Adjustment: The change to the terms of an option contract because of a situation such as a stock split or dividend payment.

Ask Price: The price a seller is willing to accept for an option.

Assignment: The obligation of a put seller to buy the underlying stock at the strike price, or for the call seller to sell the underlying stock at the strike price.

- If an option expires in the money by even a penny, the seller will be automatically assigned.

- Option traders can get in and out of trades before expiration, thus avoiding assignment.

At the Money (ATM): When the stock is trading at or near the option’s strike price.

Bid/Ask Spread: The difference in the bid and ask prices for an option.

Bid Price: The price a buyer is willing to pay for an option.

Black-Scholes Model: A pricing model that factors in the stock price, strike price, time until expiration, volatility, and interest rates to determine the price of an option.

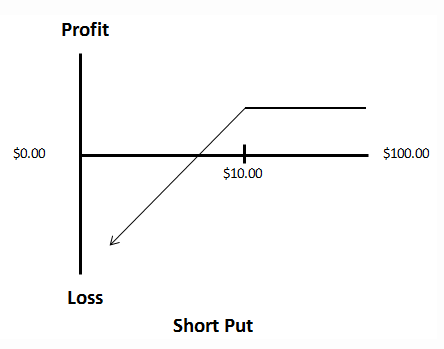

Breakeven: Where a trader needs the stock to move in order to not incur a loss.

- Breakeven on a call purchase is equal to the strike plus the premium paid for the option.

- Breakeven on a put purchase is equal to the strike minus the premium paid for the option.

- Breakeven for a bull put spread is equal to the sold put strike minus the net credit.

- Breakeven on a bear call spread is equal to the sold call strike plus the net credit.

Call Option: Gives the buyer the right (but not the obligation) to buy 100 shares of a stock at a predetermined price (the strike price) by the option’s expiration date.

- Call buyers are generally bullish on a stock.

- Call sellers are generally bearish on a stock.

Credit Spread: An options spread established for a net credit (sold option premium is bigger than bought option premium).

Debit Spread: An options spread established for a net debit (bought option premium is bigger than sold option premium).

Delta: Measures the amount an option’s price changes per a $1 move in the stock.

Earnings: A quarterly report issued by companies to share financial health with shareholders.

Exchange-traded fund (ETF): An investment fund that holds assets like stocks, bonds, or commodities, designed to generally reflect the performance of an index or sector.

- The SPDR S&P 500 Trust (SPY) is an ETF designed to mirror the movement of the S&P 500 Index (SPX).

Exercise: When a call or put owner invokes the right to buy or sell the underlying stock, respectively, at the strike price before the option’s expiration date.

Expiration: When an option contract is no longer valid. Typically occurs on a Friday.

- Standard monthly options usually expire at the close of trading on the third Friday of the month.

Extrinsic value: One half of what makes up an option’s price, primarily determined by time value and implied volatility.

- The other half of the option’s price is made up of intrinsic value.

Fed: The Federal Reserve sets U.S. interest rates.

- The Fed tends to hike rates when the economy is booming, and cut rates when the economy is vulnerable.

Fibonacci Retracements: A number sequence used to gauge a stock’s retracement after a big move, as stocks often find support or resistance at these levels.

- The most common Fibonacci retracements are 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

- For example, if a stock rallied from $50 to $100, a 50% retracement would mean the stock fell from $100 to $75 (half its gain).

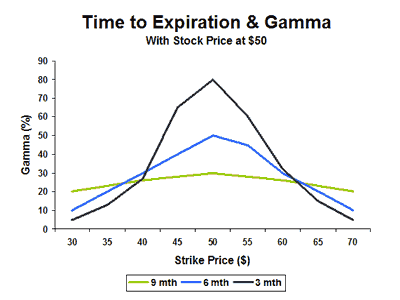

Gamma: Measures how much the delta will change with every $1 change in the stock price.

Greeks: Metrics to determine how an option’s price will react to a list of variables.

Guidance: A forward-looking metric of profit and/or revenue often issued by a company with its quarterly earnings report.

Hedge: To protect or “insure” an investment, usually with another investment.

- Example: Buying a protective put on a stock you already own, to guarantee a minimum selling price for a stock.

Historical Volatility (HV): The measure of a stock’s movement over a set time frame, based on daily closing prices.

- HV is often compared to an option’s IV for the same time frame. For instance, if 30-day HV is higher than a 30-day options’ IV, that options may be considered pricey.

Implied Volatility (IV): Expectations for a stock’s volatility that impacts the price of an option.

- Higher IV typically means higher demand for an option, resulting in higher prices.

In the Money (ITM): When a stock is trading above a call strike or below a put strike.

Intrinsic Value: One half of what determines an option’s price, calculated by the difference between an ITM option’s strike and the stock price.

- ATM and OTM options cannot hold intrinsic value.

LEAPS: Long-Term Equity AnticiPation Securities are options that can trade several years out, in the January series.

Leverage: The control of a larger number of shares with a smaller amount of money.

- One option controls 100 shares of the underlying stock.

Limit Order: An order that will only be executed by your broker if the price of the option hits a predetermined price.

Long Options: Bought options.

Margin: The money borrowed from a brokerage firm to purchase stocks, bonds, and other securities.

Moving Average: A trendline made up of successive averages of closing prices in a certain time frame.

- A moving average cuts out the “noise” of a stock’s fluctuations, and often emerges as a line of support or resistance.

Open Interest: The number of outstanding option contracts at a particular strike or in a particular series.

- Open interest changes every morning, based on the previous day’s trading activity. If new positions are opened, open interest will rise overnight.

Out of the Money (OTM): When a stock is trading below a call strike or above a put strike.

Overbought: When a security has experienced a sharp move higher in a short window, to the degree that it is deemed overvalued and ripe for a short-term bounce.

- This is often measured by a 14-day Relative Strength Index (RSI) that’s above 70.

Oversold: When a security has experienced a sharp move lower in a short window, to the degree that it is deemed undervalued and ripe for a short-term bounce.

- Often measured by a 14-day RSI that’s below 30.

Premium: The amount of money an option buyer pays or option seller receives for a trade.

Put Option: Gives the buyer the right (but not the obligation) to sell 100 shares of a stock for a predetermined price (the strike) by a predetermined date (expiration).

- Put buyers are generally bearish on a stock.

- Put sellers are generally bullish on a stock.

Relative Strength: The comparison of a stock to the performance of an index or sector, or to itself.

Resistance: An area on the charts where an uptrending stock might stall or be turned lower.

Rho: Measures interest rates. An increase in interest rates typically increases call prices and decreases put prices.

Short Options: Sold options.

Short Selling: When a trader borrows shares of a stock from a broker, and then sells them, hoping the stock declines. If this comes to fruition, the short seller can then buy the stock back at a lower price to replace the shares they borrowed, and pocket the difference.

Spread: A position involving two or more different options on the same stock.

Strike Price: The stated per-share price where a stock can be bought by a call buyer, or sold by a put buyer, if the option is exercised.

Support: An area on the charts where a stock’s downward momentum might stall.

Theta: Measures an option’s time value — or, rather, how much an option price will decrease each day.

Time Decay: The loss of value in an option as expiration approaches, assuming all other factors are constant.

Time Value: The difference between an option’s price and its intrinsic value. Erodes as the option approaches expiration (see Time Decay above).

Vega: Shows how an option price will change based on a 1% change in the contract’s implied volatility.

Vertical Spread: An option strategy involving the purchase and sale of puts and/or calls on the same stock, with options in the same expiration series but at different strikes.

VIX: The Cboe Volatility Index (VIX) reflects investors’ expectations for short-term stock market volatility by measuring IVs of S&P 500 Index (SPX) options.

- Sometimes called Wall Street’s “fear index,” as rising VIX often coincides with stock market drops.

Volatility: The tendency of a stock to swing in either direction.

Volatility Crush: A sharp drop in IV — often after a known event like earnings.

Volume: The number of contracts traded on a stock or option in a specified time frame.

Weekly Options: Short-term options that expire at the close each Friday.