“A chart is a chart is a chart.” – Jeff Williams.

It doesn’t matter if I am charting a penny stock or AMZN, I still look for the same things. For instance, last Friday I spied a classic “W” pattern setup in Tempest Therapeutics Inc. (TPST), and I looked to play the continuation of the “W” pattern breakout and strong volume.

At nearly $20 per share, TPST was by no means my usual penny stock play. But that didn’t keep me from making the trade.

If there’s one thing I know, it’s chart patterns…and chart patterns don’t discriminate based on stock price.

Technical analysis is the same regardless of the price, or asset class for that matter. The same principles I teach can be used for stocks of all price levels, as well as currencies, commodities, and so on.

So when I came upon TPST breaking out of a classic “W” pattern, I didn’t worry about the price tag, I simply lasered in on the technicals and trade potential.

What is a “W” pattern?

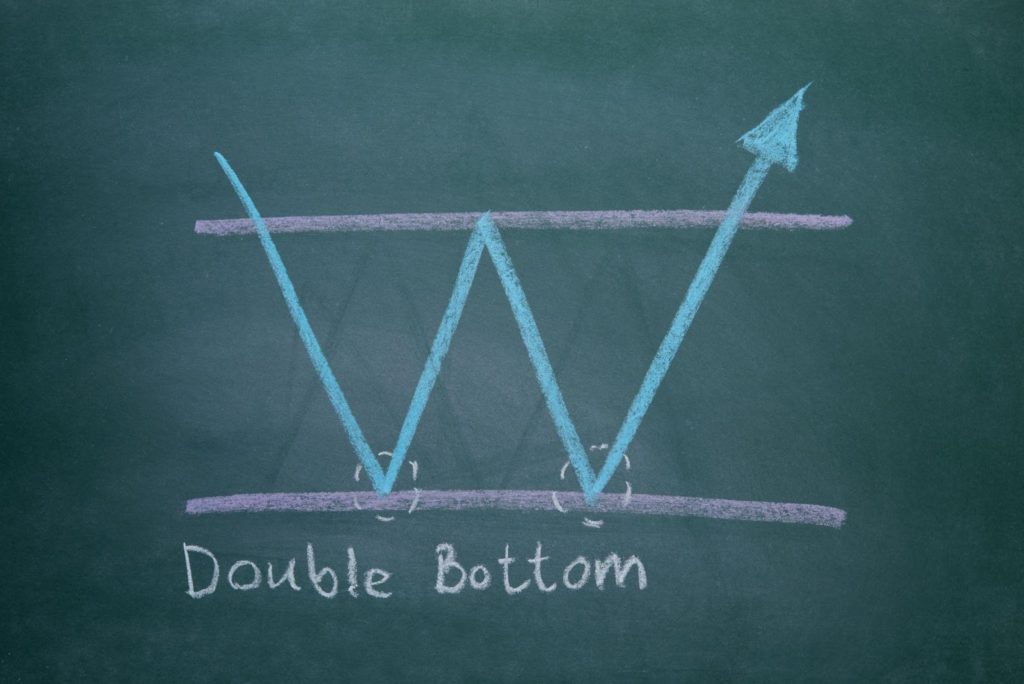

If you’ve never heard of the “W” pattern, maybe you are more familiar with the term double bottom instead.

The “W” is just another term used for the double bottom.

The reason for this is the pattern itself. When formed, the stock creates a visual “W” on the chart (as you can see on the chart below).

But first the basics…

The stock makes a leg down, then tries to rally but hits resistance and ends up pulling back to form a second down leg (double bottom).

The stock then rebounds one more time and is finally able to punch through the first leg up and move higher, creating the “W” visual on the chart.

Digging Deeper

The double bottom pattern follows a major or minor downtrend (creating the first leg down) and signals a potential reversal.

For the most part, I’m letting the charts do the talking… but it’s not a bad idea to note that the pattern is often validated by a fundamental change in the market, industry or stock itself… lending to the idea of a reversal or change in trend.

In this case TPST completed a merger on June 28, that added additional financing to help push their drug development forward, along with giving them access to the public markets.

All of this price action is coming from new attention to the company. Will it last? I don’t know, but as you will see, the “W” pattern broke out nicely.

Now, how to play the setup…

With the double bottom, the buy signal comes when the stock breaks above the high of the first leg up (peak of mid “W”).

Now, if you’ve followed me at all, you surely know I believe volume is key in technical analysis.

And with the double bottom, a spike in volume typically occurs during the two upward price movements in the pattern, but I am especially looking for a volume spike on the breakout to serve as further confirmation of a successful double bottom pattern.

Looking at the chart below, TPST got a massive surge in volume on Friday leading to the break above the midpoint at 13.67 (buy point).

That’s not the only thing I saw in this chart. If you look at the MACD, I was eyeing positive divergence with the price. This happens when the stock’s price makes a lower low, while the MACD makes a higher low…showing a potential for reversal.

When multiple technicals line up going into a trade setup, it really gets me excited.

Now once in, stop losses are generally placed below the double bottom, with profit targets calculated at two times the stop loss above the entry price…

For example, if I had bought the breakout (which I didn’t), I may have entered at 13.75 and would have placed a stop at 10.30, just below the double bottom.

In this instance, my exit target would have been 20.65, calculated as follows…

13.75 entry – 10.30 stop loss = 3.45… 3.45 x 2 = 6.9… with an entry of 13.75, I simply would have added 6.9 to give me an exit target of 20.65.

That’s the typical “W” pattern playbook, but it’s not the trade I took on Friday.

Here’s what I did…

As mentioned in the opening, I was looking to trade for continuation from the “W” pattern breakout and strong volume.

I didn’t get in on the original break of the “W” midpoint, but that’s okay.

TPST had a massive surge in volume after breaking up from a double bottom on Friday, along with a recent merger adding new financing and access to public markets, this stock was moving.

I got in around 18.23 simply looking for a continuation over the weekend from all the traders chasing into this stock.

When I woke up this morning TPST was making a move toward 30 in the pre-market and I was all too happy to take my trade off at 26s.

I was out and happy with my trade, but the move wasn’t over…TPST was still hot, in fact there was more volume traded today than on Friday…and the stock ran up to a high of 41 at the open before pulling back on profit taking.

Do I need to catch every dollar or every cent on a trade?

Absolutely not! In fact, that’s a recipe for disaster in my opinion.

There’s no way to know exactly where a stock will trade in the future. All I can do is use the tools at my disposal to make an educated guess…and with that said, I prefer to stay on the conservative side.

This allows me to find good setups that might have otherwise pulled back sooner than expected. I’m not a greedy trader and I think that’s something that has actually helped me tremendously over the years.

7 Comments

My friend Charles had a sign with pictures. It said:

The bulls can make money and the bears can make money.

But the pigs always loose!

Good pointers.

Hello Jeff, I have finally gotten enough knowledge and have opened my first trading account paper of course. I work so much I could not take alot of advantage of the masters club. But I listened everyday looked at the screen when I could. Well any day now I will make my first trade and we’ll we will see how she goes. I’m looking forward to putting your expertise to work and learn and have some fun see where this takes me. Well it has to take me up so I can afford some more of that masters club loved it thanks for your knowledge and willingness to share.

That was a great move . I will be watching for moves like that. Thanks

Well done! Great explanation on how to utilize the W chart, check for a catalyst of sorts, determine your entry, and calculate your out. Also a great example of discipline. So tempting to stay in and “let it ride”, but you are correct, “letting it ride” increases risk. I’ve lost too many $$ waiting for more. Today I learned:

How to recognize a W chart break out

How to calculate for my “out”

What discipline looks like when “you stuck to your plan”.

Thank you Jason. Educational dollars well spent.

+

Correction: Thank you Jeff Williams for your W chart education.

Check out KTCC looks like a double bottom W formation and the right side is reached, passed and closed at or near it’s breakout point. Volume is increasing as well.

Super cheap value stock to boot.