As you likely figured by now, I love short squeezes.

They might very well be my favorite kind of momentum set up on the long side – the imbalance of supply and demand for shares can drive the price up to mind-boggling levels.

I mean just look at some of those recent ones… GME, AMC, SPRT, TLRY from last year…

The moves they pulled off were nothing short of insane, which is why I’m so excited to share with you a stock that, in my view, may very well soon join the above list!

Short Trap

Before I tell you about the stock itself, let me jump to the drawing board for a second.

In my review of the Support.com (SPRT) squeeze, I broke down the squeeze process into 4 key pieces:

- A fundamental event or a technical move that attracts the attention of short traders.

- A “short trap” – an area where short traders think they’re right & the stock is headed lower, causing them to pile in aggressively.

- A climb above that area, making shorts uncomfortable or outright putting them underwater.

- A resulting parabolic explosion higher.

And here’s how this looked and played out in real life and on the chart:

In a nutshell, a squeeze becomes possible when a stock climbs above the area where most people got short, putting them in the red and forcing coverings.

A monster squeeze like SPRT becomes possible when traders keep adding to short positions while a stock keeps climbing higher, immediately making them uncomfortable – the green area on the chart above.

And this is exactly what I’m seeing in…

IVERIC bio – ISEE

Let me give you a quick overview of what’s happening:

- Last week, ISEE’s main competitor Apellis Pharmaceuticals (APLS) reported Phase 3 data which validated ISEE’s technology, while putting APLS’s own product at a disadvantage.

- Shares of APLS crashed, while ISEE jumped on excitement over the company’s “validated” potential and market position

- Many traders were skeptical given their relatively weak cash position and were expecting a stock offering – a great reason to get shorts involved

- Shorts were involved, to begin with: even before the move, the stock sported a nearly 20% short interest.

And here comes the best part, the chart:

So, plenty of shorts were involved in the 2-month long consolidation of $9-$11 – those are already underwater.

Now note the insane volume on the first day of the move – 160M shares that traded hands that day is almost 3x of the company’s 59M share float.

Imagine if even a tiny piece of that volume is short trades – that adds a lot to the original ~20%.

And best yet? Those traders are also in a bad spot – the stock has never stopped the grind since.

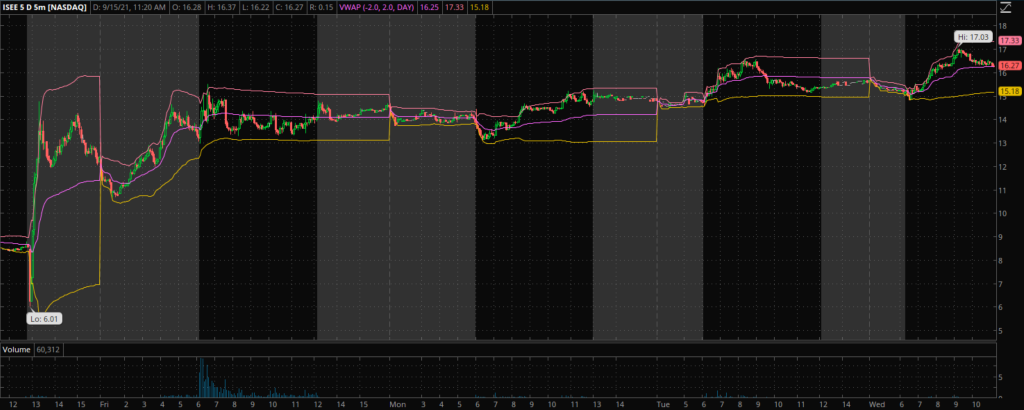

Here’s how it looks on a lower timeframe:

As you can see every short trade of the past few days – and there could’ve been many given the stock offering speculation – is now red.

A Monster Squeeze Coming?

One thing is for certain – short traders are in a real bad spot right now.

The stock keeps grinding higher on low volume, giving them plenty of reason to be nervous.

Any further up move from here may easily triggerr a big wave of covering, and then some more covering as the price advances.

So far the stock has been as strong as they come – a textbook momentum name – if it continues this way, we can easily see some fireworks in the near term.

Trade Plan

At this point, I really want to see the grind continue – I don’t want it to spend much time below $16.

If dips continue to hold above $16, I might go long against it and see what happens.

If I’m right and many people are stuck short from the first, 160M-share day, I truly think ISEE may turn into a monster squeezer – I wouldn’t be surprised to see it hit $25-$30 very soon.

If you’re looking to trade it – bear in mind that the stock offering fears are not baseless and you definitely don’t want to get caught in that.

I’d only trade ISEE with small size and go even lower for overnight holds – this is when an offering is most likely to be announced.

Stay safe, and let’s see how this plays out over the next few days.

3 Comments

Nice DD sir, always appreciated!

I have some powder laying around. grabbed 100 at 16.45 if it will fill my order ><

Thanks to your teaching I saw the fishook on ATER – bought some in the 5 and 7s out at 14.

Killed CEI

Now watching TTOO — apparently their tech can spot covid variants.. *juicy

and HUGE- pot and mushrooms lol.. what has this world come to..

Thanks, J!

Similar to identifying a market peak or trough, recognizing a dead cat bounce ahead of time is fraught with difficulty, even for skilled investors. In March 2009, for example, economist Nouriel Roubini of New York University referred to the incipient stock market recovery as a dead cat bounce, predicting that the market would reverse course in short order and plummet to new lows. Instead, March 2009 marked the beginning of a protracted bull market, eventually surpassing its pre-recession high. ? ????