Happy Monday Everyone!

The so-called Meme stocks – with AMC and GME being two absolute superstars – gave incredible opportunities both ways…

Then there was the small cap action: MEDS, LEDS, AMST are just a few out of many!

I often say – stick to what’s working.

Momentum names have so far not shown any signs of exhaustion, so why would I reinvent the wheel?

Here’re 3 small cap stocks I’m keeping on my watch this week:

Novan, Inc – NOVN

- Market Cap: 137.11M

- Free Floating Shares: 14.07M

- Short Interest: 2.18%

- ATR: 1.72

Summary: After a major crash following a disappointing trial in early 2020, NOVN, a biotech stock, has lived a life relatively obscure and forgotten.

There was an attempt at a run up in February – March, but that didn’t really lead anywhere either.

All of this changed last week – the company put out promising updates on 2 of its ongoing trials: Phase 3 trial for treatment of Molluscum Contagiosum and Phase 2 trial for treatment of COVID-19.

This could be what I like to call a “changing fundamentals” trade. The name speaks for itself – a new piece of information comes out that gets investors excited about the company. I also like the fact the stock just had a 1:10 stock split, reducing the number of shares in circulation.

The action will likely be wild – to consider a long, I’d like to see clear support above $17 for a potential move into $25.

Vinco Ventures – BBIG

- Market Cap: 129.11M

- Free Floating Shares: 19.08M

- Short Interest: 23.92%

- ATR: 0.63

Summary: I’ve been keeping the name on my watchlist ever since the incredible move in early January: the stock jumped from ~$1.5 to a high of nearly $10 in a matter of 1 day. It’s given most of it back, but gained some traction over the past 2 weeks.

The company has historically been pretty active putting out PRs – coupled with its short interest and current position on chart, this can be one explosive combination.

I don’t want to get ahead of myself and need confirmation first – if the stock holds the $4.5 area well, I would consider a long position for a move into the $7 area.

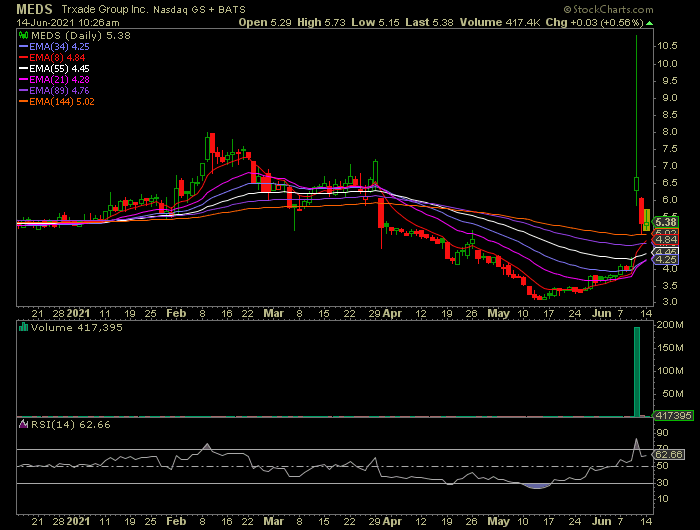

TRxADE Health – MEDS

- Market Cap: 54.20M

- Free Floating Shares: 3.28M

- Short Interest: 0.1% – likely, inaccurate given last week’s action

- ATR: 0.76

Summary: Similarly to NOVN, MEDS is a name that likely hasn’t been on many watchlists.

Last week the company announced it’s COVID-19 Health Passport App and it sent shares ecstatic – from $4 to a high of $10.82 in a matter of one session.

While one may argue how significant the news is, I do need to go by price action – the stock has retraced a lot of its gains very quickly and I won’t be surprised to see at least a bounce from current levels.

I like any hold above $5 and then above $5.50 to consider a long trade against these levels with a target at $7.

Pro Tip: Confirmation is Key

Even if this is the very first time you’re seeing a watchlist by me, you might’ve noticed common language between all three picks – to consider a trade I want a stock to “hold above” a key level.

In trading we call this “confirmation” – the key decision making component that may convert a name from one of the many you’re watching into an actual trade.

Confirmation “validates” your thesis.

If you would like to go long – seeing all dips get bought and a stock hold a support area cleanly may “Confirm” to you that there is significant demand

Conversely, if you want to be short – failure to hold higher and continuous push backs from a resistance area may rightfully confirm there’s overhead supply.

Patiently waiting for confirmation vs entering just because something looks good – is one of the keys to becoming a skilled trader.

7 Comments

I found that imformation to be very helpful. Looking forward to seeing more. Very easy reading. I will consider trading some of the suggestions.

Question?

What is ATR

Thank you, Jason, for this quality, informative, and strategically helpful email message. I am going to study, research and follow the three stocks you discussed in your message as I continue to learn and improve my stock-trading skills. I am very happy you and the Raging Bull platform are back online. I enjoy, am grateful for, and very much appreciate your quality educational service. Thank you again and best regards, Steve

Thanks for the information

Thank you, awesome insights.

Thanks, love your articles. Would like to do some live training but they happen during the work day. I read everything article. Keep them coming!

Thanks, again, J! See you in the Octagon! KD

Hi please send more about chart patterns