In case you don’t know me, I’m Jeff Williams. I’d like to share my story about what drove me to become a stock market educator.

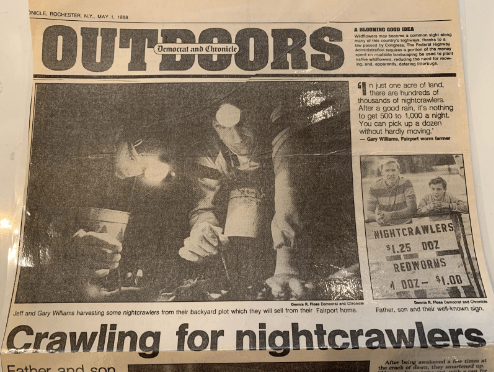

I got started in the stock market at a young age. My parents always taught me to invest some of my paycheck into a retirement fund, even when I was just 16 years old. At the time I didn’t understand but now I couldn’t be more appreciative – you can see how my dad impacted me as we started a business together selling worms. Here is a photo back from 1988. Crazy how time flies but I used that money to help pay for part of my college education as well as save for retirement. Thanks Dad!

Fast forward a few years and I’m teaching in New York State, still with the strong desire to trade stocks, so I would try to trade during my breaks. This was difficult because my breaks were random.

After 12 years of teaching, as much as I love working with kids, I knew I wanted to try something new.

My trading career really took off about 12 years ago when I started trading penny stocks and teaching traders just like you how I approached my trading day and my trades.

Trading penny stocks was a lot of fun, however, I noticed there were certain times of the year where volume would dry up. On top of that, I felt like my times of making the trades were very sporadic.

You see, in my opinion, stocks run randomly. They randomly drop news and you wake up to a stock moving up or down 50% or some other type of unknown reason would move the stock. I felt I couldn’t really get an edge with this.

This is when I decided to make a change and since that change my success has dramatically improved.

So after years of trading stocks and getting frustrated with their lack of liquidity at various times of the year, I took a deep dive and changed the way I traded and the results have been dramatically different.

Was there a way to trade year round without worrying about random drops in liquidity, without worrying about if markets were up or down but more importantly, a SPECIFIC time of the day to trade?

I finally found my answer, trading options on the S&P 500 or SPY. The most liquid ETF out there. One ticker that tapped into the TOP 500 companies in the United States.

Markets up or down, it didn’t matter because options give me the ability to trade in BOTH directions. (Click here to review all my SPY trades and you’ll notice I’m making trades in all types of market conditions.)

Very quickly, Market Navigator was developed. A trading service that now focuses on my SINGLE HIGHEST CONVICTION trade idea between 9:30am and 10:30am.

A set time that 9-5 working traders could look for each and every day, then focus back on their busy schedule.

Each morning I study the world markets starting around 6am. I get a feel for how global markets and major economic new pieces could affect how the SPY could trade in the first hour of the day.

From here, I type up a 3-5 minute read email that I send directly out to members of Market Navigator. In the email it teaches trades what I see happening today and WHY I think markets will move up or down.

Then, most importantly, I conclude the email with my single highest conviction SPY “Trade of the Day” which includes the exact expiration date and strike price for either calls or puts that I plan to trade shortly after the market opens.

This email gets delivered at 8:45am each morning to their inbox. Plenty of time to take a look, learn and pull up my top trade idea for the day.

Then, at 9:25am, about 5 minutes before the markets open, I send an App alert to their phones detailing the exact trade I am about to make, just to confirm my email thesis. No guessing on what trade I am about to buy or sell! That’s right, I do the exact same App alert process BEFORE I am about to sell as well.

My goal with my SPY “Trade of the Day” is to be in and out before 10:30am each morning.

For those that have extra time, they can join me in a live trading chat room to literally watch and listen to me as I prepare the trade, break down the options chain and then buy and sell the trade. This isn’t required but it’s a great learning opportunity when you have some spare time.

New to options? No worries, Market Navigator also has an extensive, on demand video library that you can use to watch short lessons on the most important topics I feel every trader should know.

Want even more trade ideas? No problem, our live trading chat room shares about 5-10 trade ideas per day with hundreds of members all over the world. The chat room atmosphere is welcoming, friendly and full of education.

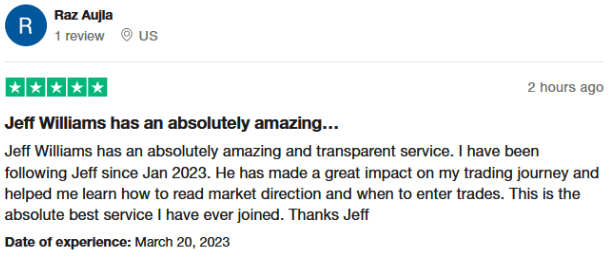

If you’ve been struggling to find your trading direction, then I think Market Navigator could change the way you trade. I know it did for me and I’m confident it’s helped members just like you feel more confident in their trading and sharpen their skills.

I look forward to teaching you more about the service very soon → please click this link to learn more about Market Navigator!