Options are risky, eh?

Yes, I agree. They have their downsides, especially for beginners. That’s why some traders just stick to trading stocks.

But besides the leverage of trading with less up-front capital…

I’ve found that if I take calculated risks and play my cards correctly…

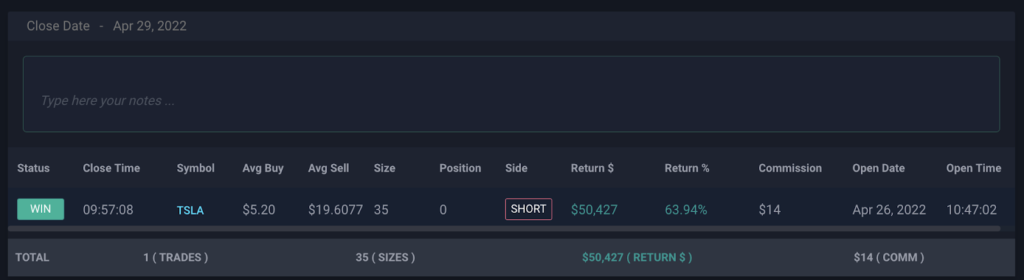

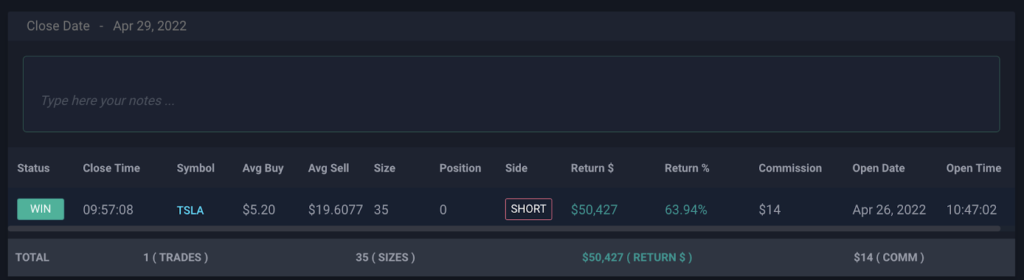

The results can be rewarding! Just like this 64% gain on TSLA!

Here’s a quick breakdown of my TSLA trade

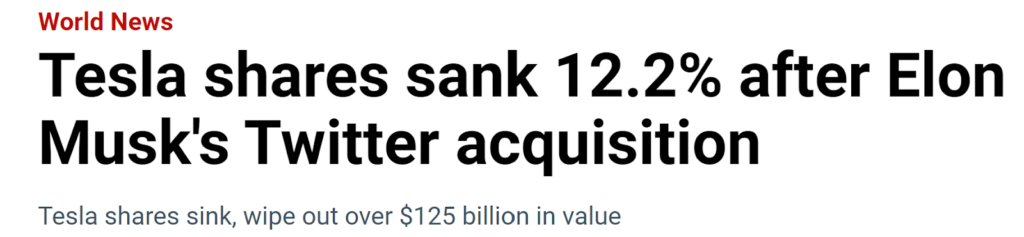

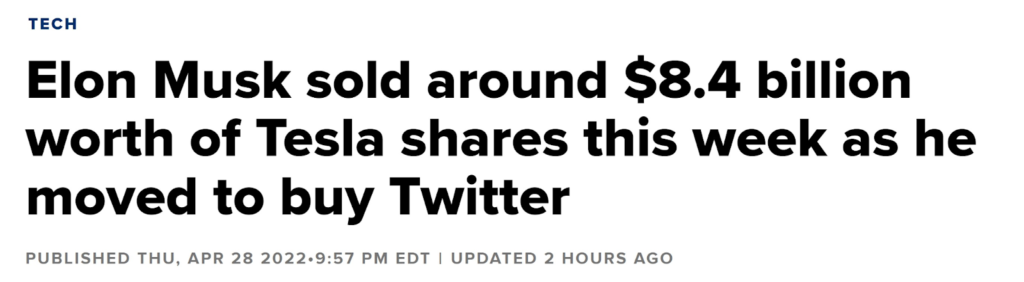

So Elon has been in the news lately, and after news got out that he was actually going to buy Twitter…

Tesla’s stock tanked!

Looks like traders were worried about how much stock he might sell to close the Twitter deal.

I talk about this type of market overreaction in my J-hook video lessons.

Anyway, I figured the move was a little overdone given they just had good earnings.

My Move?

Bull Put Spread.

This is a common trading strategy traders can implement when they’re slightly bullish on the movement of a stock.

The gist here is basically short selling a put option, and then buying another put option…with the same expiration date…but at a lower strike price.

I can reduce some risk while still aiming for profit.

If both options expire, I won’t have to pay any commissions to get out of my position.

When TSLA was crashing, the Implied Volatility was high…which sent the options were expensive. That’s when I like to trade options.

In this case, I sold the $910 Put and bought the $860 Put option. I was in 35 contracts with Friday (April 29) as the expiration date.

The stock was already up 6% early this morning after Musk announced he won’t be selling the remainder of his stake.

The result?

This trade turned out well — I got about 70% of the premium, with a 64% return on the trade.

I was up nicely on the trade Wednesday, then down on Thursday, and then back up today.

Did you trade TSLA? What are your thoughts?

I’d love to hear from you.