We are in the middle of earnings season, and I have been busy working on a new trading strategy. I will slowly be integrating it into my live trading over the next couple of weeks.

Newer traders might be seduced into wanting to gamble on earnings by buying shares before an earnings report comes out.

As I always preach, Risk Management is key to any trade.

You could end up singing the blues if you don’t take risk management seriously

Today, I will show you how to trade a stock with upcoming earnings responsibly and with defined risk by selling (or buying) Iron Condors.

Setting the Trade

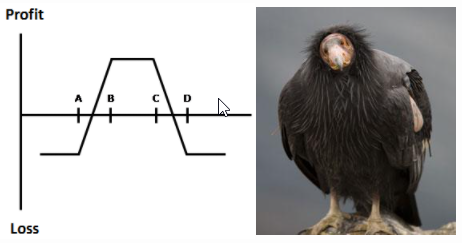

The iron condor is constructed using two short spreads. One is a bull put spread the other is a bear call spread. They are both credit spreads. These strategies get their name from the shape of the profit/loss graph, which vaguely resembles the shape of the big bird.

Said another way, I’m selling a bear call spread and selling a bull put spread. Both will be out-of-the-money. Because I am selling both spreads, an iron condor is always a credit spread from the seller’s point of view. As with all short option positions, the credit you bring in is the maximum opportunity on the trade. There are two break-even points in an iron condor.

The upper breakeven is the strike of the short call (“C”) plus the net premium received. The lower breakeven is the strike of the short put (“B”) minus that same credit.

The sweet spot for an iron condor is between the two short strikes, “B” and “C”. And, again, that’s right where I want the underlying to be at expiration. Ideally, I want all four of the options to expire worthless. Now, despite the complicated appearance of this trade, most brokerage accounts allow you to place this trade as a single order.

The iron condor is the combination of a short out-of-the-money vertical call spread (“C” and “D” in the above image) and a short out-of-the-money vertical put spread (“A” and “B”). So I would sell a call with strike C, buy a call with strike D, sell a put with strike B and buy a call with strike A. That is the iron condor.

Determining Risk/Reward

Now here’s how I determine risk, reward, and breakeven on an iron condor.

The trade reaches its maximum profit potential if the underlying is trading at any price between “B” and “C” (in the graph above). When this happens, the maximum reward is limited to the net premium received on the trade. If the underlying is trading below “A” or above “D” at expiration, I’ll suffer maximum loss, which is limited to the difference between “A” and “B” (or “C” and “D”), they have spaced evenly apart from each other, less the premium I received.

Break-even occurs at two different prices. “B” minus the credit received or “C” plus the credit.

Usually, with a short options position, I’m looking for the time value to decay the value of all four strikes. But because I am trading an earnings catalyst here, I am mostly looking for implied volatility to shrink, especially if the underlying is trading between “B” and “C”.

Implied Volatility

Before a corporate earnings report is released, implied volatility will be at its highest. This is because implied volatility represents the expected volatility of a stock over the life of the option. As expectations change, option premiums react appropriately. Implied volatility is directly influenced by the supply and demand of the underlying options and by the market’s expectation of the share price’s direction. As expectations rise, or as the demand for an option increases, implied volatility will rise. Options that have high levels of implied volatility will result in high-priced option premiums. For this reason, the options expiring the week of corporate earnings in a stock will usually be higher than at other expiration dates.

Putting It All Together

My new strategy involves finding stocks with high implied volatility coming into a corporate earnings release. I will then be selling an iron condor with strikes in a range I believe the stock will stay within post-earnings. You see, a lot of retail traders gamble on out-of-the-money calls or put options into earnings. Market makers selling these options contracts have every incentive to make sure a stock does not move much, especially when most participants are expecting a big move. When everyone is positioned one way, the market usually does the other. With an iron condor, my risk is always defined. Obviously, there is a lot of nuances in finding the right stock to use this trading setup.

In addition, there is always the possibility to buy an iron condor when I think a stock may surprise and move more than expected. I usually prefer to be on the side of the smart money and sell options and condors. However, there are some occasions where an unexpected corporate earnings release can catch participants the wrong way and have a bigger than expected more. I will be on the lookout for this setup also.

Bottom Line

Earnings season provides enormous opportunities as volatility in stocks reporting corporate earnings increases. I avoid any temptation to gamble on corporate earnings reports. Instead, I focus on the process and continue looking for good risk/reward opportunities. I manage risk during corporate earnings releases by using advanced options strategies, such as the iron condor. I usually like to stay on the side of the smart money by selling options and thinking about market psychology. However, there are times when it might be prudent to trade the possibility of an increase in volatility if the market has not adequately priced that in by being a buyer of options.

Related Articles: