As you know, most of the time, my focus is on the long side, especially with penny stocks.

However, today I want to go over a critical concept and trade example.

The Backside

The Backside refers to the Backside of the move. For example, a stock with significant momentum to the upside suddenly breaks the uptrend and begins drifting lower.

It is essential to understand this concept because it might significantly improve risk management, among other things.

If you are long a stock, identifying the Backside might help you lock in gains and avoid giving back too much.

If you like shorting stocks, then being able to identify the Backside of a move might prove to be your most profitable strategy and edge.

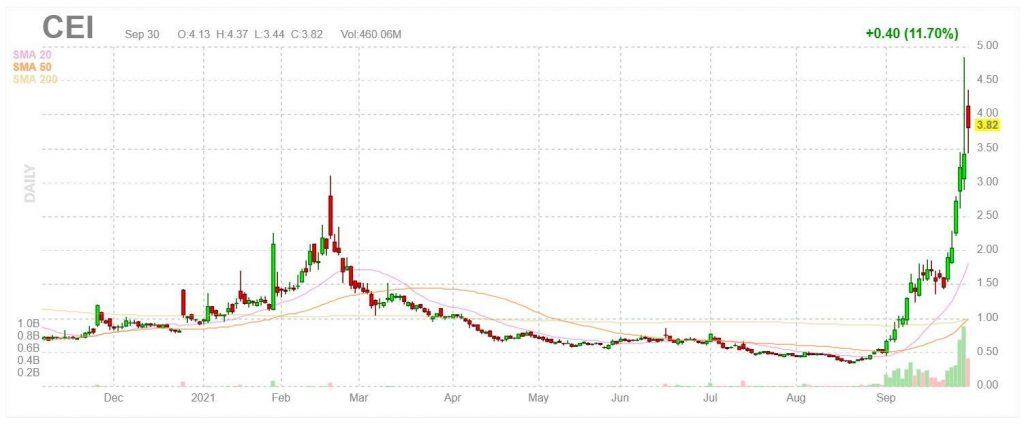

For this case study, let’s use the most current in-play name and runner, CEI.

The most elusive backside trades present themselves after a stock has experienced a sharp increase in value over a short period, just as CEI did.

Up until Wednesday, CEI had been in an uptrend. The stock continuously made higher highs and higher lows, trended above VWAP, and held firmly above the upward trendline.

The Backside exists once the stock is no longer doing the above. So, when the stock is no longer holding above the uptrend, VWAP, and critical levels of support.

The most immediate indication of the Backside is if the stock experiences clear topping out action.

For Example:

The upward trend and channel are drawn in the chart above, beginning at $1.80, where the stock broke out from previously.

Notice the range expansion on Wednesday and how the volume increased dramatically. The stock went parabolic. The sharp reversal and break of the upward support is confirmation of the stock topping out in the short term.

The following day, notice how the stock made a lower high off the open, traded below the intraday VWAP and barely held up at support.

The action from these two days signals the stock has topped out in the short term and that the Backside exists. With a lower high confirmed and the stock trading below the uptrend’s support, momentum has shifted to the downside.

How to take advantage of the Backside

First and foremost, risk management is vital. Therefore I believe that being aware of the resistance and waiting for confirmation is essential when trading the Backside on the short side.

For example, there was an opportunity on Thursday to short the stock when it failed at resistance from Wednesday. Notice on Thursday, right off the open, the stock popped into $4.30 and failed. This might have presented a good backside opportunity to short the stock. The move into $4.30 and failure signaled a lower high. From a risk: reward standpoint, this might have been a brilliant opportunity for those wanting to short the stock.

The short-sellers might be looking to take advantage of quick pops higher in the stock now that the stock is in a downtrend and momentum has shifted. They might look to short pops as long as the stock remains trading lower.

It’s critical to understand the concept of the Backside. After a stock has run up considerably and topped out, you do not want to be buying every dip unless a change of character has taken place.

Again, it is critical to listen to the price action and character of the stock. If I were considering a long in CEI or any other small-cap stock that has experienced a similar type of move, I would need to be patient and wait for a shift in momentum before going long.

For example, I might want to wait for the stock to reclaim support. I might want to wait to see the stock break the downtrend. I might even want to see the stock blow-off to the downside and put in a clear bottom.

The Backside not only identifies opportunity on the short side, but it also acts as a stop sign for bulls and gives longs the chance to take profits and get out safely.