Hey Gang,

It’s been tough in penny stock land as of late.

It seems like every time I see a good move up, the next day it’s reversed.

The chop is never fun.

But there’s more than one way to skin a cat.

So when follow through is hard to come by…there’s always the fade play.

EyeGate Pharma (EYEG)

EyeGate Pharma (EYEG) is a clinical-stage pharmaceutical company, focused on developing and commercializing products for treating inflammatory and immune diseases with a focus on the eye and nervous system.

Yesterday the company announced the appointment of a new CEO and a non-binding letter of intent to purchase Bayon Therapeutics. The new CEO is the co-founder of Bayon by the way.

And with that…the stock doubled overnight, from a close of 3.10 to an open price of 6.39.

But the party didn’t last long as you can see from the chart below…with EYEG down over 30% from the open, currently trading at 4.36.

So what gives?

Well looking back at the chart for EYEG, this isn’t the first time we’ve seen a move like this.

Back on December 21, the stock gapped up from 3.57 to 7.69… only to trade down over 30% from the open to close the day at 5.21.

And guess what?

That was on the news of an acquisition. Sounds familiar.

So instead of just buying hype, here’s another way I deal with a move like this.

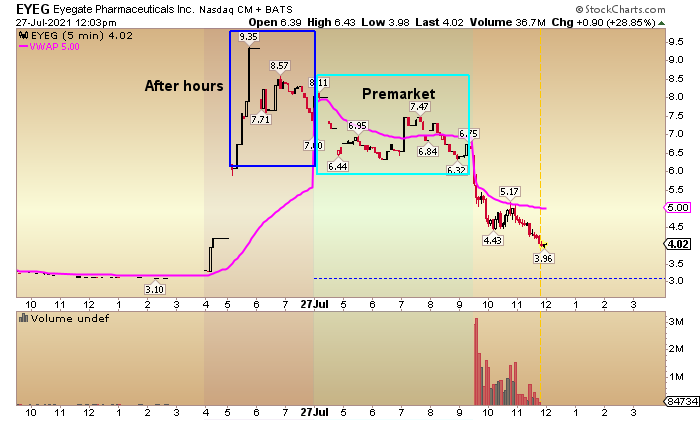

First off, it’s important to note that this stock has a low float at under 7M shares, so any moves it makes can be exaggerated as we’ve seen from yesterday’s close of 3.10 to the after hours high of 9.35 yesterday.

Now looking at the 5 minute chart below… you’ll see that EYEG hit a high of 9.35 in after hours trading yesterday and a high of 8.11 in the premarket trading this morning…

I’ll also point out that the low in the premarket was 6.32 just minutes before the opening bell and the price seems to be trending down going into the open.

Then as the market opens, EYEG continues that trend to the downside…

Now that you’ve seen the price action going into the open…

Let’s take a look at what happens in the opening minutes.

As you can see, just after opening, EYEG breaks below the premarket low, creating a new lower low…effectively continuing the downtrend formed in the chart above.

And after hitting a new low at 4.53, the stock makes a move to 5.17 where it hits resistance at the VWAP…getting turned away and eventually making another lower low at 3.96.

Sure some traders may have been buying the stock on the news, but just from looking at the post and pre market price action into this morning’s open (downward trend)…I would have needed to see the stock actually trade up, breaking those levels, before jumping in.

So going long was out the window based on that.

But there was another way to play this…

Without a move to break above the premarket downtrend, selling short as EYEG continued the downtrend would have been an option…or when it failed at VWAP.

Fading gaps is not an uncommon move.

Just look at TSLA this morning, right off of its earnings report it traded up in the after hours yesterday, and premarket this morning.

But coming into the open, TSLA sold off, breaking below the premarket low never looking back.

Again…without a move above the premarket resistance levels, there’s no reason to jump on this long…even though it technically gapped up from yesterday’s close.

By taking into account the post and pre market price action, I would hopefully keep myself from getting burned here…

And if I was a short seller (which I’m not)…there’s another way to play moves like this in TSLA and EYEG…fading the gap.

2 Comments

How do I rejoin the weekend wiretap group? Thank you

Like always Thank you for the insight Jeff

Bill