I often mention the importance of trading patterns when I talk about momentum stocks.

I’ve explained that history may repeat itself in the past few letters – you won’t find two identical charts, but stocks with similar characteristics may have similar moves.

Some setups repeat…

…over and over…

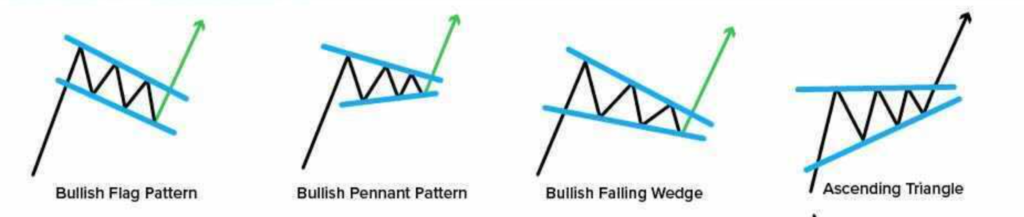

And below you can see a few of my favorites when it comes to continuation patterns:

So, why do I like them so much? And why seeing one gets me so excited?

The reasons are quite simple: they let me define my risk and wait for confirmation – two most important components of my trading.

If we’re talking about defining risk, it’s not hard to see the appeal of the charts above – the consolidation areas give you clean levels to trade against.

Confirmation is a trickier concept though…

In simple terms, confirmation is a price action that validates my thesis.

Confirmation means different things for each setup, but if we’re talking about long momentum uptrends, I like to see no hard failures and continuous gradual grind higher – indicators of strong underlying demand.

The setups I mentioned earlier allow just that: they demonstrate whether a stock establishes itself higher and can get supported at new price levels.

They then provide clean risk levels I can place a trade against for the next leg higher.

Below are three names I’m actively watching, given how well they’re shaping up:

Vertex Energy – VTNR

- Market Cap: 436M

- Free Floating Shares: 36.53M

- Short Interest: 6.40%

- ATR: 1.00

Vertex is involved with many things: from waste management to production of oil-based products.

The price reaction to their $75M purchase of a refinery in Alabama is… impressive!

I really like the volume it did, and how well it’s been holding up since – talk about confirmation!

It seems like the next leg higher might have commenced, thus I’m interested if the stock can hold above $8 for a move to $14.

ContextLogic – WISH

- Market Cap: 8.9B

- Free Floating Shares: 366.3M

- Short Interest: 5.01%

- ATR: 1.35

I’ve mentioned WISH a number of times over the past week as the strength so far has been just incredible – the demand is clearly there.

The question is – will it sustain a breakout or “pop and drop”?

The stock has had a lot of trouble at $15, so I’m not looking to get involved until that resistance clears.

If it does – I’m interested on the long side for a momentum ride higher into $20+.

Progenity – PROG

- Market Cap: 215M

- Free Floating Shares: 45.18M

- Short Interest: 9.18%

- ATR: 0.35

Much like WISH, PROG is no newcomer – I shared with you the recap of my trade in it on the day it first popped.

The action since has been nothing short of spectacular – the stock held well, few dips proved very short-lived and there’s been clear underlying support along the way.

The stock has already given confirmation and started the next leg – if it holds up, I’m hoping this can develop into a full-scale momentum uptrend.

To consider a long, I really want to see a clean hold above $3.30, a breakout above $4 and a move to a next resistance level at $5.

If that clears – we might be off to the races here.

6 Comments

great

Loved your way to explain things!! Im new in trading bussines, but learning everyday more and more thanks to your advices!!

Are you giving us updates on these thru the week? Letting us know wen to jump in? Appreciate it,.

Jason, I will follow these 3 stocks to confirm your projections.

Thanks!

Hello , being a new investor with not experience, I find this information great!!

I really appreciated, and I ill be following you. that is for sure.

MarioC.

Jason,

Why did you choose those 6 EMAs?

Thank you for your reply.