Options Basics

Now that you’ve had a brief introduction to options, let’s start taking a look in a little more detail.

In this section, we will cover some additional options basics and discuss some introductory options strategies to take advantage of various market conditions.

As a reminder, here are the two basic types of options you can utilize if you are bullish or bearish on a stock.

Bullish

- Long Calls

- Unlimited profit potential on a bet the stock will move higher

- Risk is limited to the premium paid for the option

Bearish

- Long Puts

- Significant profit potential on a bet the stock will move lower

- Risk is limited to the premium paid for the option

But don’t run out and buy options yet! In fact, one of the first common mistakes beginning traders make is to blindly buy options.

Let’s discuss why buying options might be the wrong tool for the job.

The Disadvantages of Buying Options

In the previous section, we discussed some of the advantages of buying options, including limited risk and potentially unlimited profit potential. And while options give the trader a unique and powerful way to trade a stock, they also come with a set of disadvantages.

Here are some of the highlighted disadvantages to buying options.

Upfront payment

You will immediately realize that an upfront cost needs to be deposited in the form of the premium when you buy an option.

Commissions

Commissions and other fees for options trading are not included in the new zero-commission environment that brokerage firms have rolled out recently. Option trading costs and commissions can easily eat up your profits if you overtrade your account.

Limited availability

Although you will find options for many stocks, they are not available for all of them.

Time

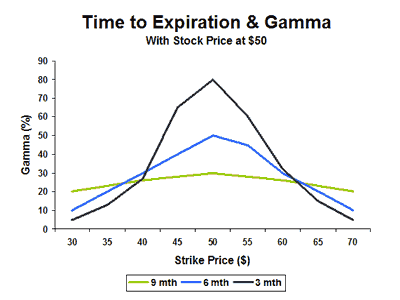

It is essential to consider the implications of the expiration date when you trade an option. As the expiration date draws closer, the option loses its value due to time decay.

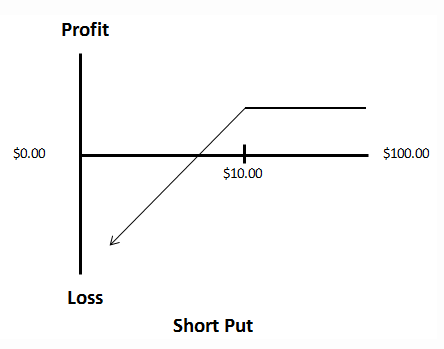

The disadvantages to options sellers can be even more severe, including the risk of unlimited losses. This is why naked call and put selling is only available to the most advanced options traders (which we’ll cover in a later section).

Alternative Options Strategies

Now that you’ve gotten a glimpse of some options basics, let’s take a quick look at some different options strategies that can be utilized depending on the anticipated price moves. These strategies are discussed in more detail elsewhere in Options Academy.

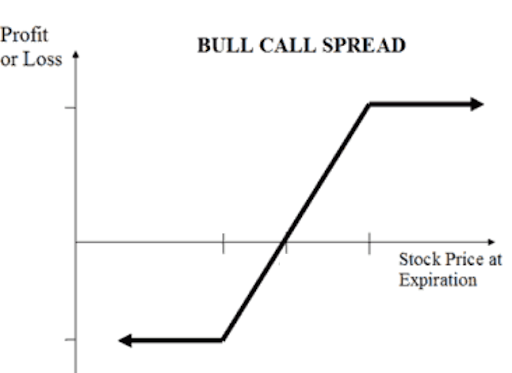

Bull Call Spread

A bull call spread involves a trader buying a call option while simultaneously selling a call on the same asset but at a higher strike price. Both calls share the same expiration date.

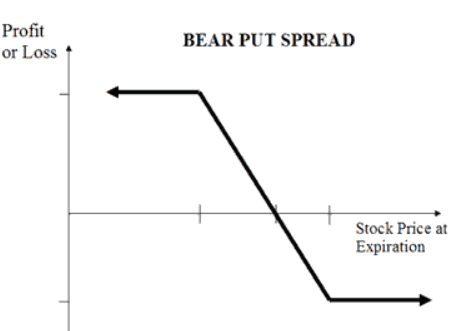

Similarly, a bear put spread involves a trader buying a put option while simultaneously selling a put on the same asset but at a lower strike price. Both puts share the same expiration date.

These strategies are just two examples of alternative ways you can use options to place bullish or bearish bets on a stock. With a little bit of creativity and imagination, a trader can make more elaborate trades that will allow them to further increase profits, decrease risk, or potentially a combination of both!

Wrapping Up

Trading options is not easy, but once you get the hang of things, you could potentially see high returns. As with any trading venture, it’s important to understand your risk tolerance and profile before diving in.

Keep reading to learn more about options and other strategies that can increase your trading profits.