Options Strategies for a Bear Market

A bear market is one of the most dreaded events in the world of stock trading. It can cause investor confidence to plunge to extremely low levels — and make investing risky even for the most experienced traders. During a bear market, many investors rush to sell off their stocks in an attempt to avoid further losses, resulting in a devastating cycle of negativity.

Different people define a bear market differently. However, the general notion of what makes a bear market is a situation in which an asset drops at least 20% from recent highs. Usually, a bear market happens as a result of an overall decline in the stock market, but specific stocks may also enter bear-market territory if they fall at least 20% over two months or more.

There are many things that can lead to a bear market, including a weak or sluggish economy, low investor confidence, or a black swan event like the coronavirus pandemic.

A bear market typically has four phases:

- Stock prices and investor sentiment are high.

- Stock prices start to drop sharply as investors “capitulate” to the sell-off.

- Traders begin to re-enter the market.

- Stock prices trend lower at a slower pace.

To survive a bear market, long-term investors may do things like invest in dividend stocks or buy defensive stocks or put their money into cash.

Options traders have choices, too. Here are some of the best options strategies for a bear market. While we give brief explanations of these strategies below, more detailed breakdowns can be found in separate sections of RagingBull’s Options Academy.

- Long put: Buying a put option on an underlying stock based on the assumption that it will fall below the strike price by the expiration date.

- Covered call: Selling a call option on a stock you already own in your portfolio to generate income and/or protect against any downside risk.

- Bear put spread: Buying a put option at a specific strike and selling a put option at a lower strike. Both options will have the same expiration date and underlying asset. This is used to position for a modest fall in the underlying, with the sold put lower the cost of buying a long put outright.

- Bear call spread: Selling a call option at a specific strike and buying a call option at a higher strike. This is used to position for a moderate fall in the underlying, but traders can still make money even if the stock fails to move.

- Protective call: Buying a call option on a stock that you have a short position on as an “insurance policy” to protect against any upside risk in the underlying security.

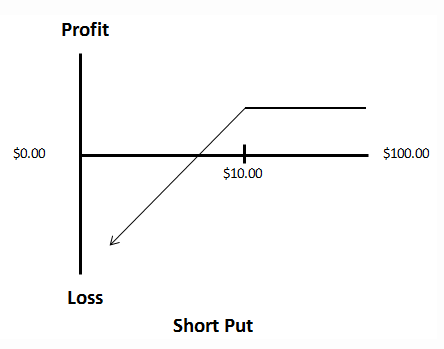

- Naked calls and puts: Selling a call option or put option to take advantage of elevated implied volatility levels, which tend to boost options prices. However, stocks move fast in bear markets, so it’s important to pick strikes that are far enough out of the money, it lessens the chance of the options getting assigned.

- Put ratio backspread: Selling a put option at a specific strike and buying two put options at a lower strike. The options will have the same expiration date and underlying asset. This strategy is used to position for a breakdown in a highly volatile stock.

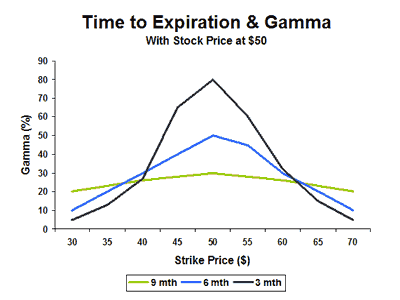

As briefly touched upon above, volatility tends to spike in periods of market turmoil. One of the best measures of market volatility is the Cboe Volatility Index (VIX), which is also referred to as the market’s “fear gauge.”

Higher volatility means higher options prices, so options buyers need to pay close attention to the ask price to make sure they’re not walking into a trade where volatility expectations are too big to overcome. Higher-volatility environments also make selling options a rewarding strategy, since traders are able to collect attractive premiums.