When it comes to trading penny stocks, it’s just trading, as I have said before.

What do I mean by that?

Price action, ladies and gentlemen, is king! When it comes to low-priced stocks that move independently, price action is what truly matters, not bias.

If you disregard price action and instead trade a stock based on what you would like to see happen, you might find yourself in trouble.

Yesterday provided a great example of just that.

So, I will go over a few lessons and warning signs that might help you identify when you should not go long and how you might capitalize on the short.

Verastem (NASD: VSTM)

VSTM is a development-stage biopharmaceutical company. The company focuses on developing and commercializing medicines to enhance the life of cancer patients.

The stock was gapping higher in the pre-market as the company announced a clinical collaboration agreement with AMGN.

This news saw the share price of VSTM rocket higher in the pre-market. At one point, the stock reached $3.96 before pulling back before the open.

Year to date, shares of VSTM are up 31.92%, and after yesterday, up 8.91% on the week.

Market Cap: 496.84M

Float:130.70M

Short Interest: 5.10%

Average Volume: 2.34M

Now, let’s take a look at some of the warning signs:

Looking Left

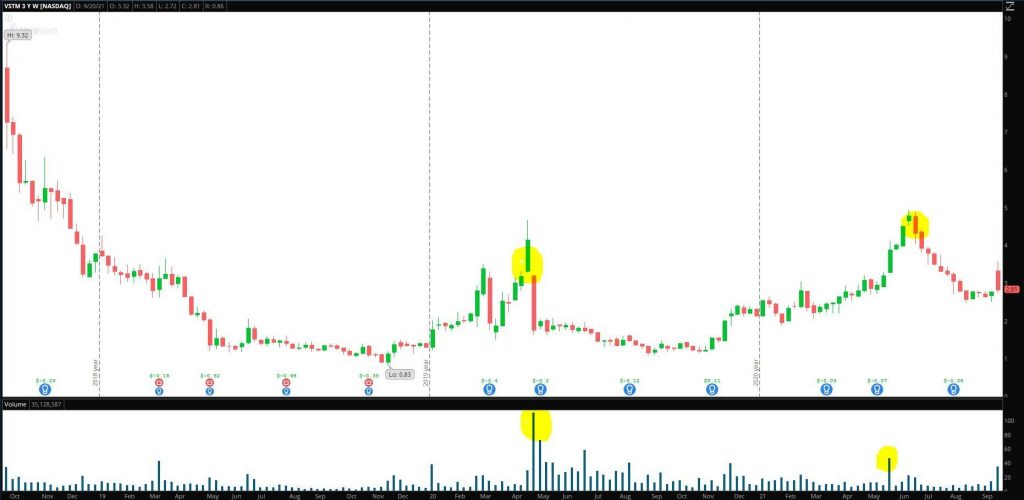

By zooming out and consulting the 3-year weekly chart, the bigger picture can be painted.

First of all, the stock is in a downtrend on a higher time frame. On a higher time frame, the stock has not been able to turn resistance into support. This signals that selling pressure has not yet subsided.

Secondly, each time the stock trades abnormal volume, it has signaled the short-term top and sold off.

Selling Pressure

During the pre-market, after the stock first reacted to the news and traded to $3.96, sellers stepped in, and the stock made lower highs and lows. Not the confirmation nor the action you would want to see if you are a bull.

On the 2nd of August, 2021, a 424B5 prospectus was filed with the SEC. This filing states that the company has entered into a $100M sales agreement with Cantor Fitzgerald & Co.

The action in the pre-market, the higher time frame downtrend, and possible dilution are all potential warning signs. All of which could hamper the ability of the stock to trade higher.

Selling Pressure Confirmed and Opportunity on the Short Side

Off the open, the stock broke the downward trend from the pre-market. Shortly after the breakout attempt, the stock failed to hold above resistance and slammed lower.

This signaled that the sellers were still in control. Price action confirmed the points I made above.

A short might have been placed once the stock failed above resistance and then broke below the support. That is a solid entry as momentum to the downside had now been confirmed.

Once the support had been broken, anyone who bought it in the pre-market was underwater, further adding to the selling pressure.

An excellent zone to take profits and close the short position could have been below $3, where the stock closed the previous day. This area of $2.80 – $2.90 was also where the intraday downward trendline leveled out.

The Bottom Line

While I believe the upside potential in penny stock trades outweighs the downside potential from going short, it is vital to have an understanding of the reasons why in-play penny stocks might not go higher.