into long-term support from a weekly chart.

My thesis was that the selloff was overdone in short term and the big support level would be a reasonable place to expect a bounce.

Now, BABA is an expensive stock and it likely won’t bounce more than 5-10%.

Buying options outright is also rough – premiums have exploded following the sharp down move.

So, what can I do to avoid locking up a ton of capital, control my risk and still get a good return on my money?

I can sell some expensive (remember the exploded premiums?) put options, collect the premium, and hedge the risk out with less expensive put options – in other words, enter a bear put spread.

If the stock bounces or time passes by, implied volatility on my puts will shrink and I’ll collect the difference between the premium I got and the less expensive premium I paid.

Here’s the trade I made in Puts expiring on September 3rd:

- Sell 165 Puts for ~$8.10 per contract

- Buy 160 Puts for ~$5.90 per contract

- Collect ~$2.20/contract spread, wait for my bounce

As the stock bounced, volatility shrunk and the puts got a lot cheaper. I was able to close out the trades for:

- Bought back 165 Puts for ~$4.15

- Sold 160 Puts for ~$2.90

The trade netted me ~$1 per contract (the difference between initial spread and spread at the time of closing out).

A bull spread would be the mirror image, except that you’d be dealing in calls and using it to play the downside.

Sounds easy enough right?

Butterfly Spread

Now, what would happen if you were to combine a bear spread (that pays if a stock doesn’t go down) and a bull spread (that pays if a stock doesn’t go up)?

That’s right, you’d get a market-neutral position that pays you off as long as the underlying share price remains within your option borders.

Let me give you an example of what such trade may look like – let’s bet that Tesla (TSLA) stays around its current price of $730 for the next month.

I can enter a Butterfly by simultaneously entering a Bull Spread and a Bear Spread in Oct 1 contracts:

Bear:

- Sell 720 Puts for ~$26.50

- Buy 700 Puts for ~$19.70

- Collect $6.80/contract

Bull:

- Sell 740 Calls for ~$23.15

- Buy 760 Calls for ~$15.55

- Collect $7.60/contract

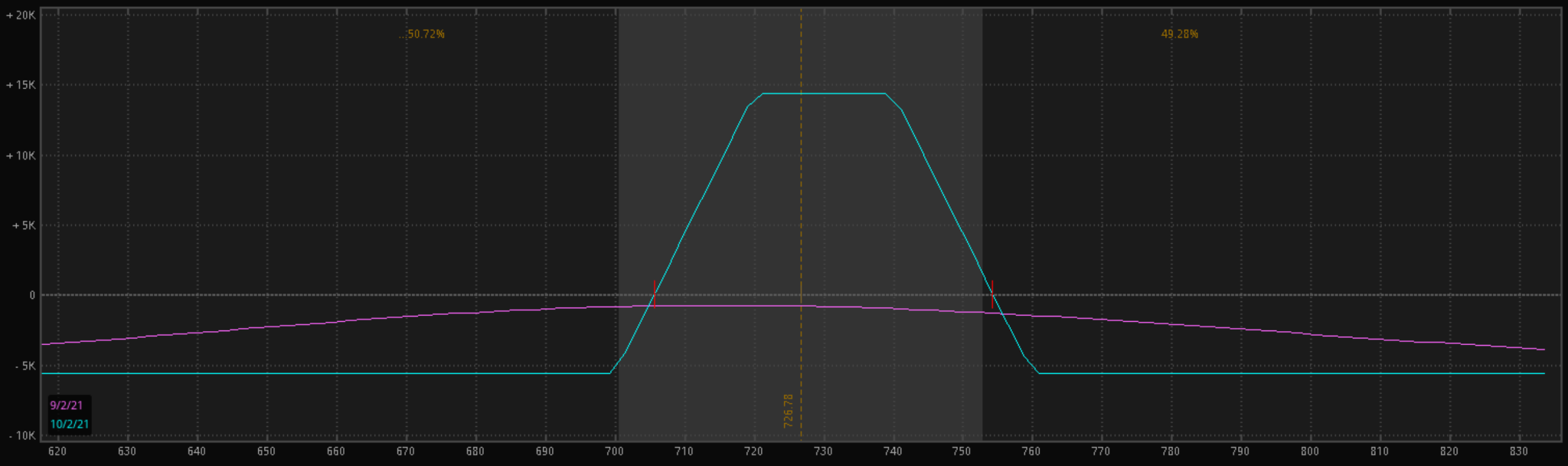

Here’s what the payoff chart of such a trade would look like:

As you can see, at expiration the trade would give the max payoff if the price stays within the borders of the options we sold – $720 to $740.

However, we’d still come out green, should the price stay between ~705 and $750.

When To Use One

I think the answer is quite self-explanatory by now – unlike most market tools, a butterfly spread will make a profit when the underlying stock does little to nothing.

If I don’t expect a stock to do much in the near future – such a trade is my go-to strategy.

I make sure my range is reasonable and the premiums are fat enough to make the trade worthwhile.

2 Comments

will look for opportunity to try this

can we not make a butterfly directional by picking the short strike we sell either above or below the price i try to use this in earnings and seems to work all right. thE BUTERFLIES ARE USUALLY BALANCED AND THETA POSITIVE ALTHOUGH IM STARTING TO LOOK AT THE BROKEN WING ONES NOW . best paRT IS THE LOW COST AND NO NEED FOR A MARGIN UNLIKE IRON CONDORS . THE ONLY OTHER STRAGY THAT ALLOWS ME TO TAKE ADVANTAge of the volatitly crush is the calensder or diagonel