Not the usual focus of my attention, but the longer it goes on the more I wonder…Can GameStop (GME) pull off a massive turnaround?

This is the company that started the meme stock craze.

But contrary to popular belief, it was never just about sticking it to the man (hedge funds). Or maybe it was…

Over time that theme may have taken over a bit. Still, initially, it was about finding beaten-down stock with heavy short interest… yet had some underlying value or turnaround potential.

The idea was to buy in for the longer-term turnaround as the pandemic subsided…and along the way it became a way to crush hedge funds who were heavily short.

As it goes with investing, not every pick will be a winner. There are a lot of variables outside of our control.

But GME is one stock that somewhat boggles the mind.

Is this a true turnaround story or simply a massive short squeeze headed back to earth?

Is GameStop For Real?

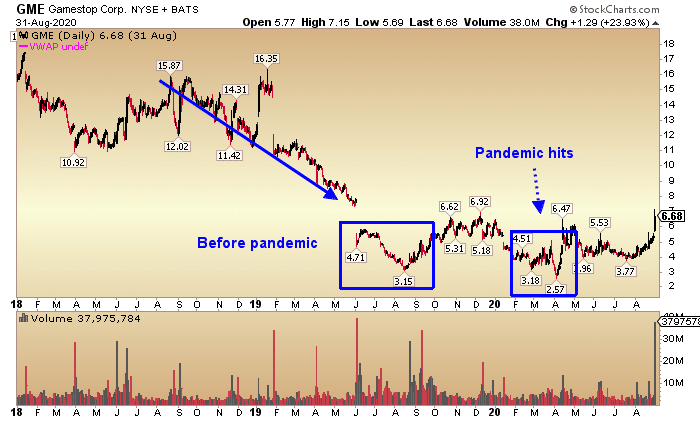

GME was dead in the water just over a year ago.

With gaming software sales shifting to online, other than finding someone to buy them out, this was a stock that many investors believed was headed to zero.

And every time there were rumors of a potential suitor that would prop the stock up, those rumors would amount to nothing, and the stock would flop again.

GME was down to $3.15 in 2019…before the pandemic was even a thing.

Then the pandemic hit, and indeed this bricks and mortar stock was doomed, right?

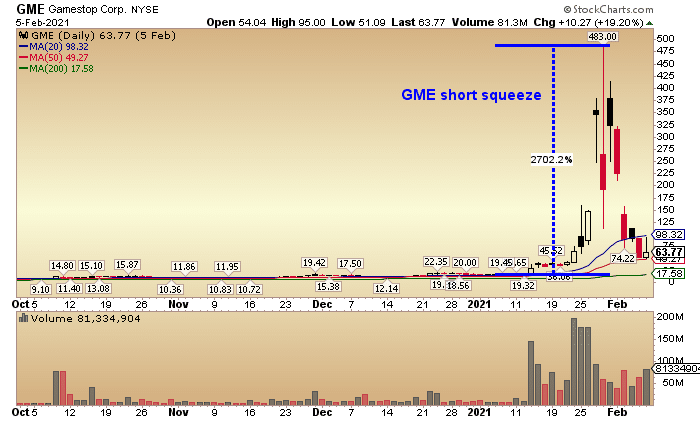

One would think so, but what happened next was the infamous GME short squeeze led by the Reddit group WallStreetBets.

The stock went from a mere $2.57 in August 2020 to a high of $483 in January 2021.

And with that, all eyes are on GME.

Betting on a New Strategy

Enter the Chewy co-founder Ryan Cohen as Chairman of the Board with a vision for the future of GameStop.

That vision? the “Amazon of gaming”

That will get some people listening, but is it possible?

Ryan Cohen thinks so…I mean he’s leading the charge so of course he does and he has recently recruited at least 5 veteran Amazon executives to run/ create the new GameStop.

But when it comes to the details, he isn’t sharing much.

It’s one thing to use phrases like the “Amazon of gaming” and it’s another to share a detailed plan and deliver those results.

Ultimately GME went from a market cap of a few hundred million to close to $20 billion in a short period.

With the latest earnings report being a non-starter, it’s safe to say that investors aren’t buying the current GameStop or its earnings.

It all comes down to buying-in to the new strategy.

A turnaround of this nature is no small task that makes this a tough call, especially when the stock has already squeezed up.

Software sales will continue to shift to digital downloads. And while that is where the new strategy is focused…the companies making the games don’t need GameStop’s help in that department.

So where do they really fit in here?

Debt Free Squeeze

The good thing that came out of this meme stock short squeeze is that GameStop was able to raise a boatload of cash to pay off debt and fund the ambitious turnaround plan.

Today alone the company closed on an equity offering of 5M shares to raise a little over $1B.

This was great for the company for sure, but it also dilutes the shareholders value.

Granted if the money is used productively, it can ultimately benefit all. One thing is for sure, without the money GME was headed to the grave. At least now, the company has the capital to try something new.

But the question still remains…can GameStop actually create a totally new sustainable business model?

And do it before the meme stock group gives up and takes profits?

It’s hard to see this as a safe buy being that if the group of HODL (hold on for dear life) investors starts to sell, it could end in panic. If a Reddit investor is up a million on GME and holding for more.. How far do they let it slide before grabbing profits?

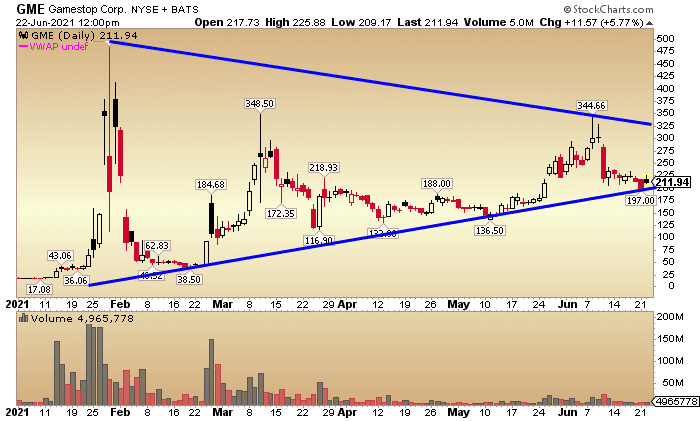

Since the big squeeze, the stock has just been wedging. It’s kind of in no man’s land for now.

Yesterday it broke below $200 for the first time in a month. But it popped back above today as they closed on the equity offering.

The $200 level will be an interesting psychological level to watch. If it breaks back below, it could get sketchy.

Any way you look at it, GME is an exciting story.

Is it a stick-to-the-man short squeeze? Diamond-in-the-rough turnaround story? Or something in between?

Ryan Cohen has put together a vision and team to create this vision…but is there a place for it?

There are too many unknowns at this point. And there are no fundamentals to work with, it’s all about the vision…

Until more details are revealed, this is like investing in someone’s dream and hoping they can accomplish it.

1 Comments

Great perspective!