If you know me, then you know I LOVE The gap and go strategy.

It’s easily one of my go-to strategies for penny stocks because it works as a day or swing trade.

My goal is to ride the momentum and exit as soon as I take my profit.

The “gap” happens when a stock price rises significantly above the close price of the previous trading days.

The Gap and Go strategy is not complicated at all…

Here’s How It Works

When trading momentum, it’s important to know if the stock closes at the highs or near the lows.

Most of the time, trading volume is low during the pre-market hours, but there are exceptional cases where there’s good volume…especially after some positive news or earnings announcement.

The pre-market hours are the best time to gear up to take advantage of the momentum that’ll happen when the market opens.

Why?

Because when trading the gap and go, a key factor to take note of is the level the stock opens relative to the recent high.

Basically, you want to measure the difference between yesterday’s market closing price and today’s opening price.

Being early helps because you will be adequately prepared once the market officially opens.

Whenever I’m trading the Gap and Go strategy, I’m looking to tick these boxes;

- There’s a very recent positive news release or earnings announcement that causes the stock to spike

- The stock has a heavy volume

- The stock opens above a major resistance level

- Finally, there has to be a good range between the previous resistance level and the new support level.

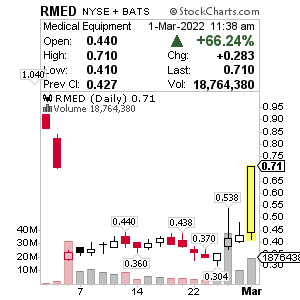

Real-life example with RMED yesterday

RA Medical Systems, Inc. (RMED) — with a Market Cap of 11.15M — designs, develops and produces medical devices. The Company offers excimer lasers for the treatment of dermatologic and cardiovascular diseases.

Criteria 1 — Positive News: On Monday, February 28, the company put out a press release, announcing the filing of a 510(k) application with the U.S. Food and Drug Administration (FDA) for their next-generation DABRA catheter.

CEO of the company, Will McGuire, said “We are confident we’ve met our objective of designing a next-generation DABRA catheter that will allow physicians to better access difficult anatomy”

Criteria 2 — Heavy Volume: According to Finviz and Newswatch, the stock has a Float of 24.26M and Average Volume of 3.86M.

Criteria 3 and 4 — Opening above a major resistance level, plus a good range between the previous resistance level and the new support level

After my technical analysis, I noticed the stock crossed the 0.54 mark. I felt pretty sure that was the trigger for a 0.75 gap fill…so I made an entry.

My goal was to sell at the mid 0.60 mark, which I did. And then I jumped out before it rose to 0.75.

I caught a good chunk of that move and the result was an almost 17% gain. Click here to see all the details on my trading journal here.

My members watched me take action LIVE in the Cheddar room. You can check out the room here in your RagingBull account.

Important Note

Before using this strategy, I strongly recommend having a scanner handy that helps you search for stocks with good volume in the pre-market.

Also, it’s important to know what drives the stock price, so you won’t trade on impulse based on general market news only.

I like to have a clear understanding of what’s going on so I can evaluate if the news has enough power to continue the upward price movement.

Finally, it doesn’t matter how high the pre-market volume is during the pre-market trading time…things move quickly once the market opens. So you have to monitor the price movement closely.