It would be impossible for me to name all of the different trading strategies that exist. There are hundreds, if not thousands, of different strategies. Of course, not all of them are profitable.

One thing in common, however, is that all traders like to fight for price.

Fighting for price is when traders will do their best to have precise entries and exits, thereby ensuring maximum risk: reward.

This is a concept that is not widely spoken about.

As indecision rocks the market and choppy action can be seen across the board, I thought now it would be great to discuss this topic.

Before I go into detail, let me give you an example of fighting for price.

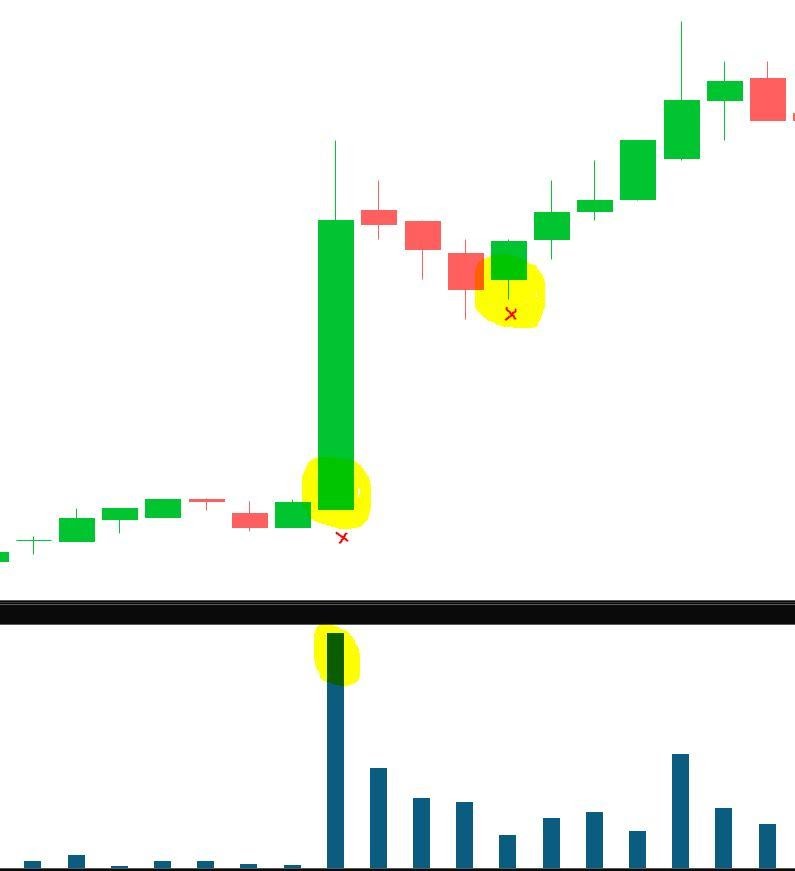

In the above chart, with the stock breaking out, a trader is faced with many possibilities. A trader could get long on the initial breakout candle as soon as the consolidation is cleared. Alternatively, a trader could chase the stock once it is near the high of the candle.

In this example, successfully fighting for price would mean a trader could get long as soon as the consolidation has broken to the upside. A stop might have been placed at X. That trade would have presented a significant risk: reward. If you had chased the move near the high of the candle, the risk: reward is no longer desirable.

The second highlighted area presents another opportunity for fighting for price. If you had missed the first opportunity, then this higher low gave another.

As soon as buyers step in (highlighted in yellow), a higher low is confirmed, and a long could have been placed with a stop at X. This would have been a substantial risk: reward entry and an excellent example of fighting for price.

Why is precision necessary for entries and exits?

You might still be wondering, why is a precise entry necessary if I believe the stock will go up anyway?

Well, the difference between a good entry and a lazy entry is lost money. In the end, as traders, the goal is to make money trading. So why not maximize the profit potential of each trade while minimizing the risk?

How to fight for price

- Key support and resistance levels: Large moves or setups often occur once support or resistance has been broken. To fight for price, a trader would need to be aware of such levels.

- Trend: If a stock is trending, it is always good to have a trendline drawn in. By doing this, you would be aware of the support and resistance of the trendline. Fighting for price would be done by buying the stock as it makes higher lows and comes into the support, versus paying up for the stock near resistance. This practice could enhance the risk: reward of the setup.

- Have Patience: You must have the patience required to wait for the best possible entry point.

- Know where you are wrong: You should know where you are wrong or where your stop will be placed in a trade before the trade has been put on. You can then quickly figure out if your entry will lead to a good risk: reward.

Let’s look at these principles in practice:

Key support and resistance have been identified and drawn on the chart. An upward trendline has also been drawn and overlaps critical support. Below the identified support, I would be wrong and therefore stopped out. X marks the spot.

Above resistance, thereby confirming the breakout, I will get long. The risk: reward of that plan is solid. By applying the above principles, I can get a great price when the trade sets up.

2 Comments

The chart explains it well.

Thank you.

Definitely believe that which you said. Your favorite reason appeared to be on the web the easiest thing to be aware of. I say to you, I definitely get irked while people consider worries that they just don’t know about. You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people can take a signal. Will probably be back to get more. Thanks