Here’s the cold, brutal truth that most traders ignore…

Not everyone is going to be successful from trading. In fact, I read an article on Forbes the other day quoting…

“The success rate for day traders is estimated to be around only 10%”

Why?

There are a ton of reasons. From my 10+ years of trading, I can tell you that yes, finding good setups is a great skill to have…

Having a good strategy is important…

But what can make all the difference – what makes or breaks a trader – is the way they handle risk.

That’s why I’ve spent years fine-tuning these risk management principles I strongly follow.

People in my community (the Wall Street Octagon) that watch me trade have seen me apply these in real-time – including the special occasions that I have to break my rules (which I don’t recommend anyone does).

Every day, I enter the market with two goals in mind — growing my account and creating a constant income stream from directional aggressive plays.

Having this at the back of my mind is what guides me when deciding which strategies to use on the setups I find.

There are several important factors I to take into consideration when deciding which setups fit my risk parameters.

It doesn’t matter what the trade is, I always go through this checklist to determine my aggression level;

- My technical analysis

- My estimation of the level of strength of the setup

- The overall market conditions

- Risk allowed per trade – while considering my overall account size

- The target I have for my account growth

Here’s an important point to note: when assessing the relative risk of a strategy, I always teach my students to always keep in mind the position size they use when placing a trade – which should also reflect on your account size.

Risk Management Summary

Trading Style: Aggressive Swing Trader – Directional + Income

Account Goals: Like I said earlier, achieving aggressive growth is my priority, so I target a 104% gain on my account every year. For others, this number could be a bit higher.

Typically, I’ll split this to a 2% growth per week – and I’m always adjusting risk and position size each week depending on my account size.

My focus is spotting moments where I can best leverage options to significantly grow my account, while also paying myself.

Overall Acceptable/Recommended Account Risk: When it comes to position sizing, I strongly believe in and follow these principles:

- As an experienced/aggressive trader, as a general rule I allocate no more than 20% of my account on any one trade.

- At any given time, I try to have no more than 50% of my account at risk, which means sitting on a lot of cash.

- I don’t let my emotions get in the way, that’s why I always try to be as realistic as possible! I avoid having more positions than I can actually handle.

- Instead of spreading myself thin on a large variety of setups, what I focus on instead is trading the positions I have well. I prefer not to have more than about 8 positions at a time.

Another important point to keep in mind: The market is constantly changing – new opportunities and catalysts are always popping up. So every now and then, I might break my own risk parameters (in the right situation, of course). Although this isn’t something I would recommend that others do.

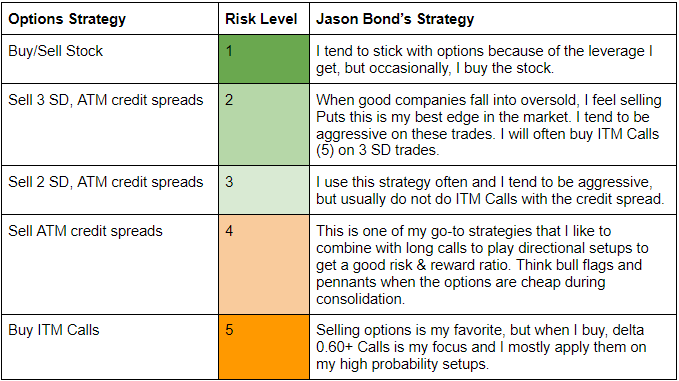

Strategy Use + Risk Taken Per Setup: For every trade, my position size and strategy usually depends on the strength of the setup – while keeping other risk parameters in mind

Methodology: I like to wait for the perfect moment to pull the trigger on my favorite setups. But before that happens, I prefer to minimize and spread my risk during lower probability plays. If you follow me, you’ve most likely seen me throw on a 200-300 lot.

2 Comments

I would love to make a financial freedom for me and my family

Thanks, Jason, this is really helpful!