We’ve had a lot of earnings reports this week, including some of the biggest names out there.

Namely, all of FAANG – Facebook, Amazon, Apple, Netflix, and Google – put out their numbers.

And here’s one thing I couldn’t help but notice… the reports of all said companies aren’t bad, but they all seem to have one thing in common.

And the price reaction hasn’t been great, to say the least.

Can the sluggish post-report performance be telling us something bigger about the state of the market?

Big Tech is Out Of Breath

Let’s start with the big boy, which, of course, is Amazon (AMZN).

Here’re the numbers the company posted late last night:

- EPS $15.12 vs consensus of $12.2

- Revenues $113.1B vs consensus of $115.4B

- Q3 Revenue Guidance $106B-$112B vs consensus of $118.72

The last part is obviously not great – stocks like AMZN have set the growth bar very high.

Hence, any unexpected slowdown may turn catastrophic, which is more or less what happened here:

Fine, AMZN messed up, so it’s getting butchered. Good on them.

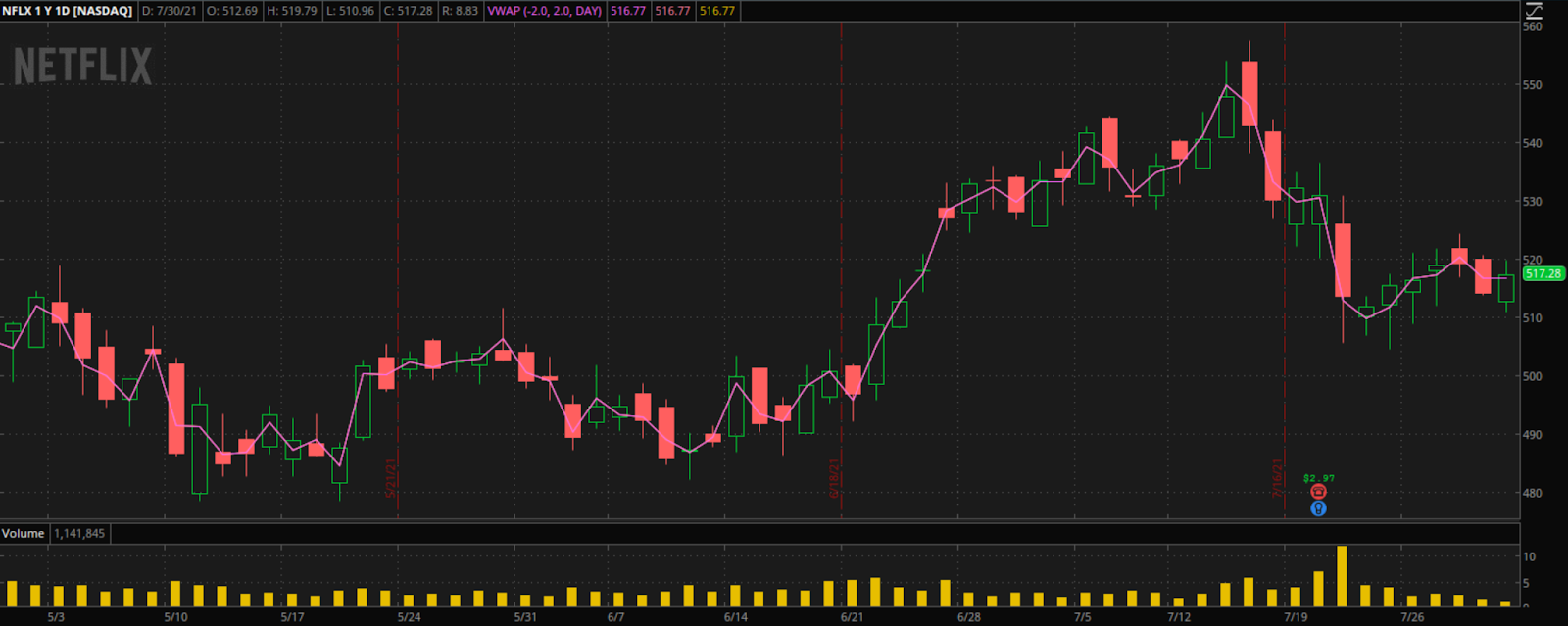

Let’s now have a look at Netflix (NFLX) – one of Wall Street’s biggest darlings ever.

The company reported earnings on July 20th, 2021:

- EPS $2.97 vs consensus of $3.15

- Revenue $7.34B vs consensus of $7.32B

- Subscribers up 3.5M vs 5M

Here’s how it played out:

Clearly, not as bad as AMZN, but needless to say the market hasn’t been ecstatic so far. The stock is holding cleanly below pre-earnings levels, seemingly ready to snap even lower.

Next up, Facebook (FB), and this is where things get really interesting. FB reported:

- EPS $3.61 vs consensus of $3.01

- Revenue $29.08B vs consensus of $27.89B

On the surface, everything looks perfect, but the market isn’t having it:

And the reason is simple, Facebook also said that it expects growth to “decelerate significantly on a sequential basis as we lap periods of increasingly strong growth“.

I won’t be posting charts of Google and Apple here, but neither has done well despite seemingly good numbers.

Market Finally Overheated?

And here’s the big question, the elephant in the room – are these slumps by FAANG names signalling bigger troubles for the market ahead?

I don’t want to call doom and gloom here, but let’s look at the facts – biggest and strongest stocks in the market, that lead the way higher before, after and even through the pandemic are all suddenly signalling drops in business.

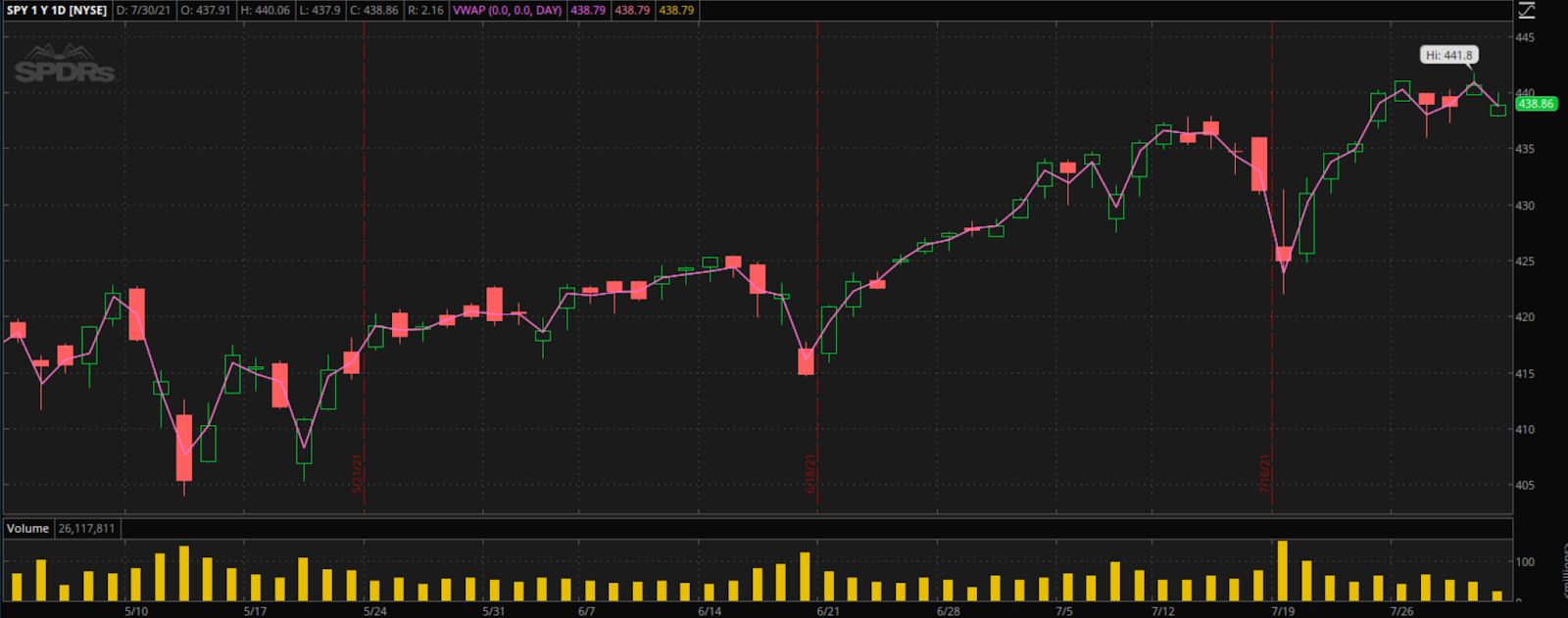

And mind you, we’re in the market where SPY can barely dip, and all eyes are on the economic recovery.

Doesn’t it seem troublesome that the market prices in such high expectations, yet the strongest companies out there fail to deliver?

Is Pullback Finally Due?

Now, I’m never the one to call tops, but look – the high flyers aren’t looking great.

If we don’t see a reversal to the upside within the next few days, I think lower could be the way to move for FAANG stocks.

And they may as well take the market with it. SPY is sitting at the highs yet again, but again fails to have a sustained push.

If SPY can’t hold above $440, I really wouldn’t be surprised to see a re-test of $420 from 2 weeks ago and then a move lower after that.

I’m not telling you to get full-on bearish, but poor share performance and bleak outlook from the world’s leading corporations are not something to leave unnoticed.