Over the past decade I’ve taught tens of thousands of beginner to experienced traders how to trade penny stocks.

Here’s a checklist that I use to help me avoid many of the pitfalls. Maybe you’ll find it useful!

When buying penny stocks, it’s important to:

- Do your research

- Have a plan

- Stick to your plan

- Manage your risk

- Be patient

- Take profits

Doing your research is critical when buying penny stocks. You need to understand what you’re buying, and why you’re buying it. Having a plan is also important. You need to know how much you’re willing to risk, and what your profit goals are. Once you have a plan, it’s important to stick to it. Don’t get caught up in the hype or FOMO (fear of missing out). Manage your risk by using stop losses, and take profits when you reach your goals. Finally, be patient. Penny stocks can be volatile, so don’t expect to get rich quick. Remember, slow and steady wins the race!

Small stocks can produce outsized gains, however, failure to use this buying checklist can lead to quick and substantial losses. Use this penny stock buying checklist to increase your chances of success.

Do your research:

I like small-caps because they are liquid enough for a retail trader like myself to move in and out easily but small enough to make big moves. I firmly believe in small bets and big moves.

Have a plan:

Scalp and day trading is a bit too intense for me so I go with swing trading. I like to hold my penny stocks for a few days to a week. I’ve found that this timeframe allows the penny stock to have a chance to move but doesn’t tie up my capital for too long.

Stick to your plan:

The number one reason people lose money in penny stocks is because they don’t stick to their plan. They get emotional and start buying and selling based on fear or greed. This is a recipe for disaster. Stick to your plan and don’t let emotions get in the way. If Ifail to follow this tip, I will likely lose money faster than tossing it into a crowd.

Manage your risk:

Penny stocks are risky by nature so it’s important to manage your risk. I always use stop losses when swing trading.

Be patient:

I always say → the money is made in the waiting, not the trading.

Take profits:

A few years back I was doing a Mastermind in Vegas and one of my students told a story how he was up nearly $250,000 on one of my trade alerts. However, he didn’t have a plan to take profits and watched the massive win go all the way back to $0. Don’t be like this student, have a plan to take profits!

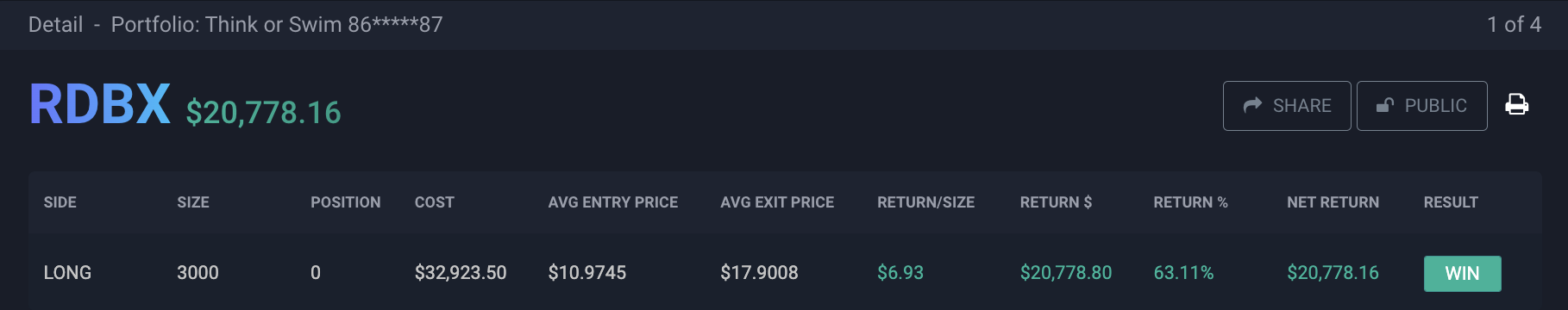

Here’s another good example.

Remember Redbox (RDBX)? You know, the actual red box outside stores that you rent Blu Ray discs from? Well that was a penny stock for about a year and I traded it a lot in the $10-$20 range. Then Chicken Soup for the Soul bought them out for about $1. Ya, ONE DOLLAR! Had I not taken profit on this trade I’d have closed it for a $30,000 loss instead of a $21,000 win.

If you follow these penny stock tips, you’ll be well on your way to success. Avoiding these pitfalls will help you become a better trader and increase your chances of making more confident trades.

Each morning I scan for hot penny stocks, create a watchlist and email that list out to my Lightning Alerts subscribers. Then, during market hours, I swing trade them. Cool part is, I alert my subscribers of my buys and sells before I jump in and out of these trades.

I’ve been doing this for a long time (over a decade) and it’s pretty fun and exciting, so if you’d like to join me, click here to subscribe.

Happy trading!