Trading may very well be the most emotionally consuming and exhausting job out there.

Show me another business, where every click on a mouse causes immediate financial reward or pain. I don’t think you can find one!

Hence, one of the first and most important things an aspiring trader has to master is learning to keep his emotions in check.

And on the list of many things that cause traders to rage in anger and despair, FOMO is definitely making it to the pedestal.

Let me tell you what it is, and how I’m overcoming it in my UPST trade.

FOMO – Fear of Missing Out

FOMO – or, fear of missing out – happens to be one of trading’s toughest psychological fallacies.

Have you ever hesitated to buy a stock, only to see it immediately jump higher?

And then you get this annoying tickly feeling in your stomach, thinking of all the gains you’ve missed out on?

And then you see the stock go higher still! Eventually, you’re so on edge emotionally that you decide to get in anyways… and end up buying the top!

The stock slaps you in the face and leaves you poorer, angrier, sad, and not knowing what just happened.

If you’ve been in that situation – don’t feel ashamed! We’ve ALL been there, at least once!

In fact, trying to control my FOMO is exactly what I’m battling with right this very moment…

My UPST Trade Plan

You may have received my trade plan for Upstart (UPST), which I’ve sent out literally this very morning.

Here was my thesis:

“I am going with UPST because it meets a lot of the criteria I am looking for right now: Oversold tech stock, great earnings, bullish trending chart in the face of a weak market.

UPST is not for the faint of heart though.

This stock has some massive swings up and down each day. It is so volatile, that most people are probably better off buying the stock than trying to time the options and worrying about time decay there.

For most of the month of February, UPST has built an incredible base, and with the strong earnings on the 16th, I feel the stock has now picked the next direction it wants to go – and that is higher!

I do want to wait on my entry though…

With all of the volatility we’re seeing, I think I will get a chance to enter about $10 lower from the close on Friday, so I am looking @ $125 as my target entry price.”

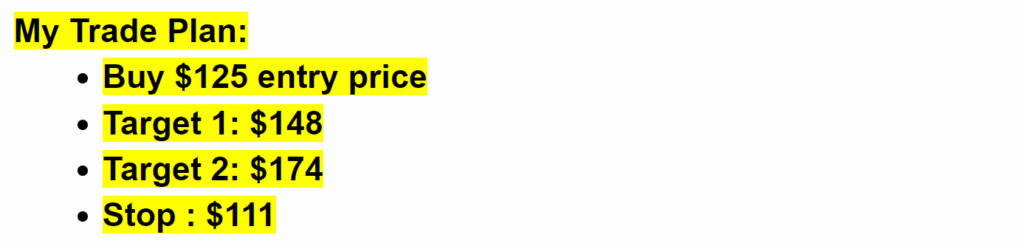

Consequently, here was my trade plan:

So, what went wrong, you may ask???

Well, nothing went wrong – in fact, my thesis was right!

But who cares about being right, when the stock is already ripping higher, past my first target while I’m on the sidelines:

My plan was to wait for a dip to $125… a dip that never came! So here I am, watching my pick work out great and gain ~$14/sh in a matter of 1 hour.

I’m not going to lie – it’s not fun. As I’m writing this, I’m feeling FOMO as clear as ever, really battling myself to be smart and not jump in!

I know I’ll manage it, but despite the years of experience trading thousands of stocks in every market environment – it still takes a lot of self-control to manage this type of emotion.

However pitiful you may feel in a situation like this, always remember 2 things:

- A Plan is a Plan – STICK TO IT!

- There’s always another trade – relax and patiently wait for it!

Make it a habit to avoid FOMO and stick to your ideas – you’ll thank me later for how much nerve cells and capital it will save.

3 Comments

all so true. What a battle inside

Yes absolutely keep telling it like it really is. Hope is NOT a strategy.

Thanks for the reminder, very useful. The stock dip down quite a bit today. Didn’t see how it closed since I had an appointment &

wasn’t on the computer at that time. Your thoughts on re-entering?