In part 1, part 2, and part 3 of this 9 part series …

… I taught why this strategy is better for trying to build a small account compared to penny stocks.

Now let’s examine HOW it works.

Options trading BLUEPRINT for traders with SMALL ACCOUNTS.

HOW to take high probability trades.

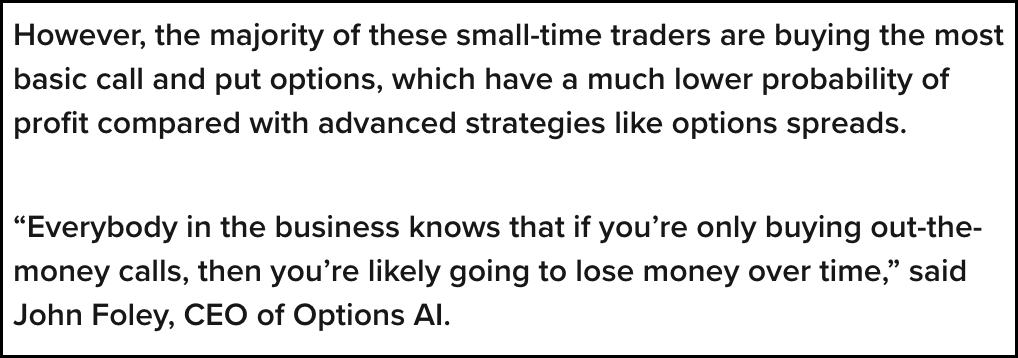

It’s well documented that most small-time traders lose money.

Why?

Here’s one answer.

My strategy?

Take the opposite side of the low probability, out-of-the-money put options they buy.

I encourage you to read the above headline and sub headline again.

I repeat.

My strategy?

Take the opposite side of the low probability, out-of-the-money put options they buy.

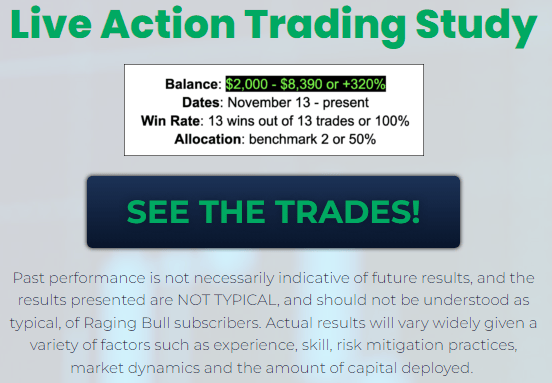

And it can be done with as little as a $2,000 margin account.

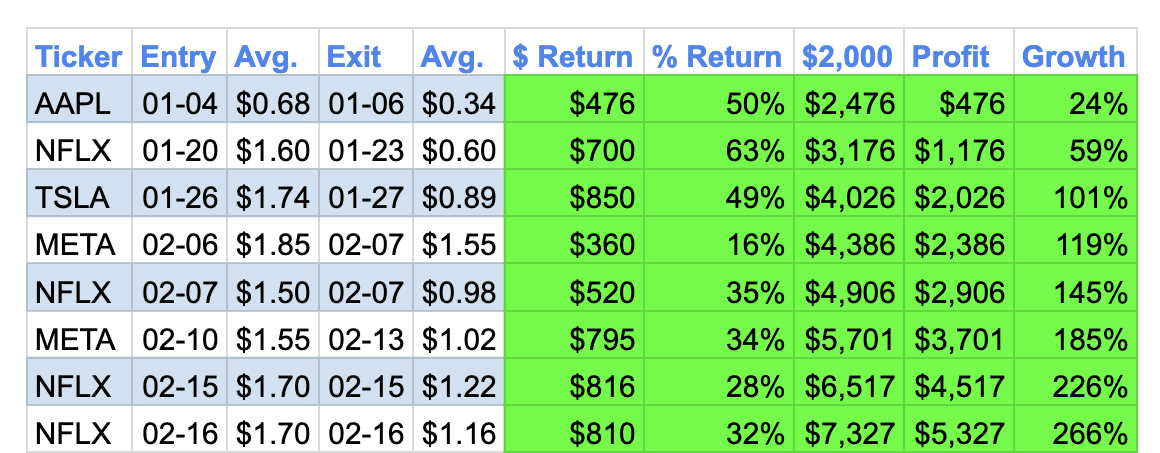

Which is why I call it the $2,000 Small Account Journey.

And the numbers don’t lie.

The Chicago Mercantile Exchange (CME) held a 3 year study.

An average of 77% of all options held to expiration at the CME expired worthless!

That means if you bought an option and held it to expiration, there was about 24% chance of a favorable outcome.

So why would anyone buy a low probability out-of-the-money put?

The simple answer, uneducated.

Not our problem!

In fact, it’s our edge.

First, find out where most uneducated traders are losing lots of money.

Second, take the opposite side of their trades.

Third, rinse and repeat.

That’s what I’m doing in the $2,000 Small Account Journey.

High probability, limited risk trades that I cash up quick.

And that’s how I get this edge.

Results not typical. Nothing is guaranteed.

Results not typical. Nothing is guaranteed.

I’m happy to teach you.

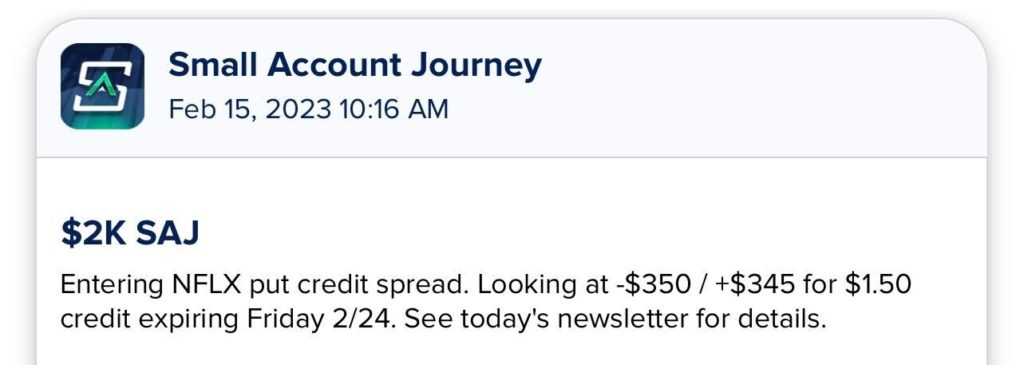

I’ll even send an alert to your smartphone before I enter and exit these trades.