Short Strangle

A short strangle is a fairly simple options trade that is initiated when a speculator is betting on minimal price movement in the underlying security.

There are two key concepts you need to understand before diving into a short strangle — time (theta) and volatility (vega). Theta is the time decay built into an option, and time decay is an option’s seller’s best friend. Every day that passes by eats into the time value of that contract until it reaches zero by expiration.

And since a short strangle involves the selling of both a put and a call on the same option for the same expiration, it is a great trade to put on when volatility is high — because the higher implied volatility, the higher option prices get. This pays you more for selling the contracts.

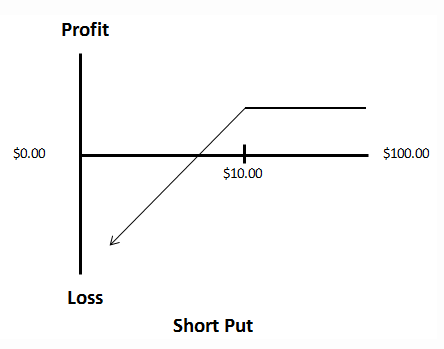

Now, a short strangle is an undefined risk trade, meaning you could potentially lose infinity on the call side and all the way down to zero on the put side — which is why it’s a strategy that’s only available to options traders who have been given level 4 clearance.

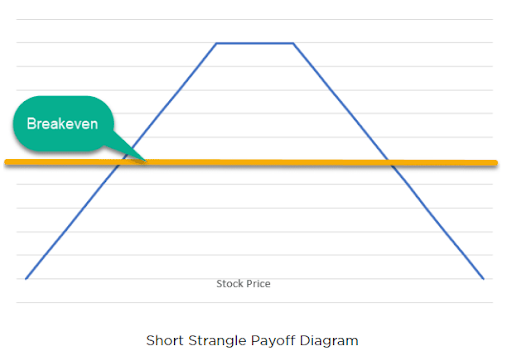

For a short strangle, the payoff diagram looks like this:

As you can see, you don’t have to know where the stock is going to go, you just want it to stay in a certain range (between the strikes).

You have to make a trade off when picking out your strike prices, though. The closer you get to the current price, the more you get paid, but the lower your odds of success are. When you go further out, your odds increase, but your payout decreases.

Let’s take a look at an example.

Say Apple (AAPL) stock is trading near the $250 mark, and you think it’s going to hold here in the near term. You could sell to open one 310-strike call for $1.50 and sell to open one 200-strike put for $8.50, collecting a net credit of $10, or $1,000, on the trade (since each option contract accounts for 100 shares of the underlying)

Ideally, AAPL will remain in between the two strikes through expiration, allowing you to pocket the initial net credit collected as the full potential reward. However, you can still profit, as long as the stock stays between the two breakeven points of $190 (put strike less net credit) and $260 (call strike plus net credit).

However, should AAPL stock breach the put strike or topple the call strike, losses could quickly add up.

For example, if the shares sink all the way to zero by expiration, the maximum potential loss on the trade to the downside is $190, or $19,000 (x 100 shares). On the other hand, potential losses to the upside are theoretically unlimited, as there’s no limit to how high a stock can climb.

Wrapping Up

The short strangle is an attractive strategy when volatility is running high, considering it consists of selling a call and a put on the same underlying stock. However, both the call and the put are naked, meaning this two-legged strategy carries significant risk and is best-suited for experienced options traders.