Below I will teach you how to do a bull put on NFLX a.k.a. selling a vertical put spread. I will use 4 examples of the same trade, each with different probability.

You now know that buying out-of-the-money (OTM) calls and puts is a low probability trading strategy.

So selling options spreads is therefore a high probability trading strategy.

You also know I like to sell at-the-money (ATM) vertical put spreads (bull puts) because that’s where the most extrinsic value is i.e. time and volatility.

But what you might not know is how to get better probability than me and this is in fact one of the best parts about selling options spreads.

Today is Monday September 5, 2022 and NFLX is trading at $226, remember that because the price determines ITM, ATM, and OTM. And since I always want to be selling bull puts with 5-7 days to expiration, in all 4 examples September 16, 2022 is the expiration of these options.

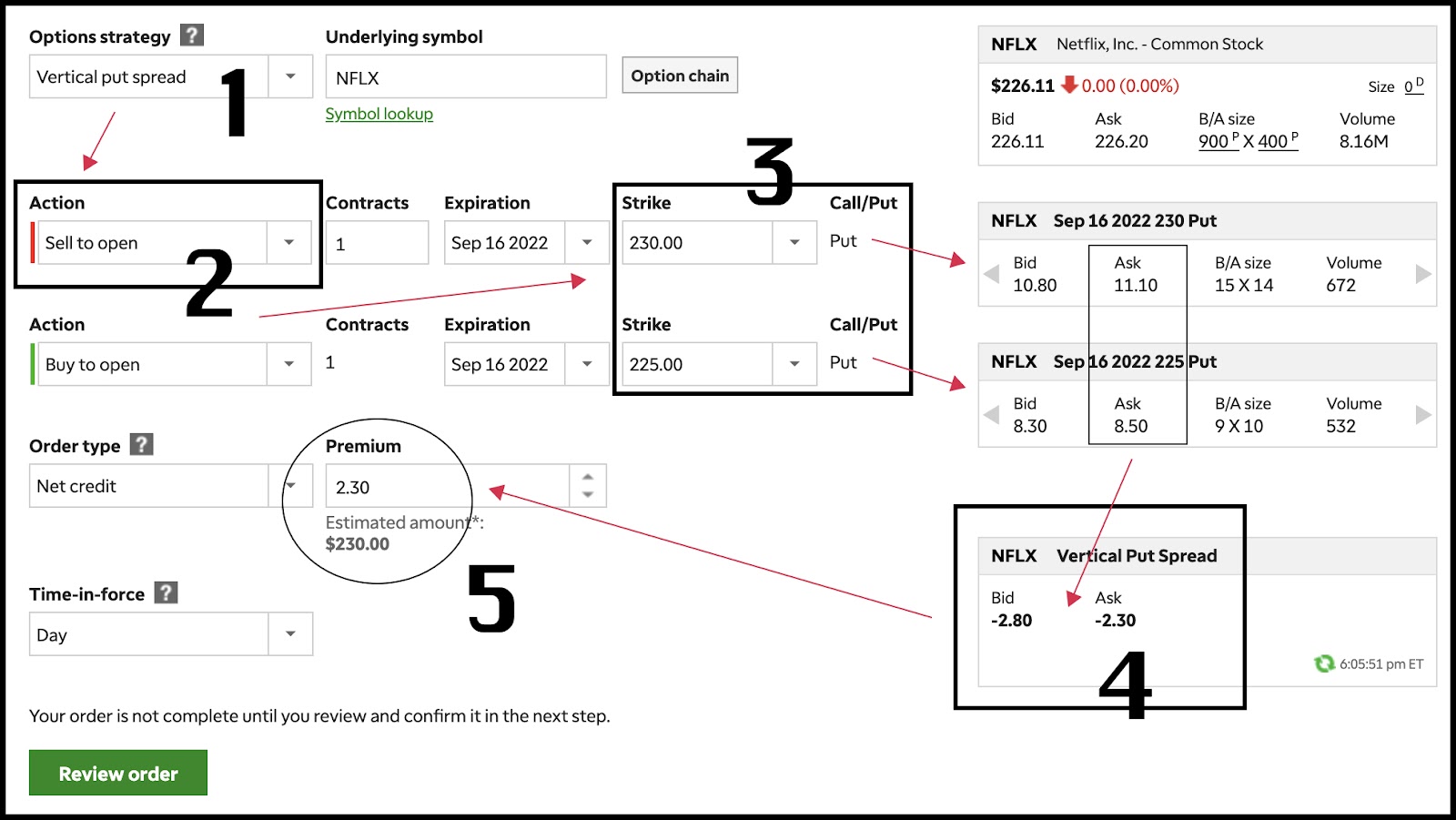

EXAMPLE 1: One strike in-the-money (ITM) bull put

- Option strategy = vertical put spread

- Simultaneously sell to open and buy to open a $5 wide spread or -$230 / +$225 5-7 days to expiration

- Sell to open ITM -$230 put for $11.10 and buy to open cheaper ATM +$225 put for $8.50

- Using the Ask, subtract $8.50 from $11.10 = $2.60, that’s your middle point for the vertical put spread

- Premium defaults to the ask $2.30, change this to $2.60

Summary: assuming an entry of $2.60, I’d be using $240 to try and make $260 and my probability of winning this trade is 45:55. NFLX must climb $4 sometime before or at expiration for this trade to work for the seller. I rarely sell ITM options spreads due to the lower probability of winning.

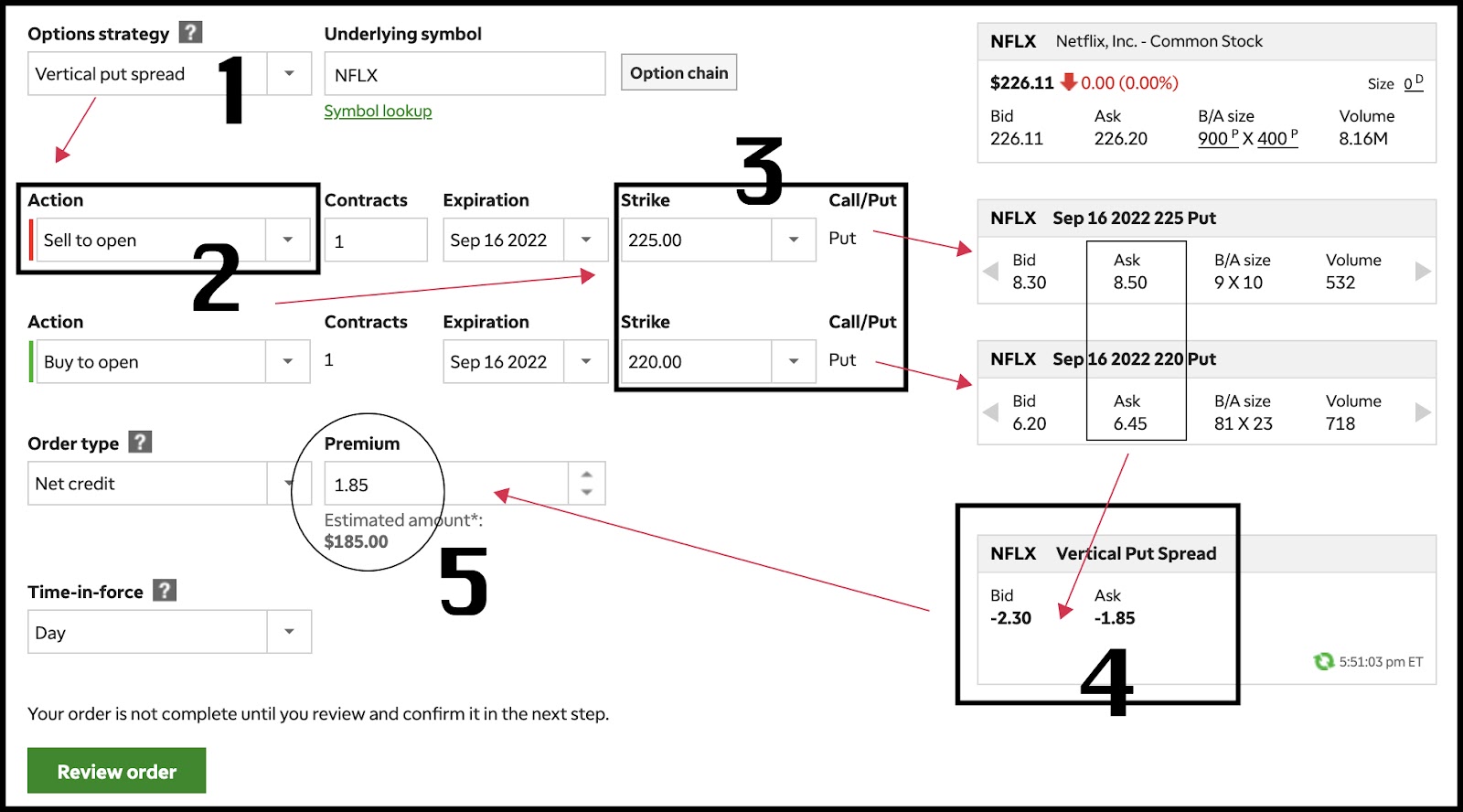

EXAMPLE 2: At-the-money (ATM) bull put (my personal favorite)

- Option strategy = vertical put spread

- Simultaneously sell to open and buy to open a $5 wide spread or -$225 / +$220 5-7 days to expiration

- Sell to open ATM -$225 put for $8.50 and buy to open cheaper OTM -$220 put for $6.45

- Using the Ask, subtract $6.45 from $8.50 = $2.05, that’s your middle point for the vertical put spread

- Premium defaults to the ask $1.85, change it to $2.05

Summary: Assuming an entry of $2.05, I’d be using $295 to try and make $205 and my probability of winning this trade is 60:40. I have 3-ways of winning this trade versus the buyer who only has 1. NFLX can slip $1 and I win, it can trade sideways at $226 and I win, or it can go up and I win. For the buyer of the $225 puts, NFLX must fall to $216.50 just for the buyer of the puts to break even. Selling at-the-money bull puts is my favorite strategy. Remember, a bull put is when you sell a vertical put spread. As a general rule, I hunt for 40% premium for my entry. So on a $5 wide vertical put spread like this -$225 / +$220 I want an entry of $2. If I’m able to get 40% of the premium, then my probability of winning is about 60% compared to the buyer of the $225 puts, whose probability is only 40%. In fact, pretty much every trade I’ve alerted since WALL ST BOOKIE opened for business on July 27 has been an ATM bull put because it offers the most extrinsic value i.e. time and volatility premium along with a good probability 60:40.

Write this down → 100 – the % of premium you collect = odds of success.

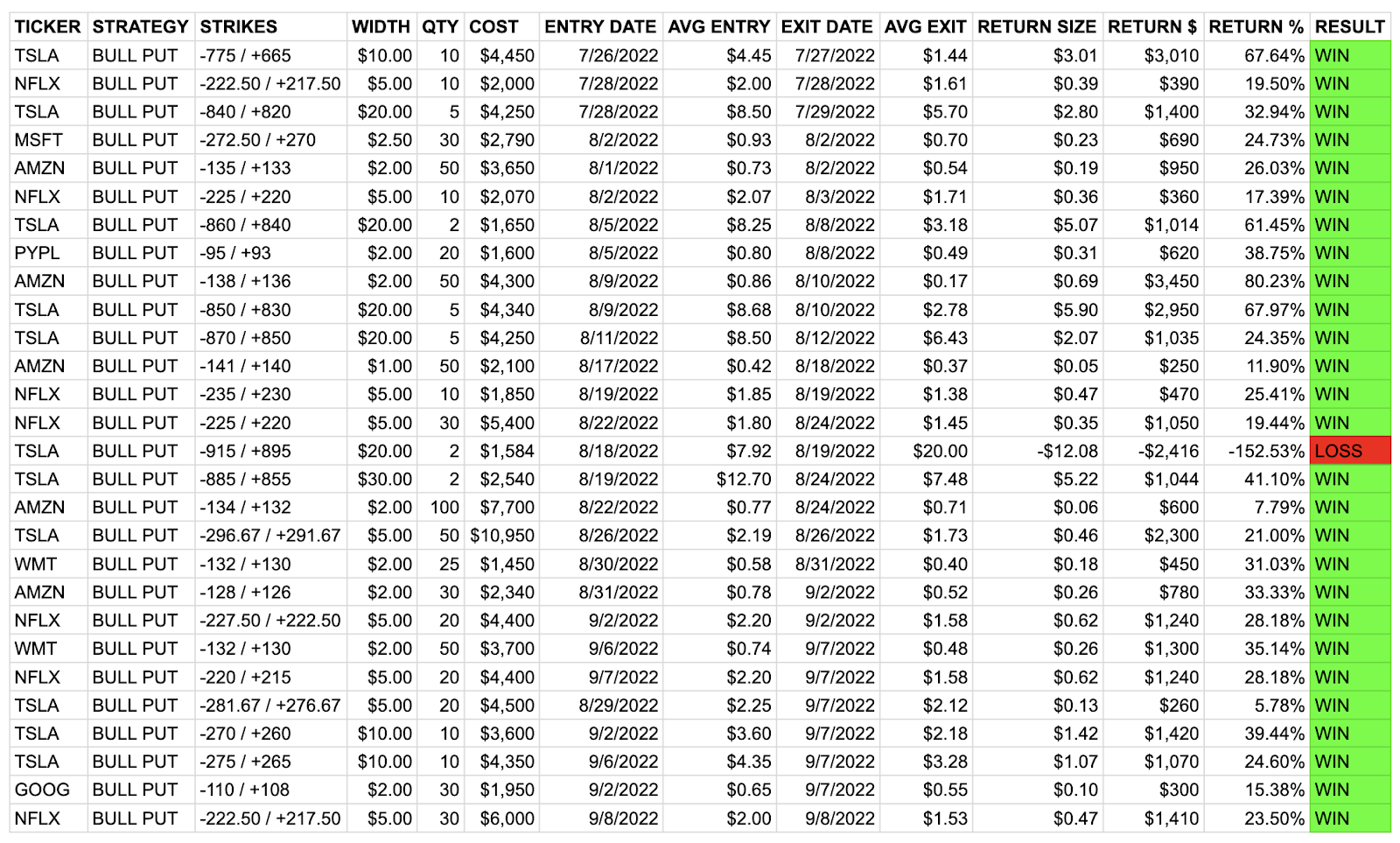

27 wins and 1 loss since the service started on July 27, 2022. Nothing promised or guaranteed in the future except my transparency and passion for teaching you to learn from both the wins and losses.

- Initial win streak: 14 from July 28 – August 19

- Last loss streak: 1 from August 19 – 24

- Current win streak: 13 from August 24 – September 8

Here’s where the lesson gets fun. Let’s say you don’t like 60:40 probability.

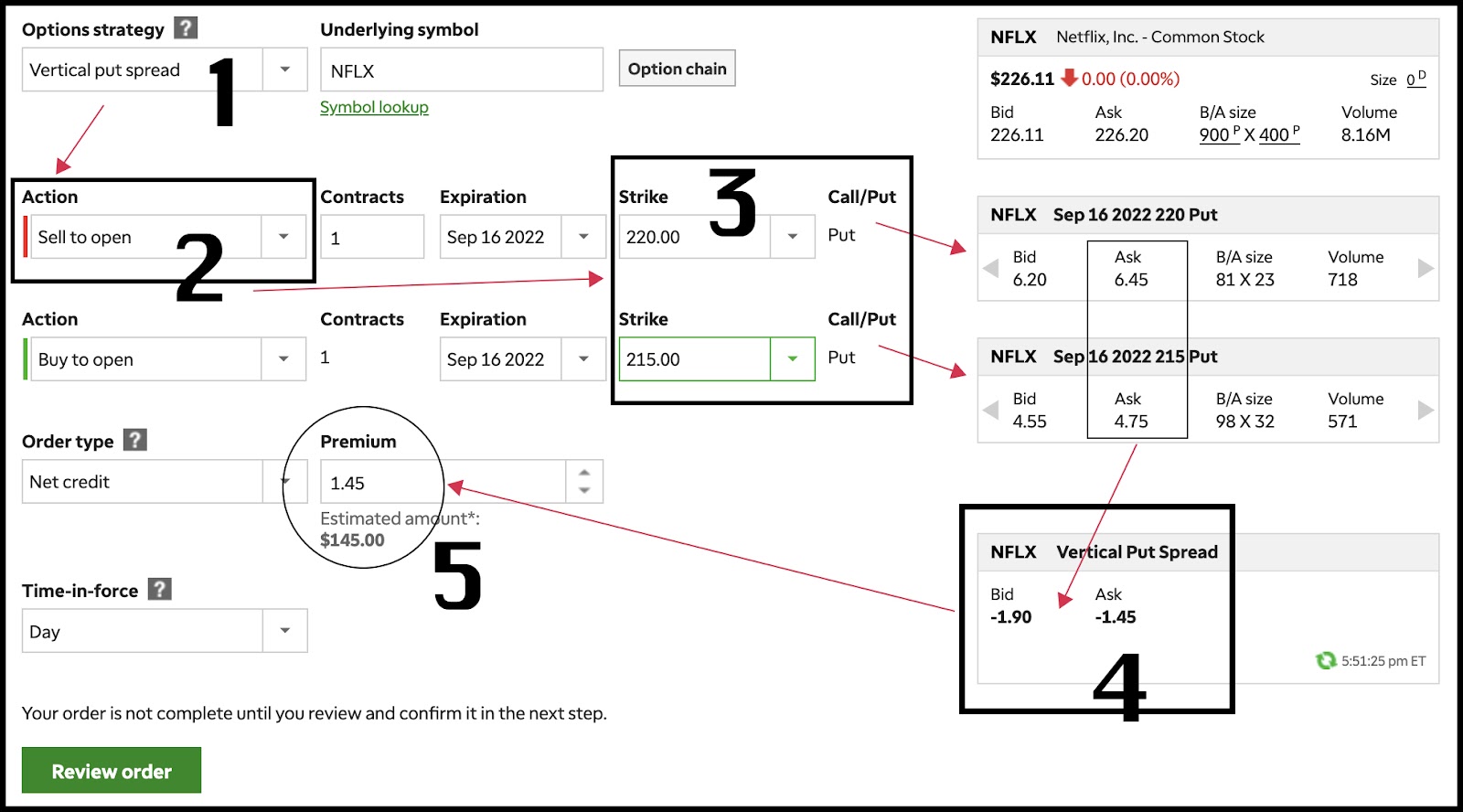

EXAMPLE 3: One strike out-of-the-money (OTM) bull put

- Option strategy = vertical put spread

- Simultaneously sell to open and buy to open a $5 wide spread or -$220 / +$215 5-7 days to expiration

- Sell to open ITM -$220 put for $6.45 and buy to open cheaper ITM -$215 put for $4.75

- Using the Ask, subtract $4.75 from $6.45 = $1.70, that’s your middle point for the vertical put spread

- Premium defaults to the ask $1.45, change it to $1.70

Summary: You’re now looking at a trade with a higher probability of winning than my trade above. However, in exchange you get less premium. Remember my ATM example above where I went for 40% of the $5 wide or $2, and found $2.05? Well in this case $1.70 is the best you can do so you’re using $330 to try and make $170, but again, you have much better odds than my 60:40. How much better?

Write this down → 100 – the % of premium you collect = odds of success.

100 – 34% of premium = 66% odds of success.

Pretty cool, right? 66:34 probability is better than my 60:40 probability – less premium though.

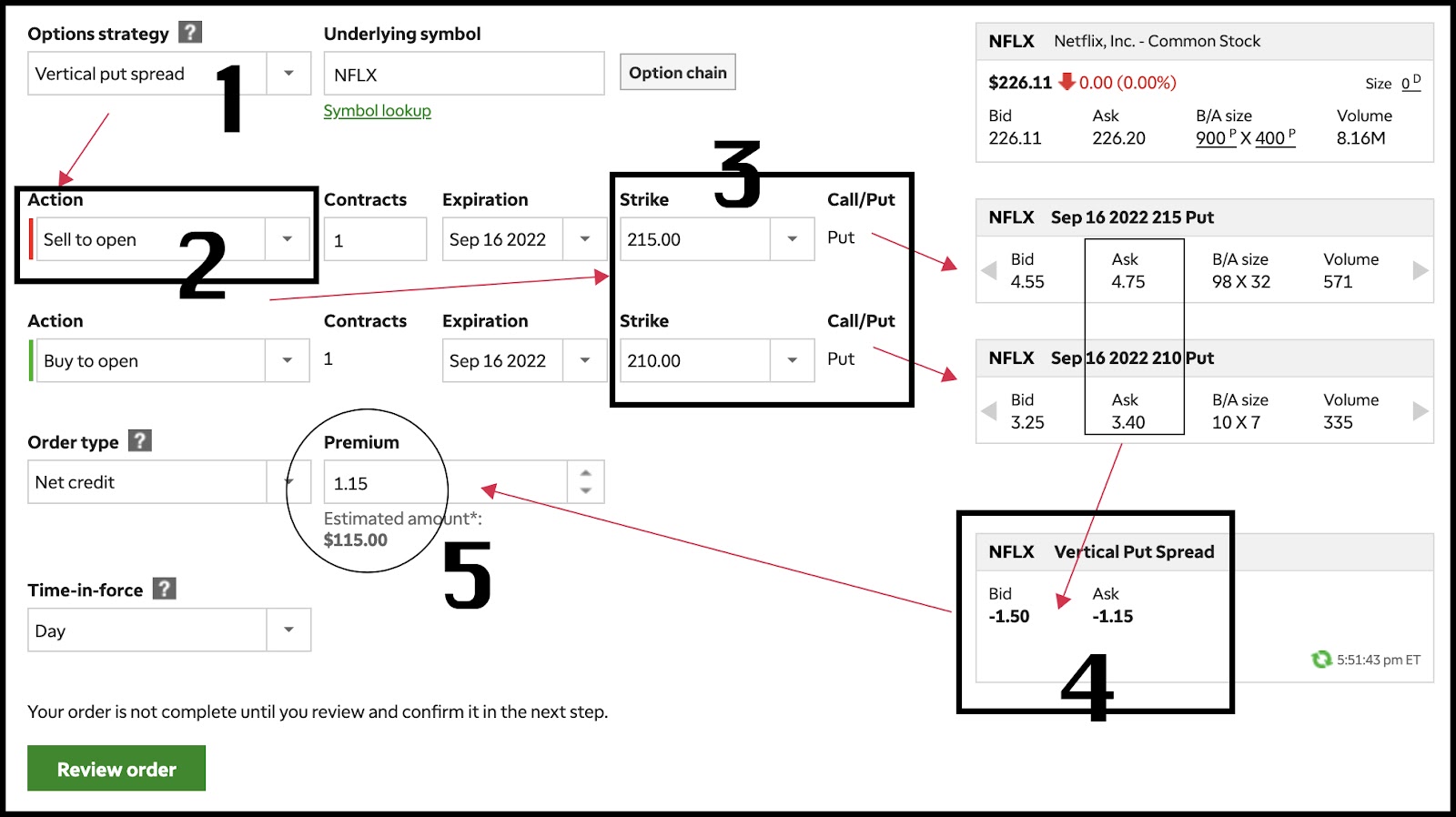

EXAMPLE 4: Two strikes out-of-the-money (OTM) bull put

In this example we move further out-of-the-money, once again exchanging premium for higher probability.

Summary: Do you see how the premium gets less and less as you go two strikes out-of-the-money (OTM). Following the same steps as above, subtract the ASK $3.40 on the cheaper $210 strike from $4.75 on the more expensive $215 strike and you get $1.35 which is 27% of the width. So in this trade you’re using $365 to make $135 but have 73:27 probability of winning. Like example 3, you once again exchange premium for higher probability by going one-two strikes out-of-the-money (OTM).

Write this down → 100 – the % of premium you collect = odds of success.

100 – 27% of premium = 73% odds of success.

In closing, I enjoy ATM bull puts, but for some it’s too volatile and risky. However, you can do the exact same trade, with better probability, by just working 1-2 strikes out-of-the-money (OTM) but for less premium.

And that my friends is how you get better probability than me. I hope you enjoyed the lesson.

To learn more about WALL ST BOOKIE watch this 45-minute webinar.

Here are some of my rules to keep in mind as you watch the webinar.

- Staying mechanical is key to my success.

- Right now I like to put about $5,000 into a trade and look for 50% of the premium so $2,500 is a good win.

- When selling at-the-money (most extrinsic value) vertical put spreads into dips I look for an entry at 40% of the width. For 1 strike out-of-the-money vertical put spreads I look for an entry at 30% of the width or 70:30 probability.

- Write this down → 100 – the % of premium you collect = odds of success.

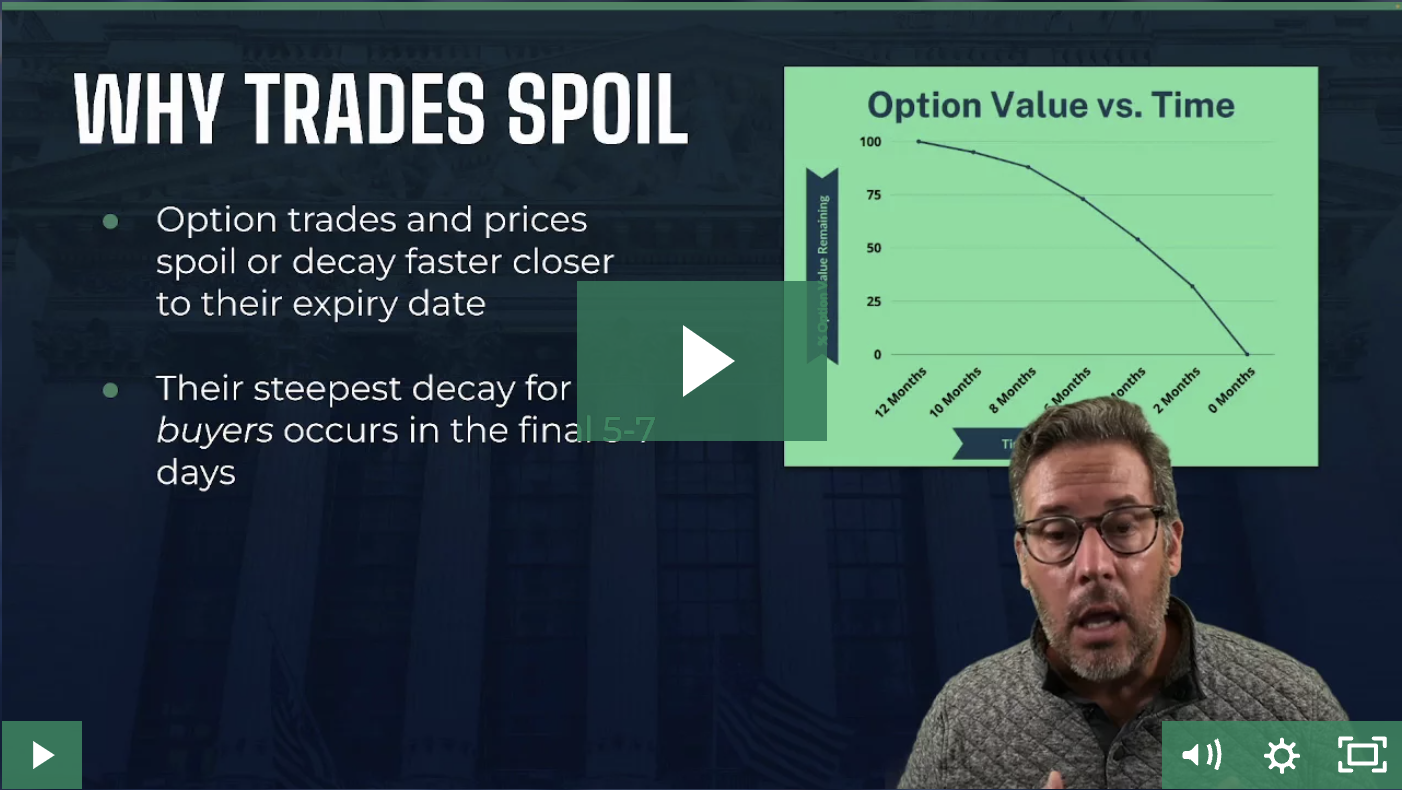

- These are swing trades so 5-7 days to expiration. Remember, the rate of decay on the extrinsic value of an option is fastest 5-7 days to expiration.

- I pick the width based on technical analysis as well as where I can get 40% credit e.g. $10 wide would be a $4 entry with a $2 exit goal.

- Opening bull puts into dips is my favorite setup.

- MSFT, TSLA, AMZN, GOOG, PYPL, WMT, AAPL and NFLX are my favorite stocks to trade right now. All are earnings winners and therefore should find buyers into dips.

Be the BOOKIE,