The market’s been hot for all sorts of wild momentum movers lately, both small and big…

I mean just look at the past few days: HOOD doubled, AMD’s been wild, NAOV is all over the place, BTBT is trying to pull a full-on Bitcoin…

Traders have sure kept busy and I think one of the bigger movers of all might’ve totally slipped through the cracks.

In fact, the stock is so obvious that you may not believe me when you hear it… but if you haven’t been paying attention – our grand COVID-19 savior Moderna (MRNA) has been on quite a ride!

Today, I’d like to fill in this coverage gap, tell you why I think MRNA might be due for a pullback and what this means for other vaccine names.

MRNA Has Been Flying High

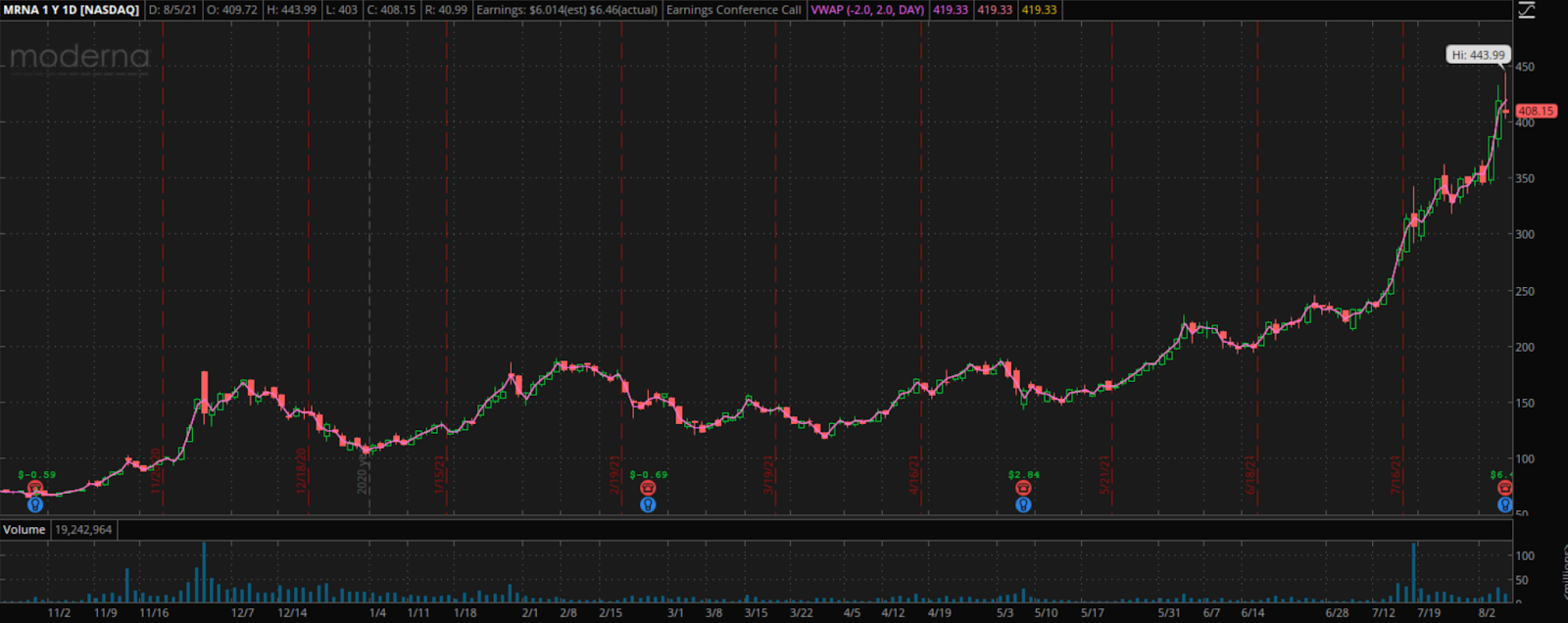

I could do a whole lot of talking and explaining right now, but the picture is worth a thousand words:

Need I say much here? I think the next time I want to write about Momentum, I’ll just plug this chart in there.

Following the FDA’s emergency use authorization for MRNA’s COVID vaccine in early December, the stock has been in a clean consolidation above prior year’s highs but spent the next half a year hitting a wall at $180.

Once the resistance cleared, some 2 months ago, Moderna has virtually not looked back.

Shares have doubled over the past few weeks alone and are now hovering above $400.

And not for nothing – the company has been posting record numbers and announcing new major orders on an almost weekly basis.

MRNA’s vaccine has surely been a much-needed market hit, but is it enough to keep the stock going?

Is This The Blowout?

Just recently I spoke about a blowout setup.

In a nutshell, a blowout is the end result of many very strong longer-term uptrends – it’s a very quick and sharp move higher that takes shares to exorbitant levels, usually followed by just as big of a pull-back to “pre-crazy” levels.

I think it’s very possible that Moderna has experienced that exact behavior and here’s why:

1. The chart has extended:

The stock has been nothing but up over the past 4 months and has gone full parabolic in the past few days – reaching a gain of 30% in 3 days earlier today. It is this kind of acceleration that often signals a pullback ahead.

2. Earnings are great, price action isn’t.

Earlier today, the company reported strong earnings: EPS $6.46 vs $6.04 consensus, Sales $4.40B vs $4.28 est; Moderna also announced FY22 capacity of 2-3B vaccine doses and presented data showing the vaccine remains 93% effective 6 months after the second dose.

The company seems to have delivered on every front, but the price action hasn’t been that positive:

The stock pushed for new highs, but failed shortly thereafter and has been holding cleanly below VWAP.

When good news is unable to lift the high-flying shares – it’s a telling sign I never ignore.

3. Business is at full-capacity for 2021; Competition likely to emerge in 2022

The company reported that it’s no longer accepting orders for vaccine deliveries in 2021 meaning that the business is currently at full capacity with all of the future orders already priced in.

MRNA is still projecting solid growth for 2022 and demand remains strong, but between exorbitant share price and the potential of competition emerging later this-early next year – I don’t see this as a major catalyst.

Trade Plan

I’m not suggesting you bet a farm on Moderna’s implosion, but there definitely are reasonable doubts of whether the current monster move is sustainable.

I think right now we could be seeing at least a local top with the potential to trade back to $350 and lower in the short term.

I’ll be watching price action closely over the next few days and if I see pops that cannot hold, I might position myself for a pullback against the current all-time high area of $445.

What Else to Watch

Luckily for us, traders, MRNA isn’t the only vaccine stock out there that’s gone crazy recently.

Here’s the chart of BioNTech (BNTX), Pfizer’s greatest ally and Moderna’s worst enemy:

As you can see, its shares have mimicked Moderna’s every step, gaining over 100% in the past month.

The company is scheduled to report earnings on August 9th, before the market opens.

Given Moderna’s numbers, I think it’s reasonable to assume the market is already pricing in the best-case scenario for BNTX.

Unless the earnings are absolutely stellar, I wouldn’t be surprised to see a sell-the-news event that would drag them both lower.

My thesis for BNTX is the same – If pops to all-time-highs can’t hold, I’m bearish for a short-term pullback into the $300 area and possibly below that.

1 Comments

Hello Jason, my name is Erline. I am pretty new at trading but I have to say, you are a true professor. I appreciate every aspect of your information. I appreciate the charts and the education that you add with each lesson and information you send out with the JB picks. I am still trying to get the concept of buying long and buying a call. Just wanted to thank you for your dedication to JBP. Ps. Hope your newborn is sleeping throughout the night now.