I’ve said it before, and I will repeat it: I see considerable opportunity lately in small-caps and penny stocks.

Across the board, it appears that the range has started to expand, along with increased volume and, of course, an increase in potential trade opportunities.

Over the past couple of days, I have written and spoken to my members about the positive change I am noticing in the market and examples of the specific signs that I am seeing.

Yesterday, yet another opportunity presented itself to me.

You have to strike while the iron is hot, gang, and that’s precisely what I did yesterday!

I cannot take all the credit, though.

A chatroom member called out the stock I traded very early on. Who knows, without that callout and teamwork, I might NOT have traded the stock.

Shoutout to Sylvie, a member of the chatroom, for calling out ENGA at 10 am yesterday, when the stock was trading at $0.75.

“Dec 15, 10:00 AM sylvie des: ENGA”

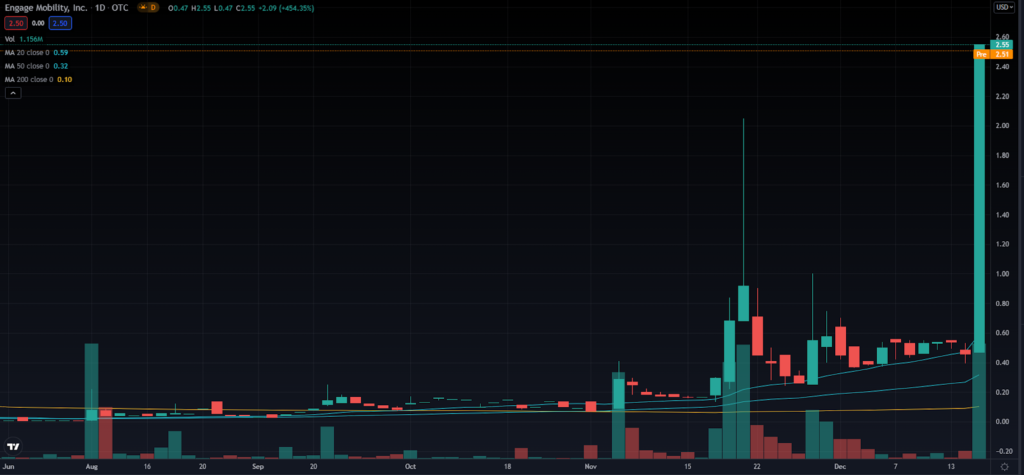

Engage Mobility Inc. (ENGA)

ENGA, according to otcmarkets.com, functions as a provider of mobile technology, marketing, and data solutions for business. By selling their Mobile Engagement System, ENGA enables business owners to engage with new and existing customers with a turnkey mobile marketing solution.

The Catalyst:

- Press Release 12/15/2021: Bebuzee (UK), LTD. announced yesterday the acquisition of ENGA.

As a result of the breaking news, the stock closed the day up 454.35% and saw an enormous increase in share volume compared to the previous session.

The Setup and Trade

Gang, as you very well might know, a consolidation breakout pattern is my absolute bread and butter setup.

On the daily chart of ENGA, that’s exactly what transpired. I liked how the symmetrical triangle pattern perfectly converged and resulted in a perfect breakout pattern along with the breaking news.

From the daily chart, I immediately had $2 as a resistance level and potential profit target area if I was to get long the stock.

On the intraday chart yesterday, there was a lot to love as well.

Not only was there a consolidation breakout pattern on the daily chart, which had been confirmed, but also on the intraday chart.

There were multiple consolidation breakout patterns, but the most notable two came midday.

The first setup came after the stock consolidated between $1.60 and $1.80 before breaking out midday with an increase in volume.

The second opportunity came into the close when the stock broke out of a bull flag at $2.10 and closed high of the day on the increase in volume.

I got long the stock near support of the consolidation. I entered the position at $1.64 and closed the long at $1.90.

I caught the momentum in the stock.

This stock experienced an explosive move to the upside yesterday and presented multiple setups along the way, allowing me to catch some of the momentum.

The continuation in the stock was fantastic, so let’s hope this action continues and spills over into other penny stocks!

1 Comments

Thanks, Jeff!