Is there ANY stock on the market that catches as much intrigue right now as TSLA does?

Elon has really captivated traders, investors, and even the general public – so when there’s a move into TSLA, I want to know about it myself!

My man Jason Bond saw a great-looking TSLA trade opportunity yesterday and he shared it with his traders.

It’s not just “buy TSLA stock”. It’s a 4-step trade…

My favorite option trade is the bull put, especially when good stocks land in oversold (RSI <30) and show a history of bouncing quickly thereafter.

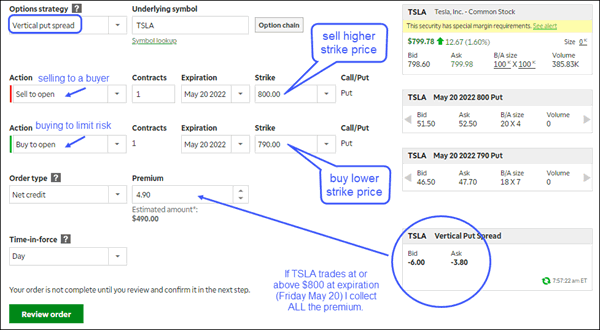

A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Both puts have the same underlying stock and the same expiration date.

So with U.S. stock futures rebounding yesterday morning, I think a $10 wide or -$800/+$790 vertical put spread (bull put) on TSLA makes a lot of sense.

Here’s the 4 steps I watched for on this TSLA trade:

- Step 1: If the stock price is $800 when I want to enter the trade, that’s the basis of my trade i.e. selling the $800 put and buying the $790 put.

- Step 2: bottom right hand corner shows the bid 6 and ask of 3.80. Market isn’t open yet so these will certainly change at open. My goal for entry is 40% of the width, which is $10, so $4. But for simplicity of this lesson I added the bid / ask which is $9.80 and picked an entry at 50% of the width, which is $4.90. Normally, I will not get an entry of 50% unless I take on more risk.

- Step 3: I’m looking to capture 50-70% of the premium before expiration, the sooner the better. Each minute TSLA trades above $800, the $490 ‘net credit’ drips premium into my account, because the buyer of the $800 put is losing i.e. theta decay of the option. The closer you get to expiration the faster the decay of the option when it’s out of the money.

- Step 4: To mitigate risk I make it a general rule to be out of the option before expiration which in this case is about 2-weeks out or May 20, 2022.

As always, I pre-alert before I take the trade. If TSLA is trading at $820 and I still like the trade, then the trade would be -$800/+$790.

Finally what this chart shows you is that in the last year, when TSLA RSI was around 30, it didn’t go much lower before a sizable bounce. Given TSLA did well on earnings, buyers should be looking for a dip and I want to be selling puts to those who think it’s going lower in the next few weeks.

This is the kind of trade I cover every day in JasonBondPicks – along with tons of trading education just like it. Click HERE to make sure you see the next trade opportunity that comes across my desk!