The stock market is not an isolated entity – it’s a part of a giant economic ecosystem.

In our day to day, we’re used to focusing on individual price levels, catalysts and earnings, but there are bigger picture factors that may have a major impact on the market as a whole.

One such factor is interest rates and today I’d like to explain how they affect the market, and what rate behavior can tell you about the future.

Stocks vs Bonds

Before we get into how bonds affect stocks, let’s get clear on the distinction between the two.

A stock is quite literally a piece of the company. Whenever I buy one share of Apple in the market, I become its part-owner.

If I own stock, I stand to benefit from share price appreciation, plus any potential profit distributions management may decide on. Conversely, my risk is share price devaluation.

A bond, on the other hand, does not grant me any direct ownership in the actual enterprise. As a matter of fact, “bond” is just a cute way of saying “debt”. A bond buyer lends money to a bond issuer – an issuer has to repay the money back within a specified period of time and at a pre-agreed interest rate.

If I buy Apple’s bond, I simply give Apple some of my money to use for a little while, the same way I may lend some cash to a friend.

With a bond, my only pay off is the interest I collect on the money I’ve given to a debtor.

So why care about the bonds, if the upside is so limited?

Well, because they’re generally known to be a lot more stable and safe!

See, bonds are a company’s obligations. If tomorrow Apple decides to fold, they’d first have to cover for their obligations – meaning repay back their creditors – before a shareholder gets a piece of any equity that’s left.

If the company’s obligations are greater than its assets – bondholders get to collect everything they can, while shareholders get totally wiped out.

And then there’s the volatility (or lack of it) factor – unlike the stock market, bond prices tend to remain very stable.

The security and predictability are exactly the reasons why nearly every big investor makes bonds a major part of their portfolio.

Bond Yields and Inflation

Here’s the obvious question – how much interest to charge.

Well, as with everything “finance”, the answer depends on many factors.

Some of the major ones are:

- Term: debt that matures later than sooner will carry a higher interest rate, as the risks of potential delinquency are higher on a longer time frame.

- Credit risk: A cash machine like Apple will likely have no problem repaying a few $B of debt, while a little known, money-losing enterprise may struggle with a fraction of that – if you were to lend money to a less safe borrower, you’d demand a higher interest rate.

- FED Funds Rate: This rate determines the yield of US Treasury Bonds – the safe-haven investment and the gold standard of debt obligations. Any issue, even that of Apple is considered less safe than US treasuries and would therefore command a higher yield.

- Inflation: and this is a big one…

Look, bonds don’t pay that much. Historically, bonds have returned 4-6% annually – a half of 8-10% that stocks have generated.

If a bond pays 5% annually and the inflation rate for the year turns 3% – as you figured, you’re not left with much.

But that’s not all – FED Funds Rate I’ve just mentioned is FED’s main tool of controlling inflation,

FED generally lowers its rate to stimulate borrowing, economic activity, and inflation and bumps it up to slow the inflation down.

Therefore, the FED’s rate, the inflation expectation, and the effect of the former on the latter are some of the most important factors when determining bond yields.

Yield Curve

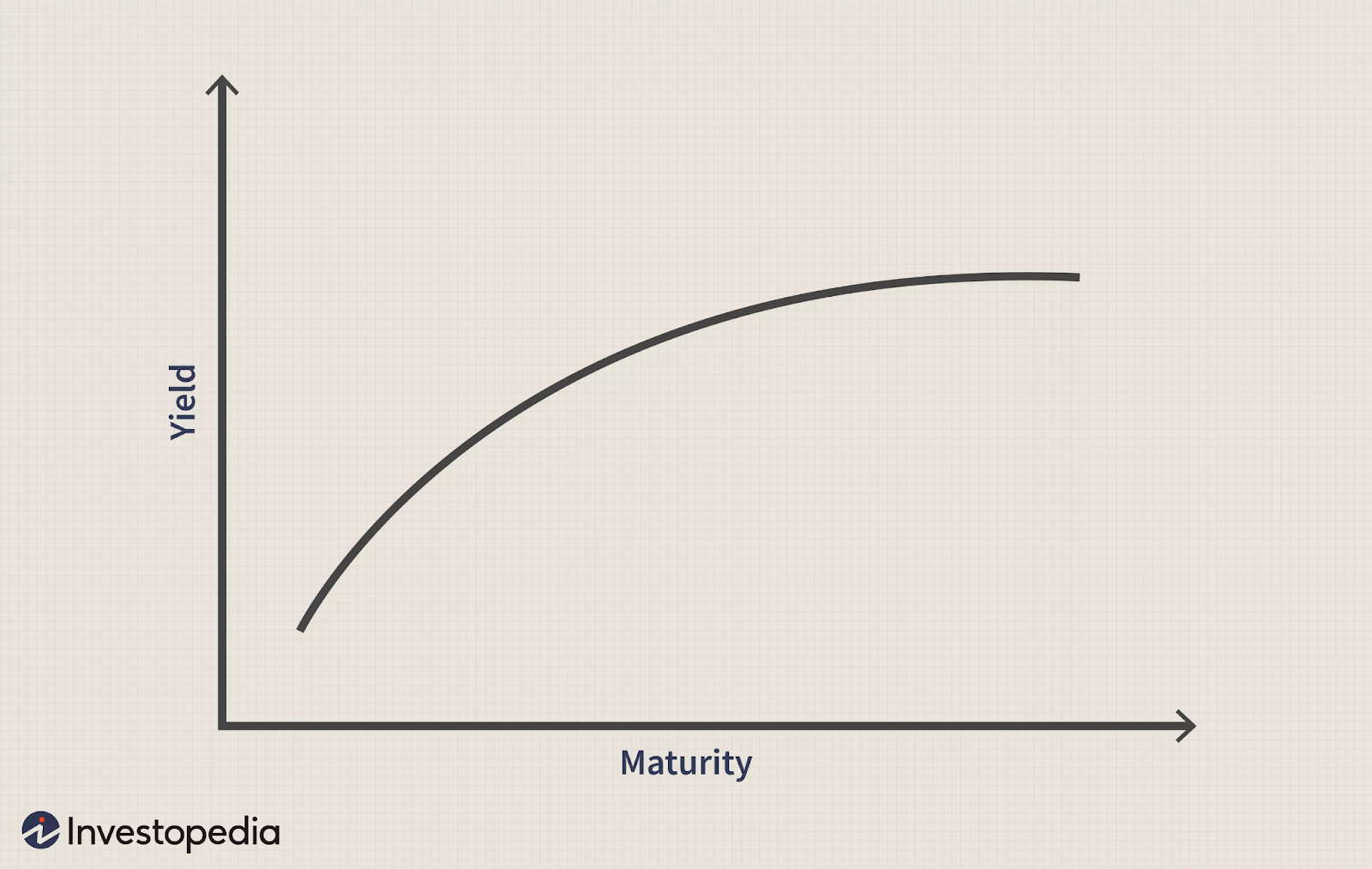

As bond yields tend to reflect the economic sentiment, there’s a tool many economists and investors use to evaluate the state of the market – it’s called the Yield Curve.

In a nutshell, it’s a plot of interest rates paid by equal credit quality bonds, but with different maturities. Here’s an example of how one may look:

(Source: Investopedia)

What you see above is known as a “normal” Yield Curve – bonds that mature further up in time will pay more (for reasons, I’ve discussed above).

Then, there’s an inverted curve – further out in time bonds pay less than bonds that mature sooner; this generally happens in a depression when a further economic slump is anticipated.

Last, but not least, there’s a chance of a flat curve – something that usually takes place in times of true economic uncertainty when investors cannot adequately model either long-term os short-term risks.

Inverse Relationship Between Bonds and Stocks

So why do we even care about bonds in the first place?

Well, let me give you an example here:

The stock market has historically returned 8-10% annually and that’s with all the volatility and risks it comes with.

If a high-quality, safe and stable bond issue started paying, say 7-8% annually, vs the average of 3-4%, wouldn’t you be willing to put your money into bonds rather than stocks?

An outflow of capital from the equities and into debt issues would cause equities to move lower, causing what’s known as “inverse relationship”.

It is generally assumed that when bonds go up, stocks go down.

What To Anticipate?

We’re in a peculiar spot right now: inflation is going through the roof – yet, Fed’s funds rate remains at lows, currently set at 0.25%.

The market, though, continues to hover near all-time highs, seemingly discounting the possibility of a rate hike – which may now be more reasonable than ever before.

At today’s “FED Minutes”, the commentary remained neutral in tone, although it was indicated that FED plans to ease up on asset buying by the year-end.

I’m not implying anything, but I do think there’s a valid concern that the “hot” market may get slumped if the rates are in fact hiked.

The next FED FOMC meeting is scheduled for September 21-22nd, a little over a month out. If inflation fears persist, I think we can easily see a gradual pullback going into it, and a further drop on rate hike announcement.

I’ll be watching how SPY acts near the highs over the next few weeks and would consider any lack of strength as signs of fear in the market.

2 Comments

Very well written and much appreciated!

So, what sectors would profit or go up if inflation increases and interest rates increase at the same time ?

Do the mkts narrow to like defensive slow growing companies like food and beverage or how about

real estate, more specifically REITs etc. or do we just bite the bullet and start making wads of money on

the short side ?? Thank you for answers and ideas ahead of time ?