I love BIG breakouts and I cannot lie!

And look, I’m not selling you on anything…

I genuinely believe breakout setups have a lot going for them: your risk is usually well-defined, your reward is solid when they work – they move fast, far, they never look back.

But…. What happens when they don’t?

The ugly truth is, a failed breakout will go against you just as aggressively as a successful one will go your way.

And even a stop (if you didn’t have one – next time you should!) may get slipped quite a bit and make your loss wider than you intended.

A failed breakout is no fun place to find yourself in, just have a look at the Cellect Biotechnology (APOP) chart from yesterday:

Today, I want to teach how you can better your odds, but first, let’s deal with the basics:

Basics of Breakouts

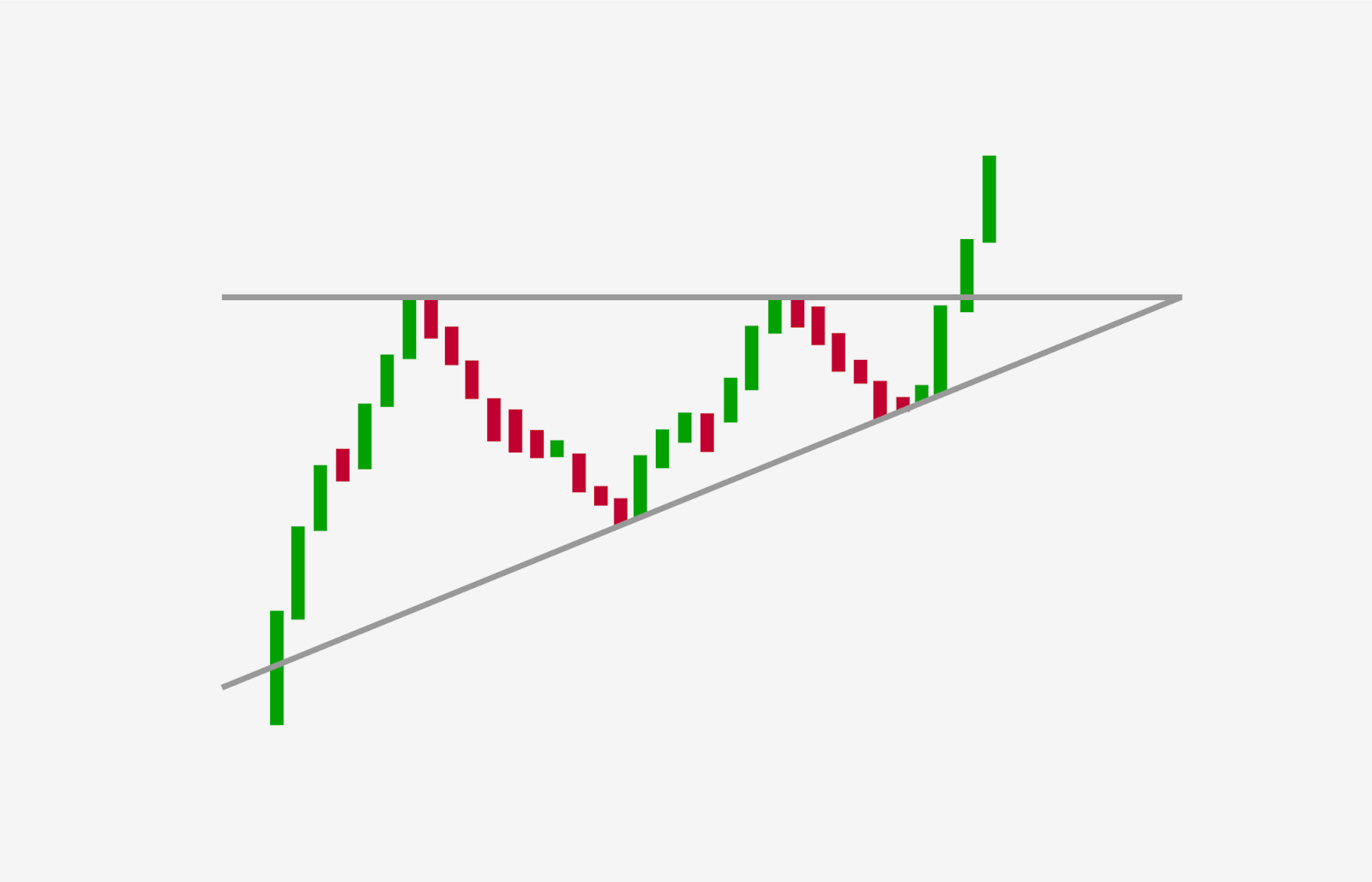

Breakouts can be defined as violent moves through and above priorly respected resistance levels.

They result from explosive upticks in demand that are caused by 4 key factors in the order of their significance:

- Demand from actual long-term buyers

- Long traders buying the breakout for continuation

- Short traders covering their positions

- Short traders getting stopped out right above the resistance level

In a perfect world, this leads to significant advances in a stock price.

In the real world, though, these very same market forces may lead to a disaster – imagine all the long traders who just aggressively piled into the breakout, only to see the stock dip right back below resistance. What happens now?

They all have to stop out and the APOP chart from above will show you how this may end.

Well, here are some best practices to help you find quality breakouts:

Follow the Trend

My general rule is – a trend is your friend.

I don’t see a point in fighting something, unless it gives you a solid reason to do so.

If the overall trend is down, the stock has been a steady sell and is really struggling to hold higher – why would I try and buy a bullish breakout?

I want the market forces working for me, not against me.

I’d much rather ride the underlying momentum, not fight it.

Trade Big Picture

The more significant your level on the longer-term chart – the better.

If you’re shopping for a breakout trade, try to find one that is breaking out on multiple time frames at once.

In my view, breakouts above the resistance of the past month, or 6 months, or a year work better than a breakout like APOP.

Longer time frame move means that the market has truly absorbed and priced in all the available information.

This ensures the pre-breakout value is justified and further move higher is warranted and supported by big players.

You want to be in breakouts with strong demand on all levels – not those bought by a few traders looking at the lines on a chart.

Which brings me to…

Check the Volume

Do you recall the discussion of what drives the breakout moves?

I put “Demand from actual long-term buyers” as the most important factor.

The reasoning here is simple – market participants who are in for the long term will provide continuous bid at different price levels.

Whereas a trader might buy a breakout only to sell a few points higher, an investor will be adding a few points higher and then some, in hopes of eventually selling a few hundred points higher.

These guys have deeper pockets and unlike traders, their buying power rarely exhausts – they will be able to support moves higher.

Obviously, there’s no certain way to tell if big players are buying, but volume is a good place to start.

If the volume of the breakout far exceeds anything the name has seen before – this may signal a lot more people and money are involved and determined to take the name to where it belongs.

Buy the Confirmation!

The goal of this exercise is to ensure a breakout doesn’t fail.

So why not see it “not fail” before you decide to buy?

I talk about confirmations a lot – in a nutshell, it’s some type of price action that validates your thesis.

It differs for different setups, but if you’re trying to buy a move above resistance that will never look back, why not see it turn the resistance into support first?

Remember, you don’t have to be the first one in! At this job, patience pays off more often than it doesn’t.

Don’t buy the first candle – see that handle not fail, and then get in accordingly.

I hope this clears up some smoke and helps you next time you trade breakouts.

1 Comments

Thank you!

I like the comments about the hypothesis. I think Basing trades around a probability thesis on the price action is important. The hypothesis holders until price invalidates the thesis. “Setup” identifies an application of the thesis. Like moving weight is potentially a setup for using a wheel.