Short Options

There are riskier options strategies that seem more like gambling as they can open you up to a significant amount of risk than more traditional options trades, like buying calls and puts. Two of these higher risk strategies are uncovered calls and puts.

And if you want to sell naked options, you’ll be required to have the top level of clearance from your broker, as well as a margin account. Most brokers require a minimum $2,000 balance to maintain a margin account.

Trading on margin can be a risky proposition. If your losses exceed your account, you still have to pay back the balance. And with short calls and puts that are uncovered, these can accumulate quickly. In fact, your loss potential is theoretically unlimited for naked calls, and extensive until the stock hits $0 for puts.

Let’s take a closer look at these high-risk, low-reward strategies.

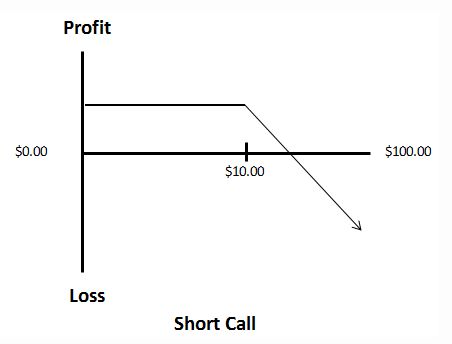

Naked Calls

When a trader sells calls, they are making a bearish bet. The position gains value when the stock stays put or declines.

An uncovered call means you are selling a call on a stock you do not own. The profit potential is capped on the trade at the premium collected, but the risk is not — if the stock price jumps above the strike price, and the call is exercised, you will be responsible for buying the stock on the open market and then selling it at the strike price to cover your portion of the contract.

In other words, you could be subject to heavy losses.

Let’s say RBLL stock gapped below $10 recently, and you think this round-number level will serve as a short-term ceiling for the stock. You decide to sell a 10-strike call for $3, or $300 (accounting for 100 shares).

This is also the most you stand to gain on the trade, should the shares remain below the strike through expiration.

However, what happens if the stock gaps sharply higher, and gaps all the way to $30? Losses can accumulate quickly once the option moves into the money. Considering your breakeven price is $13 (strike plus net credit collected) you’d be staring at a loss of $23 (30 – 23), or $2,300. This loss would only grow the higher the stock climbs.

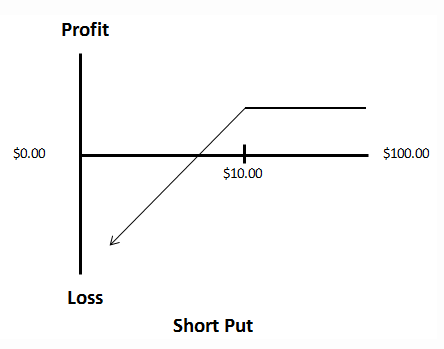

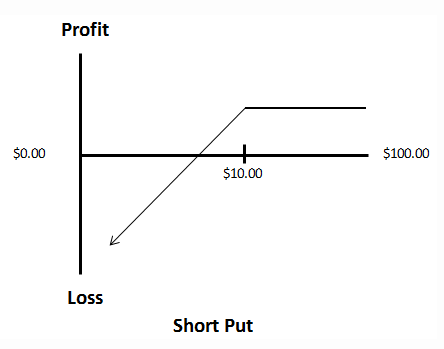

Naked Puts

A short put is also called an uncovered put or naked put, and is initiated by selling a put. Unlike the option buyer, the put seller collects a premium, and this premium represents the maximum potential profit on the trade.

A short put play is neutral to bullish because by selling the put, the trader believes the stock price will remain above the strike price through expiration. If the stock stays above the strike, the option will expire worthless, and the speculator gets to pocket the full premium. However, if the stock price falls below the strike price, the put seller faces significant losses.

Why?

Because the put seller is required to purchase the shares of the underlying stock at the strike price if the put buyer exercises the option. What happens if the company goes bankrupt, and the shares go to zero? Well, those put options would become really expensive.

Take a look at RBLL stock, which has been holding above short-term support near $10. You think this round-number mark will continue to serve as a floor for the shares, so you sell a 10-strike put for $3, or $300 (accounting for 100 shares).

This net credit received is the most the put writer stands to gain on the trade, should RBLL stay above the strike price through expiration.

What if the stock gaps below support at $10? Losses will accumulate quickly once the option moves into the money. Let’s say RBLL falls all the way down to $2. Considering your breakeven price of $7 (strike price less net credit), you’d be staring at a loss of $5 (7-2), or $500.

Wrapping Up

Writing options without being hedged is extremely dangerous and you should stray away from it when you’re first learning to trade options. For those that do choose to short uncovered calls and puts, they will need a margin account and clearance from their broker.

They will also need to choose their strike prices carefully to avoid assignment, and look for higher levels of implied volatility, since this boosts options prices — and in turn, the net credit they collect.