If you don’t know what a short squeeze is…well suffice it to say, it’s a big reason why I usually don’t short penny stocks.

Given the potential for manipulation in penny stocks and the lack of fundamental reporting, there is plenty of room to get caught in a squeeze…even in companies that have little to no intrinsic value.

And if you do get caught in a short squeeze, you will be in a world of hurt and potentially see the end of your trading career…even on a single trade.

While I generally don’t short penny stocks for this reason, buying into a squeeze however…

That’s a beautiful thing.

But what causes a short squeeze?

Selling Short

It all starts with short selling.

Simply put, selling a stock short is the opposite of buying a stock.

If you think the price of a stock is going down, you aren’t going to buy that stock.

But there’s another play…selling short. This gives traders a way to make money if a stock goes down.

By selling the stock now and buying it back when it’s lower… sell high, buy low.

Risk Alert: Shorting a stock is generally considered riskier as a stock can only go down to 0 but, in theory, it can go up forever…

Think about it…if you are long a stock that goes from 1 to 0 you would lose all of your money and the loss would stop there…assuming you aren’t on margin.

If you are short that same stock at 1, but it goes up to 2… you just lost all of your money as well.

But it’s not over… if that stock goes from 2 to 4 on a squeeze, you can literally lose more than 100% of your money when you are short.

And if the squeeze kept pushing and it was at 8 the next day,

Good bye trading career… and life savings.

Use only with caution, knowledge, and experience…and then some.

The Short Squeeze

Now you know why people short a stock…they think it’s going down.

Well, what if it doesn’t go down?

It’s no secret the losses will begin to pile up. So just like any trade, short sellers will have stop losses to get them out at key levels or predetermined thresholds of pain.

These same levels may also attract big buyers who see breaks above these same key levels to be a bullish sign.

Due to these factors, these price levels can become areas of heavy trading activity.

A breach of these levels can trigger a powerful chain reaction of buying, both short sellers trying to cut losses and get out of the way, and new buyers coming in on the bullish price action.

All of this buying causes a surge in the stock price, called a short squeeze.

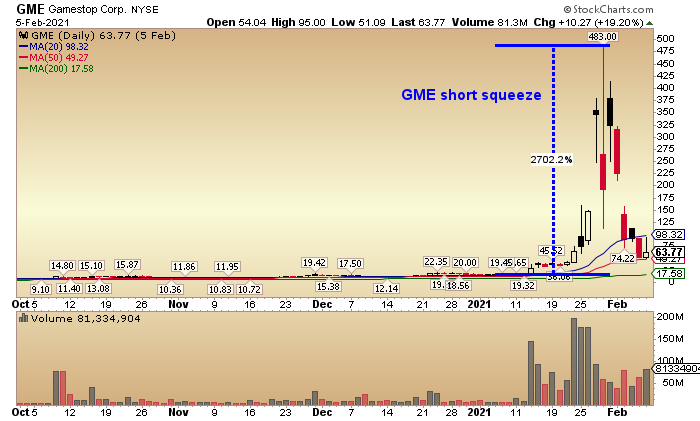

If you didn’t know about it before this year, you probably do now in part thanks to the Reddit and “meme stock” craze that started with Gamestop back in January.

And continued to roll with stocks like AMC, EXPR, NOK, SNDL, CLOV etc.…

Finding Stocks with Short Squeeze Potential

When I look for stocks with the potential of a short squeeze, I am looking at two specific things.

The concentration of short interest and the recent price action of the stock.

These together have the power to set it off.

Concentration of Short Interest

Short interest is simply the total outstanding number of shorted shares that are present in a stock.

Many people assume that a high short interest level in a stock alone tells the story. This is not the case.

I want to see how concentrated the short interest is…so I’m looking at it in relation to both average daily volume and level of the float.

For that I use the Days to Cover (Short Ratio) and the Short Percentage of Float…

The higher these numbers, the higher the relative level of concentrated short interest is in a stock.

Days To Cover (Short Ratio)

The Short Ratio (days to cover) is calculated by dividing the total number of shares shorted by the stock’s average daily volume.

This tells you how many days it would take to close out all of the short interest in the stock…the higher the number, the more pressure on a squeeze.

Short Ratio of 5 and up is generally considered high.

Short Percent of Float

This is calculated by dividing the total number of shares shorted by the stock’s float (shares available for trading).

The higher this percentage is, the more short sellers there will be competing against each other to buy the limited numbers of shares back if its price starts to rise. Many people find 10% to be the level where it gets dicey…but I’ve also seen a squeeze with less.

And again, with these ratios, the higher the better, and I love to see 20% plus on this.

Recent Price Action

As you know, when traders short a stock, they lose money when the stock goes up.

So logically, the stronger the stock’s price performance, the more pain the short sellers will be feeling.

Simply put, what’s going to push someone to cover their shorts? A strong stock that won’t let up and breaks key levels. A stock that pushes them to the brink of collapse.

Think about being short a stock that is making a strong move up. What’s keeping you in at this point?

Maybe there is one last major resistance level you think it can hold, so you put your stop there…

Maybe it’s a 52-week high, 50 day MA, or the 200 day MA.

Whatever it is, with such a high concentration of short interest, imagine how many other people have their stops in the same area…if it hits that level, watch out.

Putting it Together

In this scenario, if the stock had ratios of 10 days to cover and short percentage of float of 30%…it’s sitting with a really high concentration of short interest, which puts a lot of pressure on the stock at key levels.

Now what’s it going to take to squeeze? Bullish price action.

If the stock is going down, all of those traders are making money…It’s the price action, strong bullish price action that will set it off.

The stock glides right up to a major resistance level. A big buyer steps in and pushes it through, initiating a chain reaction of buying interest to surge into the stock.

With shorts getting stopped out and running for the exit at the same time as buyers are scrambling to buy the breakout, it takes on a life of its own.

And that is the powerful market force called the short squeeze.

In no way is it easy to determine when and if a short squeeze will happen or how long it will last, but keeping an eye on short interest concentration and price action is a good start.