While the long call spread allows an options trader to place a moderately bullish bet on a stock, the long put spread is what bears use to position for a move lower — though they also have a downside target in mind.

By combining a long put with a short one, a bearish trader can lower their cost of entry and maximum risk on the trade, while also raising their breakeven. However, by bringing the sold put into the mix, they’re also giving up some profit potential from just buying the put outright.

Here’s a closer look at the basics behind a long put spread.

Long Put Spread

The long put spread, or bear put spread, is used when you’re bearish on a stock and have a downside target price in mind. It’s the inverse of the long call spread described in a previous section.

Using the RBLL stock example from earlier sections, let’s say for instance you expect the shares to fall in the short term, but are concerned about possible support emerging near the $45 level.

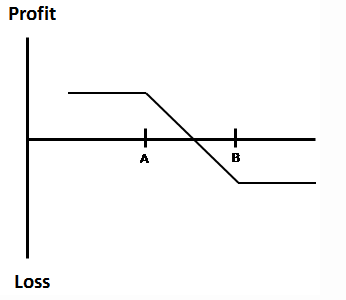

To implement a long put spread, you would buy the 50-strike put for $3, while simultaneously selling to open the 45-strike put for $1.50, resulting in a net debit of $1.50, or $150, on the trade.

By combining the long put with the short one, you’ve not only lowered your initial cost of entry, but also raised your breakeven mark to $48.50 (bought strike less net debit), compared to a breakeven price of $47 for the bear who just bought the 50-strike put outright.

However, you’ve also capped your reward at $3.50 per pair of contracts, or the difference between the two strikes less the net debit, no matter how far below the sold strike RBLL stock may fall through options expiration.

A long put player, on the other hand, could profit on a move all the way down to zero.

Meanwhile, the most the trader stands to lose is the net debit paid, if RBLL stock closes at or above the bought strike at options expiration. However, this is still less than maximum risk of $3 for the straight put buyer, thanks to the addition of the sold put.

A critical point to note is that you must have the same number of contracts that you buy and sell with the long put spread (and the long call spread). Any imbalance will be “uncovered.” This isn’t a problem with the options you buy, as your losses are capped at the total amount you paid.

However, it’s very much a problem with the ones you sell. Your losses are theoretically unlimited for short calls, and expensive until the stock hits $0 for short puts.

Wrapping Up

The bear put spread is implemented when a trader simultaneously purchases put options at a set strike price and sells an equal number of puts at a lower strike price. Both put options are for the same stock and have the same expiration date.

Unlike buying a put outright — which could have significant profit potential — upside is limited for long put spread traders due to the sold put, although this also lowers their cost of entry and boosts their breakeven level.